Citigroup: Capital Return Bonanza

Summary

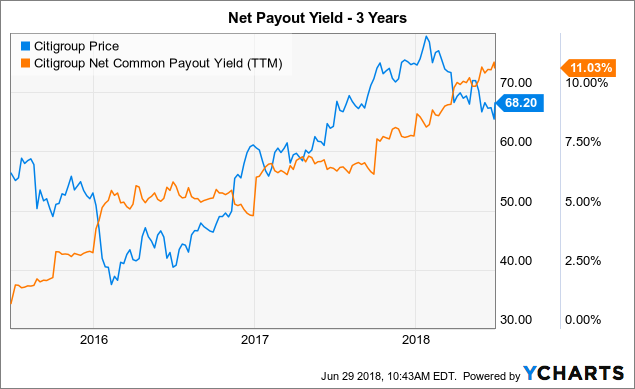

- Citigroup plans to return $22 billion to shareholders in the next year.

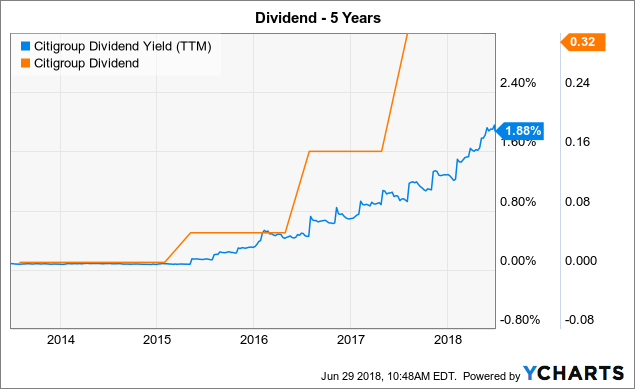

- The 41% dividend hike will offer an attractive 2.6% dividend yield.

- The bank projects a net payout yield of ~12.8%.

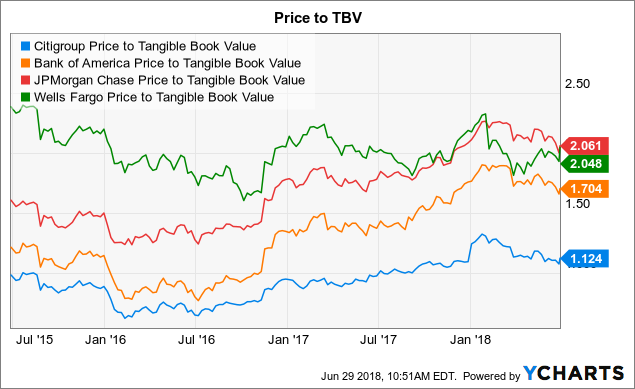

- The stock remains the cheapest in the large bank space while also offering the highest yield.

After a record 13-day losing streak, financials finally rallied on Thursday. The amazing part for a stock like Citigroup (C) is that the massive capital return plans approved by the company provides substantial support for the weak stock and only enhances an already bullish investment thesis.

Image Source: Citigroup 2018 Stress Test presentation

CCAR Plan

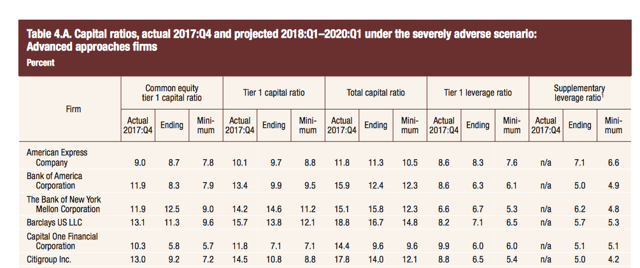

Last week, Citigroup passed the Fed's stress test with flying colors. The large bank saw capital ratios that all passed the required capital ratios under the Supervisory Severely Adverse Scenario using Dodd-Frank Capital Actions.

Under the worst case scenario in an extreme recession scenario, Citigroup would see the common equity tier 1 capital ratio, or CET1, dip to only 7.2%. The bank would end the stress test period in 2020 with a CET1 of 9.2%.

Source: Fed

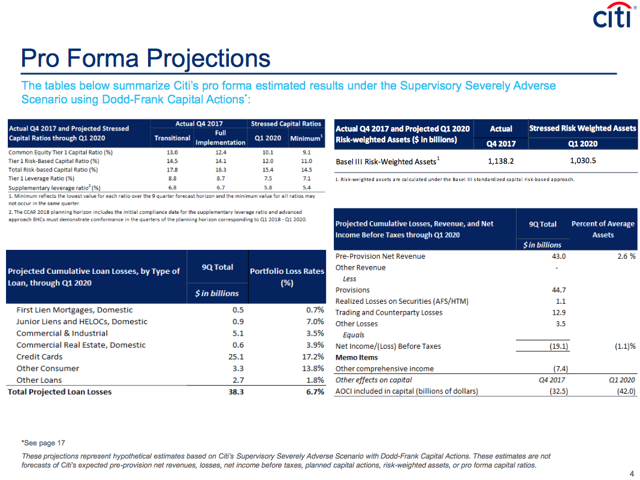

For its part, Citigroup projected a minimum CET1 of 9.1% and a 2020 level of 10.1%.

C Dividend Yield (TTM) data by YCharts

C Price to Tangible Book Value data by YCharts

C data by YCharts

Source: Citigroup 2018 Stress Test presentation

In essence, even under a financial situation that isn't likely to occur, Citigroup will have substantial capital. Remember that this scenario isn't likely to occur in decades if not a century due to the financial crisis so recently in 2008.

Continue reading at Seeking Alpha.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any ...

more