ChipMOS Technologies - Stock Of The Day

Summary

- 100% technical buy signals.

- 15 new highs and up 19.34% in the last month.

- 78.01% gain in the last year.

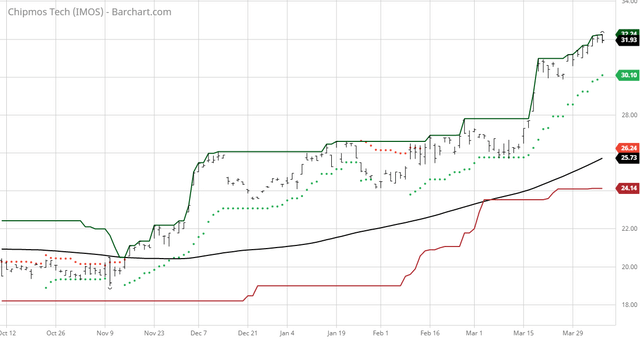

The Barchart Chart of the Day belongs to the integrated circuit company ChipMOS Technologies (Nasdaq: IMOS). I found the stock by using Barchart's powerful screening tools to find the stocks with the highest Weighted Alpha and technical buy signals. After I sorted for the most frequent number of new highs in the last month, I used the Flipchart feature to review the charts for consistent prices appreciation. Since the Trend Spotter signaled a buy on 2/12 the stock gained 19.34%.

ChipMOS Technologies researches, develops, manufactures, and sells high integration and high precision integrated circuits, and related assembly and testing services. The company operates through Testing; Assembly; Testing and Assembly for Liquid Crystal Display and Other Flat-Panel Display Driver Semiconductors; and Bumping segments. It provides a range of back-end assembly and test services, including engineering test, wafer probing and final test of memory and logic/mixed-signal semiconductors, as well as leadframe-and organic substrate-based package assembly services for memory and logic/mixed-signal semiconductors; and gold bumping, reel to reel assembly, and test services for LCD and other flat-panel display driver semiconductors. The company's semiconductors are used in personal computers; graphics applications, such as game consoles; communications equipment; mobile products comprising cellular handsets, tablets, and consumer electronic products; and automotive/industry and display applications, such as display panels. It serves customers in Taiwan, Japan, Singapore, and internationally. The company was founded in 1997 and is headquartered in Hsinchu, Taiwan.

Barchart technical indicators:

- 100% technical buy signals

- 84.93+ Weighted Alpha

- 78.01% gain in the last year

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 15 new highs and up 19.34% in the last month

- Relative Strength Index 72.80%

- Technical support level at 31.85

- Recently traded at 31.93 with a 50 day moving average of 27.51

Fundamental factors:

- Market Cap $1.17 billion

- P/E 14.42

- Dividend yield 2.96%

- Revenue expected to grow 2.40% this year and another 8.50% next year

- Earnings estimated to compound at an annual rate of 10.00% for the next 5 years

- Wall Street analysts have issued 1 buy recommendation on the stock

- The individual investors following the stock on Motley Fool voted 257 to 31 that the stock will beat the market

- 3,220 investors are monitoring the stock on Seeking Alpha

Disclosure: The Barchart Chart of the Day highlights stocks that are experiencing exceptional current price appreciation. They are not intended to be buy recommendations as these stock are ...

more