Changes To The S&P/ASX 300 Shareholder Yield Index Explained

The S&P/ASX 300 Shareholder Yield Index consists of the 40 stocks from the S&P/ASX 300 with the highest shareholder yield, which is a combination of dividend yield and buyback yield. In order to achieve sustainable performance, the eligible stocks are screened for liquidity, free cash flow, and dividend growth.

After consultations with market participants, S&P Dow Jones Indices (S&P DJI) has updated the methodology, effective Aug. 12, 2020. The index will go through the following two major changes this year, which will target to improve index diversification and maintain ongoing shareholder yield, respectively:

- Constituents will be subject to a lower weight cap of 5%, effective from the October 2020 rebalancing; and

- A monthly dividend review commenced in August 2020.

Lower Weight Cap on Individual Securities

The index constituents are weighted by product of float-adjusted market cap and shareholder yield. Currently, each constituent is subject to a maximum weight of 10%.

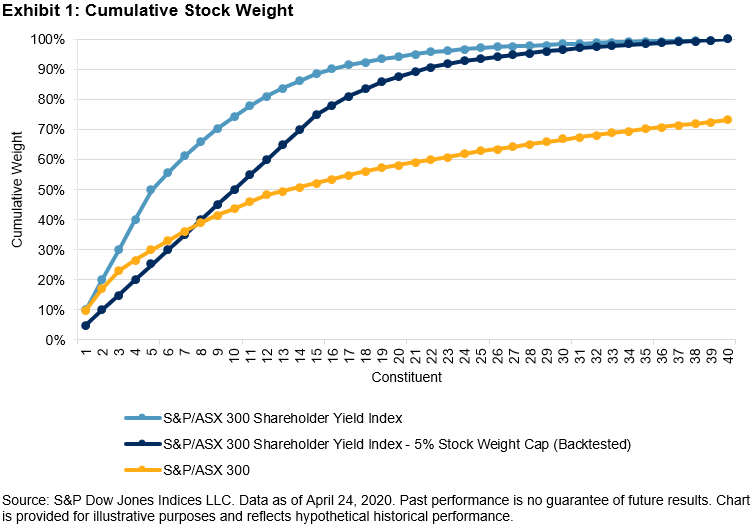

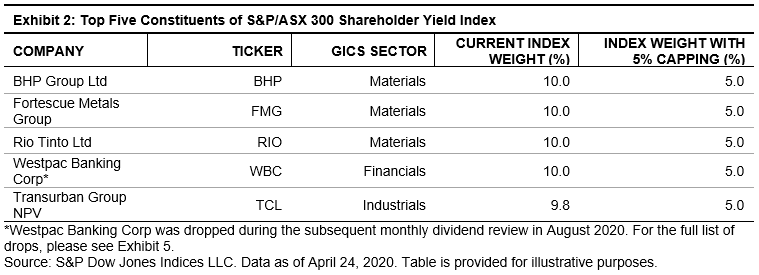

By lowering the constituent weight cap from 10% to 5%, stock concentration could be further reduced. Exhibit 1 illustrates the cumulative stock weight with the current 10% capping versus a hypothetical 5% capping, as of April 24, 2020, the most recent rebalancing. Compared with the current 10% capping, the 5% capping could help to reduce the weight of the top constituents (see Exhibits 1 and 2).

(Click on image to enlarge)

(Click on image to enlarge)

As the single-stock concentration becomes lower, sectoral balance might improve. As shown in Exhibit 3, the weight in Materials, the largest sector in the S&P/ASX 300 Shareholder Yield Index, would drop from 32.4% to 20.0%. Since 2015, the index included two big 4 banks for most of the time, which took up 20% of the index’s weight under the current 10% capping rule. Had the new 5% capping rule come in effect, the weight of the big 4 banks would have decreased to 10%.

(Click on image to enlarge)

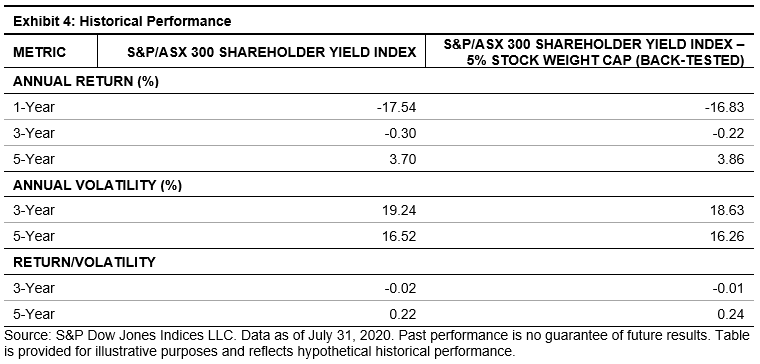

Exhibit 4 shows the actual index performance as of July 31, 2020, and the hypothetical results had the proposed constituent weightings change been in effect.

(Click on image to enlarge)

Monthly Dividend Review

Currently, the S&P/ASX 300 Shareholder Yield Index rebalances twice a year in April and October. The semiannual rebalance includes a full review of index constituents and weighting to ensure alignment with the index methodology.

To minimize the impact on index shareholder yield, S&P DJI introduced the monthly dividend review, which is intended for maintenance, typically to remove stocks that have canceled their dividends.

At the end of every month, the index committee will go through the constituents to identify stocks that have eliminated or suspended their dividends or omitted a payment. Those stocks will be removed from the index on the last day of that month and will not be replaced until the next annual rebalancing.

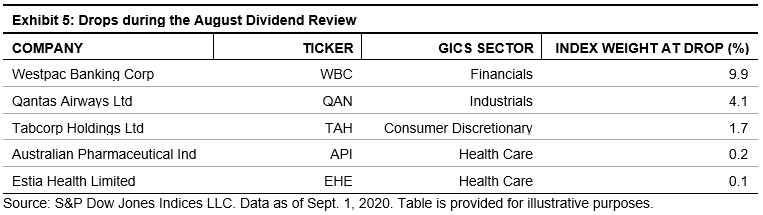

In August 2020, the S&P/ASX 300 Shareholder Yield Index went through its monthly dividend review for the first time. S&P DJI announced five drops that would be effective after the close of Aug. 31, 2020 (see Exhibit 5).

(Click on image to enlarge)

We believe these changes could help the S&P/ASX 300 Shareholder Yield Index maintain shareholder yield and reduce concentration risk.

Disclaimer: Please read our Disclaimers.

For more information on the risk-adjusted performance of actively managed funds ...

more