BTCUSD Found Buyers At The Equal Legs Area

Hello fellow traders. In this technical article we’re going to take a look at the Elliott Wave charts charts of BTCUSD published in members area of the website. As our members know Bitcoin has given us 3 waves pull back recently that found buyers right at the equal legs area. We have been favoring the long side due to impulsive bullish sequences the crypto is showing. In further text we’re going to explain the short term Elliott Wave forecast.

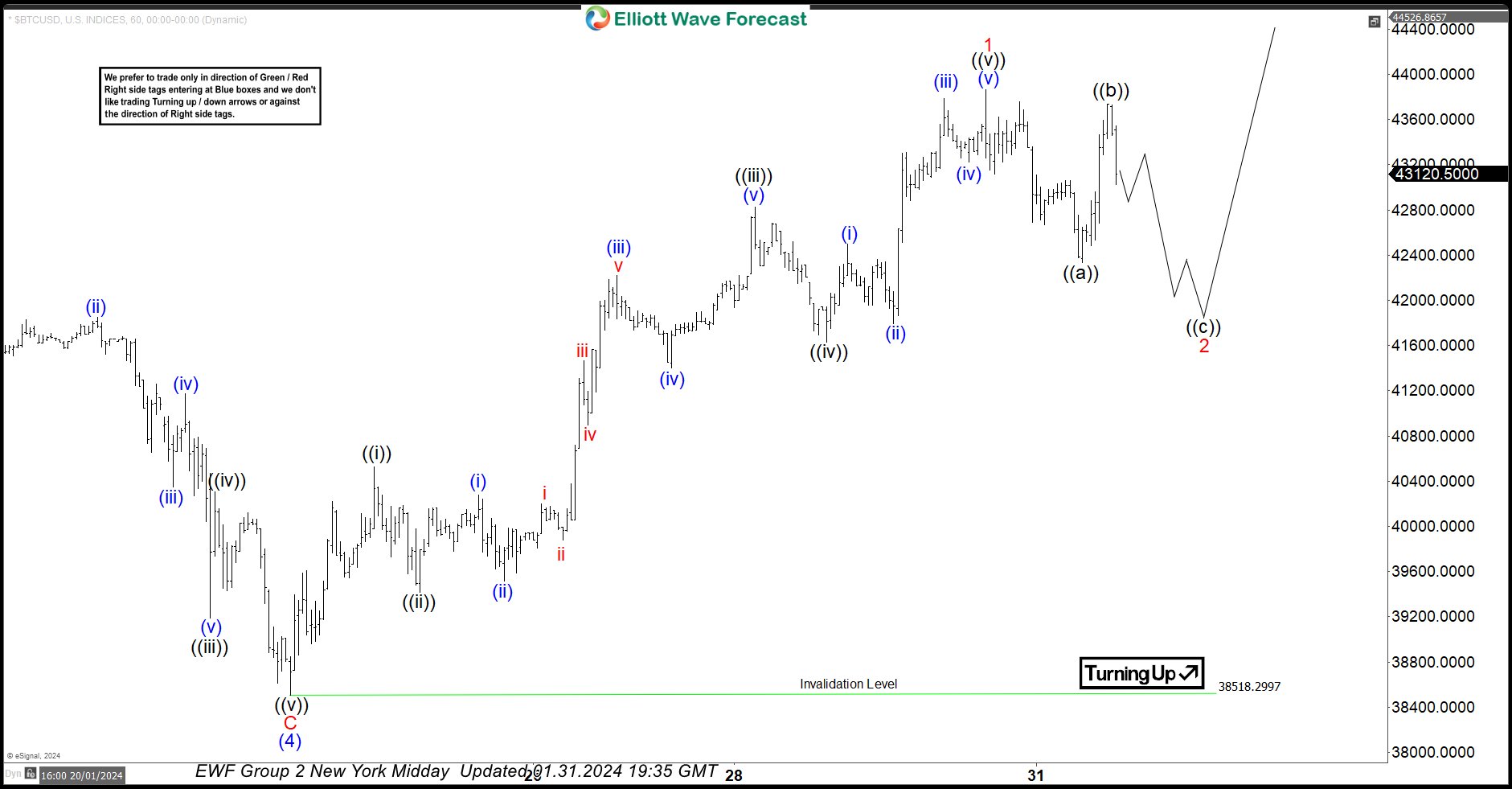

BTCUSD Elliott Wave 1 Hour Chart 01.31.2024

Current view suggests Bitcoin ended cycle from the 38518.29 low as wave 1 red. We got 5 waves up in the rally from the mentioned low. Currently the crypto is doing intraday pull back , wave 2 red. Correction looks incomplete at the moment. We expect to see another leg down ((c)) of 2 to complete the structure.

Note: Keep in mind not every chart is trading recommendation. Official trading strategy on How to trade 3, 7, or 11 swing and equal leg is explained in details in Educational Video, available for members viewing inside the membership area.

(Click on image to enlarge)

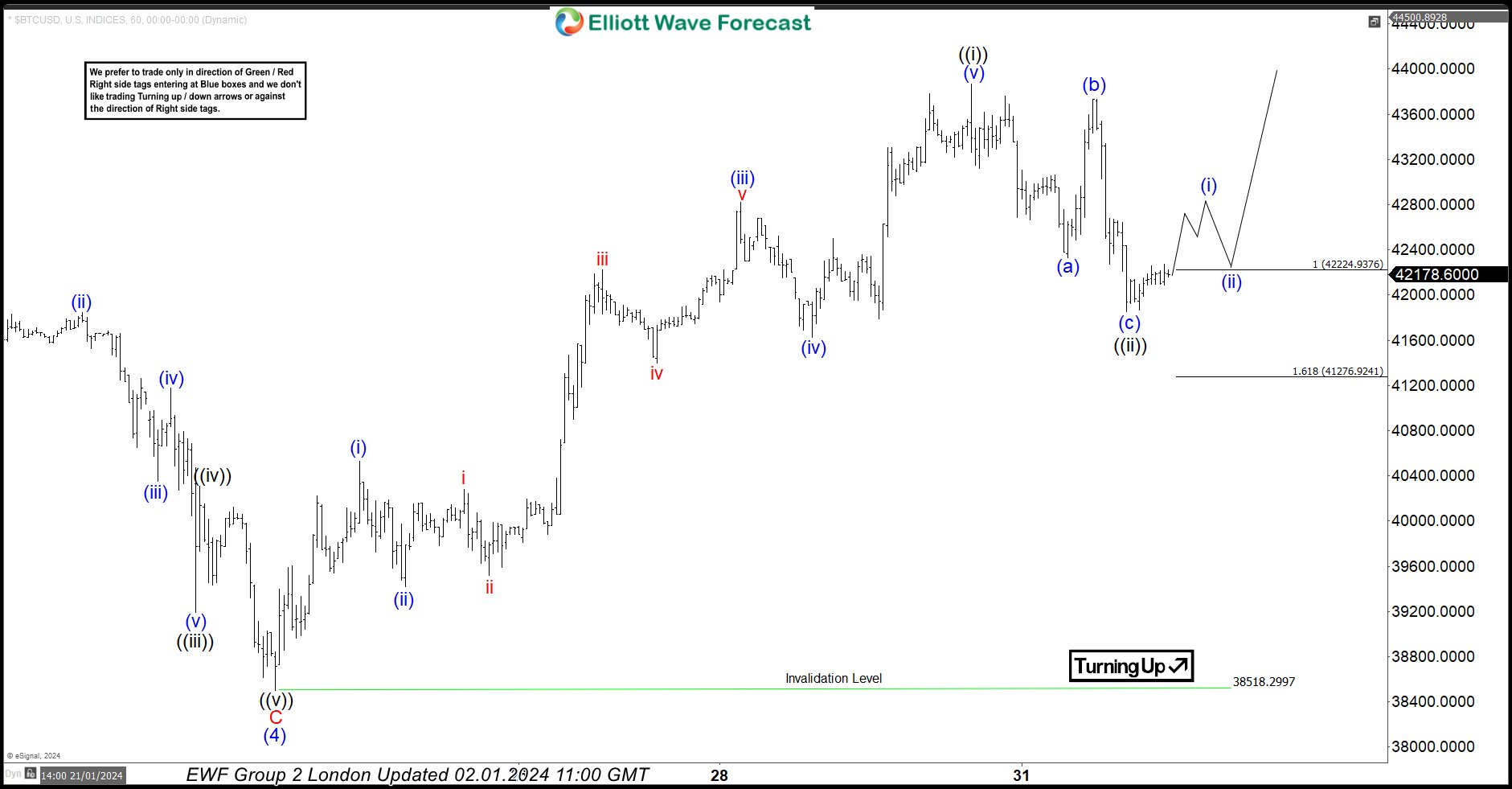

BTCUSD Elliott Wave 1 Hour Chart 02.01.2024

Pull back made another leg down and reached equal legs area at 42224.93-41276.92. We expect buyers to appear for further rally or 3 waves bounce at least. Don’t recommend selling and prefer the long side.

(Click on image to enlarge)

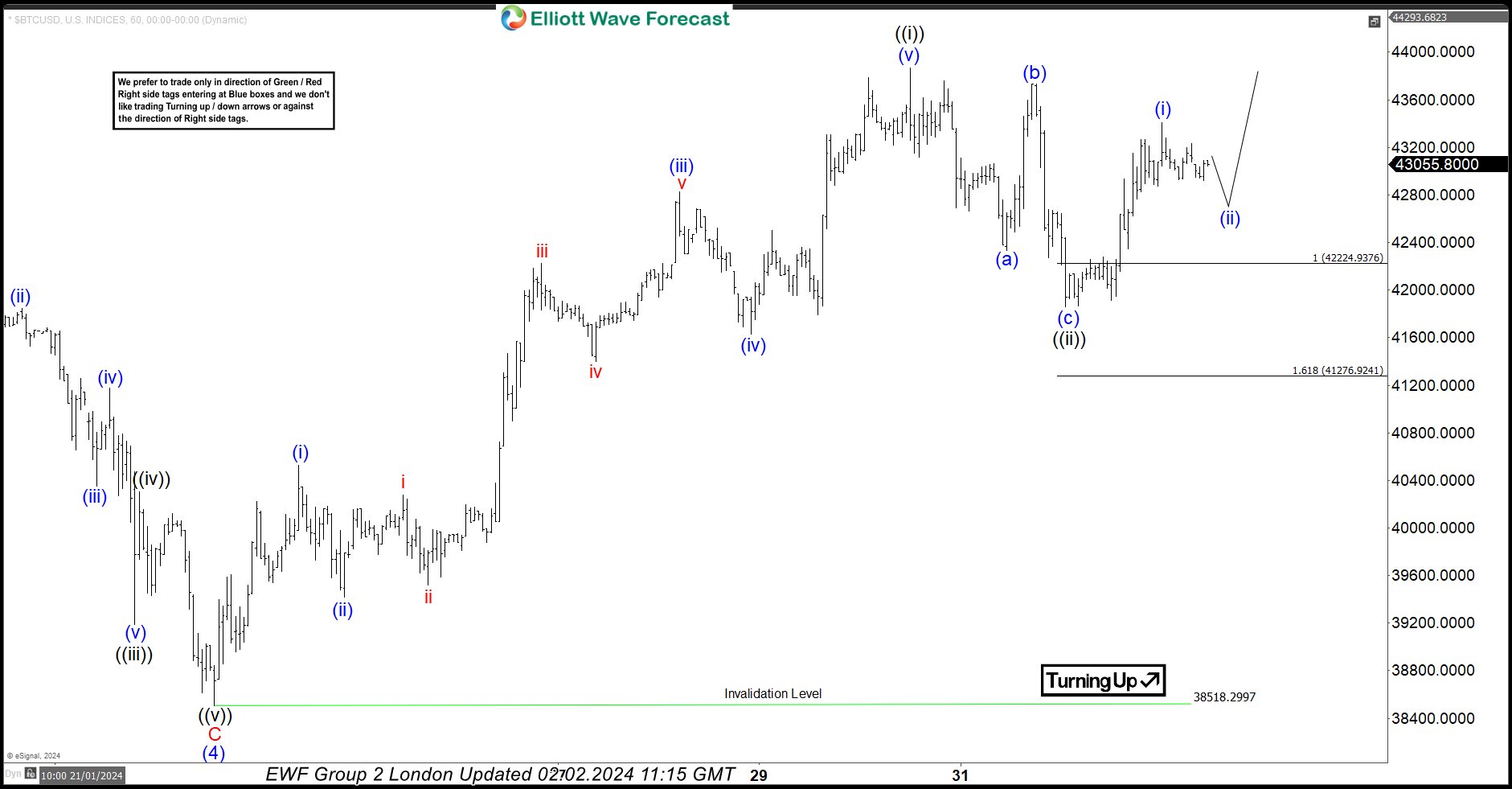

BTCUSD Elliott Wave 1 Hour Chart 02.02.2024

BTCUSD found buyers at the marked equal legs area as expected and we got good reaction from there. We count pull back completed at 41873 low. Short term rally made 5 waves up from the low, and now we are getting 3 waves pull back in (ii) blue. We don’t recommend selling in any proposed pull back. The price should ideally hold above 41873 low to keep proposed view intact. We would like to see break above ((i)) black peak 43851 to confirm next leg up is in progress.

Keep in mind that market is dynamic and presented view could have changed in the mean time. You can check most recent charts with target levels in the membership area of the site. Best instruments to trade are those having incomplete bullish or bearish swings sequences. We put them in Sequence Report and best among them are shown in the Live Trading Room

(Click on image to enlarge)

More By This Author:

DAX Near Term Support AreaNikkei Looking For Further Downside Correction

Verizon Communications Starts New Bullish Cycle

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more