BTC/USD Forex Signal: Stuck In A Range But Breakout Likely

Bullish view

- Buy the BTC/USD pair and set a take-profit at 18,000.

- Add a stop-loss at 16,500.

- Timeline: 1-2 days.

Bearish view

- Sell the BTC/USD pair and set a take-profit at 16,000.

- Add a stop-loss at 18,000.

The BTC/USD pair remained in a tight range on Monday and Tuesday as investors waited for a Senate hearing on FTX’s collapse and economic data. It was trading at 17,000, where it has been in the past few days. This price is about 10% above its lowest level in November.

Contagion risks remain

Bitcoin has been in a consolidation state as investors stay on the sidelines fearing more contagion in the crypto industry following the collapse of FTX. Recent data show that the volume of crypto outflow has risen to the highest level on record.

Some investors have pulled their coins from exchanges to self-custody wallets for safety. On Monday, the CEO of peer-to-peer exchange, Paxful, actually recommended that its 11 million customers should move their coins to their wallets.

The next key catalyst for the BTC/USD pair will be an upcoming senate hearing on the FTX collapse. Senators will use these hearings to make proposals for potential crypto regulations in the US.

Meanwhile, like other financial assets, will react to the upcoming American inflation data. Economists expect that the data will show that the headline CPI declined from 7.7% in October to 7.3% in November. If this happens, it will be the second straight month of declines.

It will also signal that the recent Fed rate hikes were working. The Fed has hiked rates by 400 basis points this year and put measures in place to reduce its balance sheet.

These inflation numbers will be important because they will come on the same day that the Fed will start its two-day monetary policy meeting. Economists expect that the bank will hike rates by 0.50% on Wednesday and hint that it will hold them higher for a while. That view will clash with those of some analysts who expect that the Fed will cut rates in 2023.

BTC/USD forecast

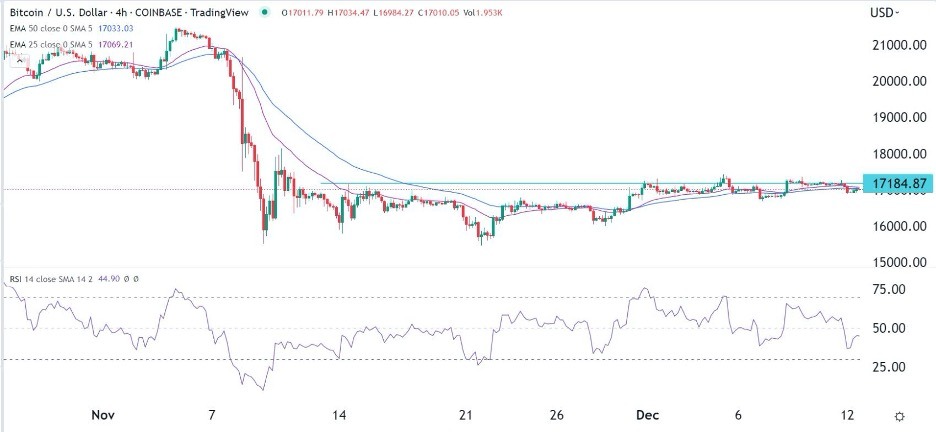

The BTC/USD price has been in a consolidation phase in the past few days. In this period, it has held steady below the important resistance level at 17,200, the highest point on December 6. It is consolidating at the 25-day and 50-day moving averages while the Relative Strength Index (RSI) has moved below the neutral point.

Therefore, because of the inverted head and shoulders pattern, the pair will likely have a bullish breakout as buyers target the key resistance at 18,000.

More By This Author:

Weekly Forex Forecast - Sunday, Dec. 11

EUR/USD Forex Signal: Cautiously Optimistic of Further Upside

EUR/USD Forex Signal: Euro Drifts Lower As DXY Rebounds

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more