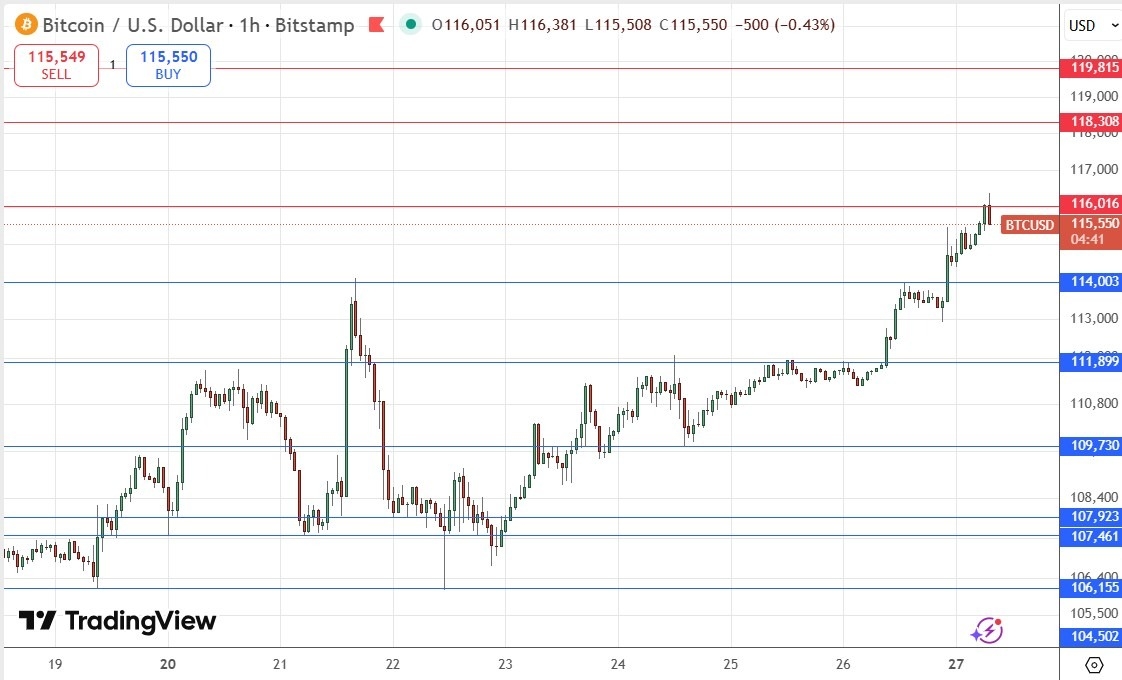

BTC/USD Forex Signal: Looking Bullish On Trade Deal Prospect

My previous BTC/USD signal on 20th October was not triggered, although the next major bullish bounce just at the start of the following day’s London session happened at my support level of $107,461.

Today’s BTC/USD Signals

Risk 0.50% per trade.

Trades must be entered before 5pm Tokyo time Tuesday.

Long Trade Ideas

- Go long after a bullish price action reversal on the H1 timeframe following the next touch of $114,003, $111,899, or $109,730.

- Place the stop loss $100 below the local swing low.

- Adjust the stop loss to break even once the trade is $100 in profit by price.

- Remove 50% of the position as profit when the trade is $100 in profit by price and leave the remainder of the position to ride.

- Short Trade Ideas

- Go short after a bullish price action reversal on the H1 timeframe following the next touch of $116,016, $118,308, or $119,815.

- Place the stop loss $100 above the local swing high.

- Adjust the stop loss to break even once the trade is $100 in profit by price.

- Remove 50% of the position as profit when the trade is $100 in profit by price and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

BTC/USD Analysis

In my last BTC/USD forecast exactly one week ago, I thought that the best approach here over the coming days would be to try to trade Bitcoin long, but I think we will need to see the price make a bearish retracement and bounce off a support level like $109,730 first.

This was a good call, although the support that finally made a medium-term low was well below $109,730 at $107,461 which was confluent with the major quarter-number at $107,500.

We have seen strong gains by many stock markets and other risky assets such as the Australian Dollar in recent hours, since US Treasury Secretary Bessent announced that a trade deal with China has effectively been agreed in outline. Bitcoin is no exception to this and has risen firmly to regain levels not seen in about two weeks.

The problem for bulls despite the short-term bullish momentum is that the long-term structure still looks bearish, with the resistance level at $116,016 forming a potential final shoulder of a bearish head and shoulders pattern.

The price has just started retreating from $116,016 and I think there could be a good but short-term short trade now from the seeming rejection of that level. Yet I think bears will get no further than the support level confluent with $114,000 which could give a short-term long trade later if it holds.

There is nothing of high importance due today regarding either Bitcoin or the US Dollar.

More By This Author:

The Best Dividend Stocks To Buy NowWeekly Forex Forecast - Sunday, Oct. 26

Forex Today: UK Inflation Surprises At 3.8%

Risk Disclaimer: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more