BTC/USD Forecast: Will BTC Break Out Of Its Trading Range?

- The Wednesday session has seen a bit of a rally in the bitcoin market, as we continue to see this market rallies significantly any time it sells off.

- That being said, we are still very much in a range at the moment, and this has a significant influence on how you need to trade in this market.

- After all, this is a market that has been bullish for a very long time, but it also needs to work off a lot of the overextension that has been part of the market for a while now.

(Click on image to enlarge)

Technical Analysis

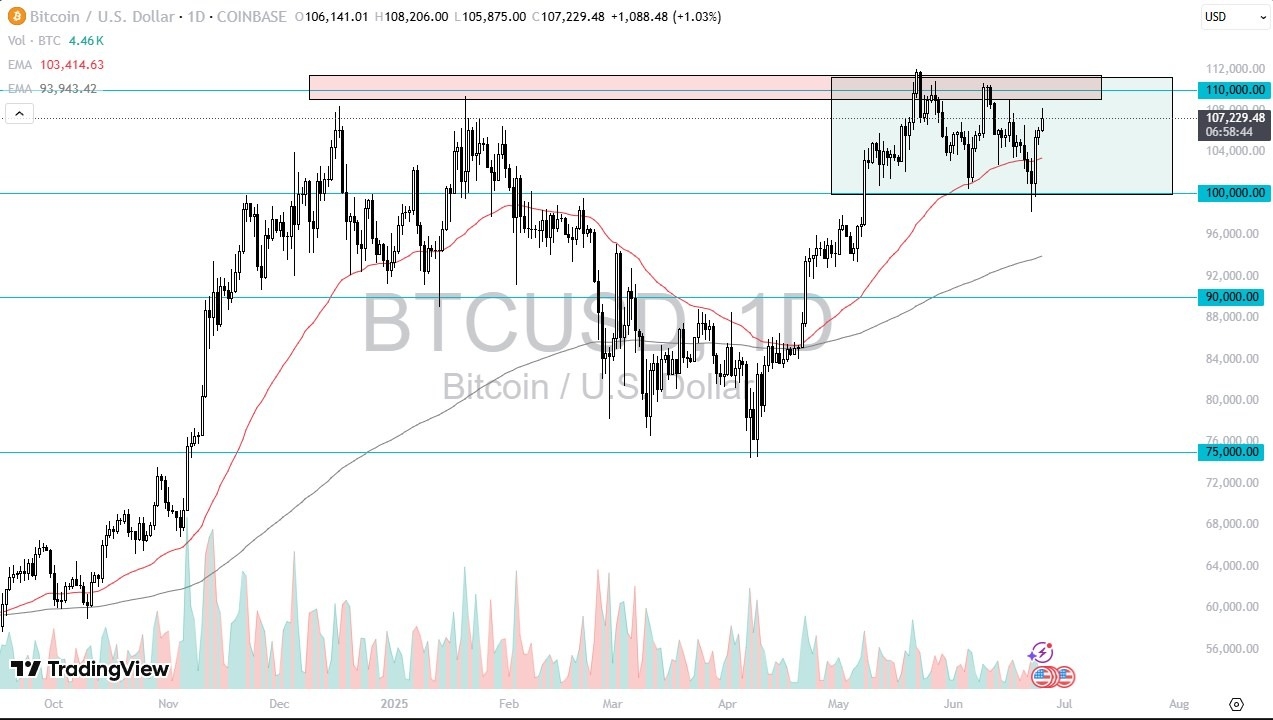

The technical analysis for bitcoin will depend greatly on your timeframe. Longer-term traders continue to look at this as a positive market, but if you are trading solely based upon the last couple of months, you may look at this more or less as a range bound market. When I look at this chart, the first thing that comes to mind is that we are working off a lot of excess buying pressure, so it does make a certain amount of sense that we would simply be a “buy on the dip” type of trader, mainly due to the fact that eventually we will break out of this range, and that typically speaking, when a market breaks out of consolidation, it tends to go in the same direction that it had been in previously.

That being said, if we were to break down below the $100,000 level, then we could see this market drop down to the $95,000 level, and perhaps even threaten the 200 Day EMA just below there. Ultimately though, I think it’s much more likely that we will break above the crucial $110,000 range, and perhaps even take out the $112,000 level, which was the recent all-time high. In that environment, I would anticipate that bitcoin could continue to the $120,000 level based on the consolidation that we have been in for a while and taking the “measured move.”

More By This Author:

Nasdaq Forecast: Struggles At Highs But Bullish Trend Remains IntactCHF/JPY Forex Signal: Swiss Franc Outshines Yen

USD/CAD Forecast: CAD Battles Greenback

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more