BTC/USD Forecast: Will Bitcoin Struggle After FOMC?

If it doesn't, then the Bitcoin market almost certainly will drop toward the $52,000 level. An area that has previously been very noisy and important in this market. If we were to give that up. Things could get ugly. What I'm worried about is this has been yet another pump and dump scheme coming out of Wall Street. What I mean by that is that everybody jumped into the ETF and Wall Street said, here, hold my bags.

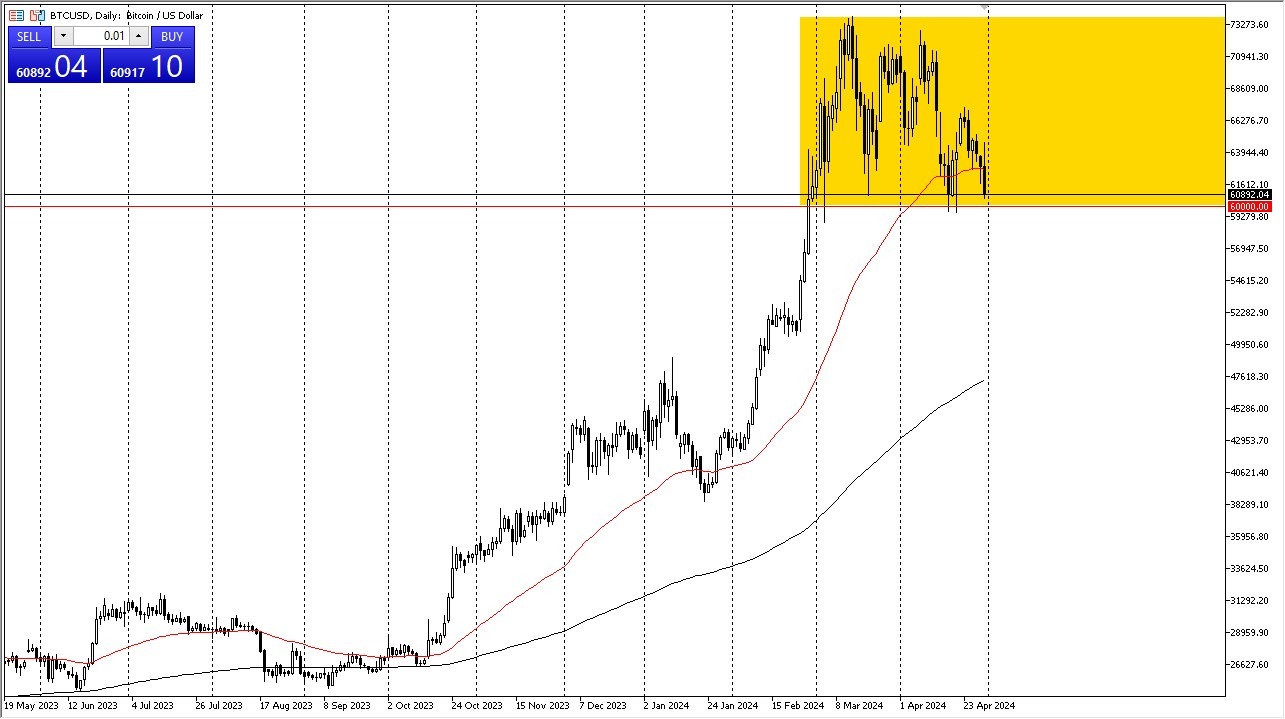

This is what Wall Street does. They sell stocks to people and benefit from taking profit later. That being said, I think we have a situation where $60,000 most certainly has to hold. If it doesn't, then you need to get out of the way and let Bitcoin sort itself out. On the other hand, if we can turn around and close above the 50 day EMA, that would be a very bullish sign and it would show that $60,000 is in fact major support.

(Click on image to enlarge)

Keep in mind that we have the FOMC meeting on Wednesday and that of course, will have a major influence on the US dollar, which by extension has a major influence on Bitcoin. It’s a bit ironic, considering Bitcoin is supposed to be a way to avoid the traditional financial world, but it is measured in US dollars, and that’s something that cannot be avoided or argued. That being said, the US dollar strengthening may finally whereupon the value of Bitcoin, so that something that you also have to keep in the back of your mind. After all, Bitcoin tends to do well with loose monetary policy, and if the Federal Reserve sounds like it won’t be loose anytime soon, that’s yet another reason to think that Bitcoin could struggle.

More By This Author:

GBP/JPY Forecast: Massive Moves Against YenBitcoin Forecast: Bitcoin Looks for Momentum

Weekly Forex Forecast - Sunday, April 28, 2024

Disclaimer: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals and ...

more