BTC/USD Forecast: Looks Bullish Overall

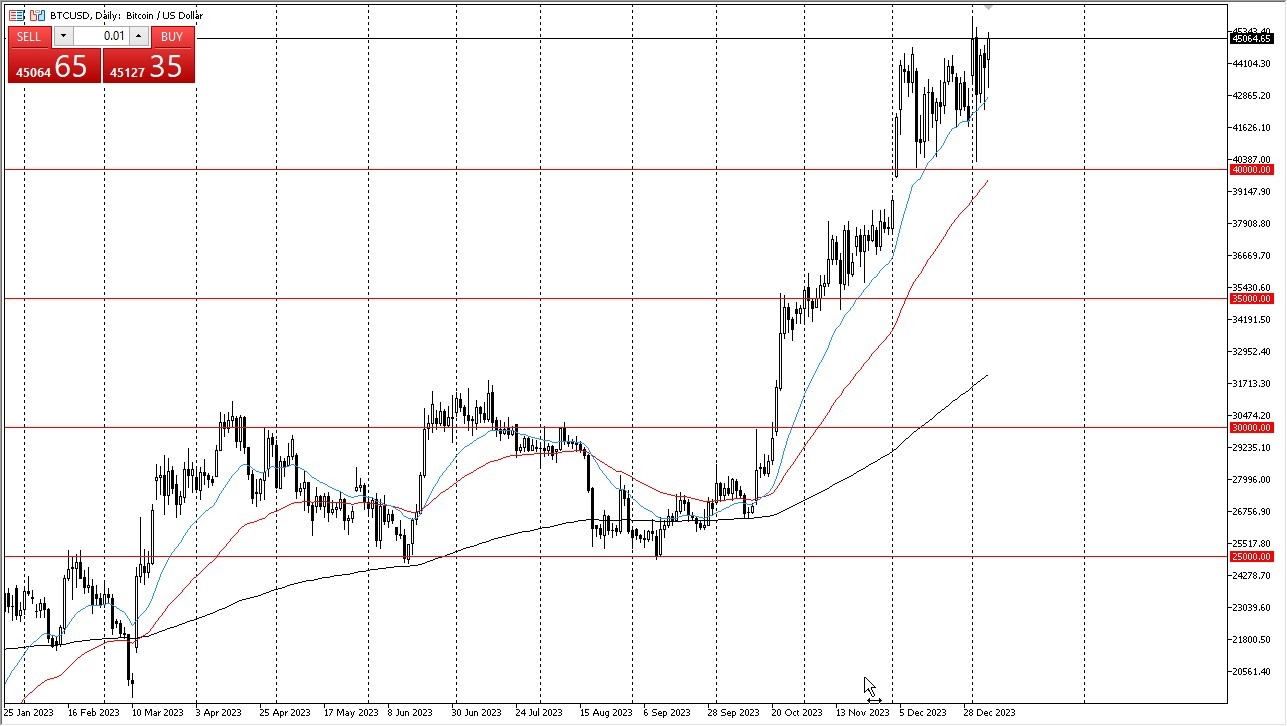

- Bitcoin experienced a minor dip in its trading session on Monday but has since displayed signs of renewed upward movement, indicating a potential breakout.

- There is a growing likelihood that the market will not only break out but also target the 47,500 level, influenced by resistance levels observed in weekly charts.

In the short term, any pullbacks should be seen as buying opportunities. The 20-day Exponential Moving Average (EMA) has provided support, as evident during Monday's trading, along with the $40,000 level and the 50-day EMA in the same vicinity. These levels have proven to be robust support zones.

To cast doubt on the broader uptrend, we would need to witness a decline below the $35,000 level. Currently, there is no significant cause for concern about the bullish trajectory. Bitcoin's momentum appears to stem from the anticipation of a Bitcoin Exchange-Traded Fund, although it remains to be seen if this news will trigger a "sell the news" response. Over the long term, the outlook appears bullish, but for now, traders seem content with a "buy the dip" approach.

Loose Monetary Policy

The loose monetary policy from the Federal Reserve is expected to continue supporting the Bitcoin market. The market anticipates multiple rate cuts from the Federal Reserve this year, and any deviation from this expectation could have adverse effects on Bitcoin. However, the prevailing sentiment points toward a bullish outlook, especially if the US dollar weakens, as Bitcoin is primarily priced in US dollars.

Volatility should be expected, but the prevailing direction appears clear, at least in the current context. The market has spent the past month gathering momentum, inching closer to a potential upward surge. This continues to be the overall attitude of the market, and I don’t see this changing easily.

At the end of the day, Bitcoin's recent performance indicates a renewed upward momentum, with potential targets around the 47,500 level. Short-term pullbacks are viewed as buying opportunities, supported by key levels such as the 20-day EMA, the $40,000 mark, and the 50-day EMA. The broader uptrend remains intact, with concerns arising only if Bitcoin drops below the $35,000 level. The market's enthusiasm for a Bitcoin ETF, coupled with expectations of Federal Reserve rate cuts, contributes to the positive sentiment. While volatility is expected, the overall direction remains positive.

More By This Author:

Ethereum Forecast: Finds Buyers On The Dip Yet AgainBTC/USD Forecast: Claws Back Some Of the Early Losses On Friday

Pairs In Focus This Week - Sunday, Jan. 7

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more