British Pound Forecast: Cable Extends Gains After Strong UK GDP Print

Cable Fundamental Backdrop

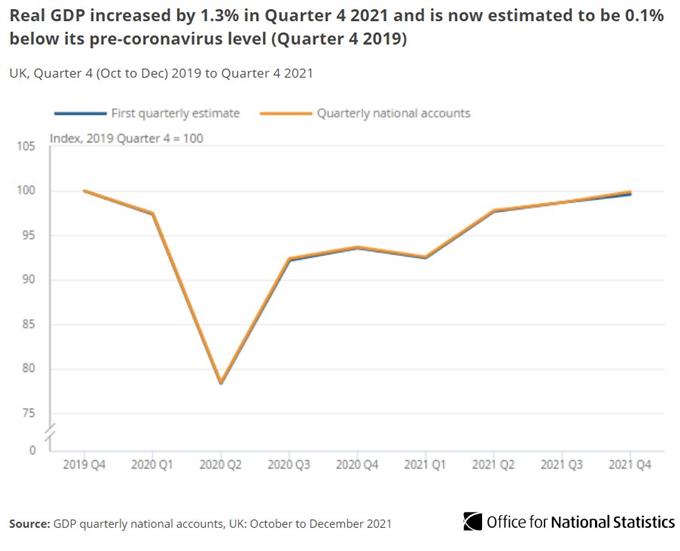

This morning sterling is trading higher against the U.S. dollar after better than expected GDP numbers (see graphic below), while a weaker greenback has contributed to the short-term relief.

Increased price pressure on the housing adds to the inflationary burden on the UK economy however, consumers have remained resilient up until now with pent-up savings from COVID-19 buoying the property sector. With inflation set to continue, household incomes could diminish further should the appreciation of key commodities including oil and natural gas endure.

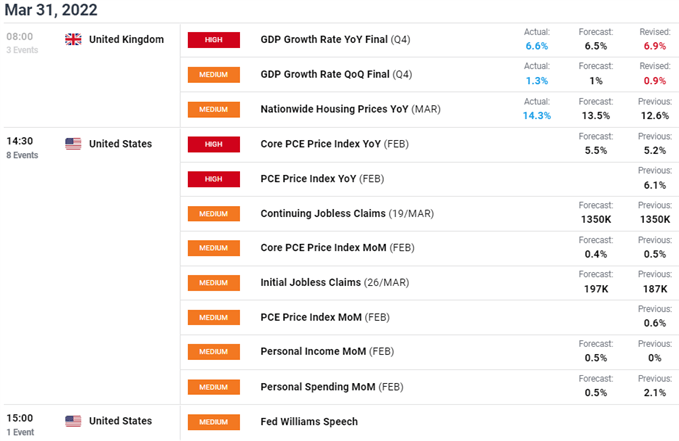

From the U.S. perspective, core PCE data is the focus this afternoon. Should data come in line with forecasts or surpass 5.5% we may see a pullback in GBP/USD as hawkish pressure mounts on the Fed.

GBP/USD Economic Calendar

Source: DailyFX Economic Calendar

Later today (New York cut), we look forward to a fairly substantial GBP/USD option expiry:

- 1.3195-00 (693m)

Generally, markets tend to advance toward the expiry level (1.3195) as the option expiry draws closer. In this case, with cable trading around 1.3136 (at the time of writing), we could see upside price pressure on the pair towards 1.3195.

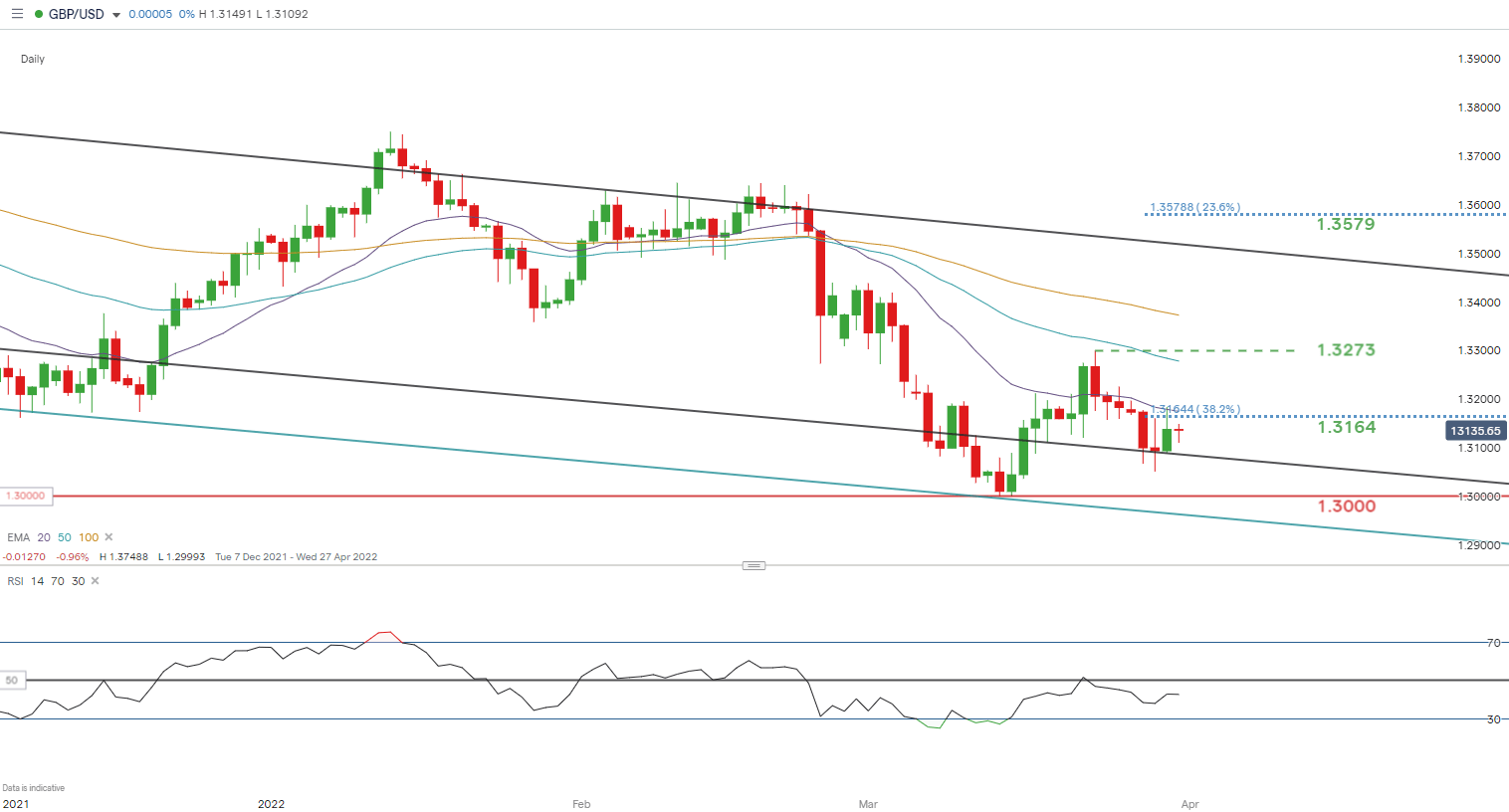

GBP/USD Technical Analysis

GBP/USD Daily Chart

(Click on image to enlarge)

Chart prepared by Warren Venketas, IG

After a soft start in the Asian session, the GBP/USD daily candle is now representative of a long-legged doji and often points to market indecision. Upside has been capped around the key area of confluence between the 20-day EMA (purple) and the 38.2% Fibonacci at 1.3164. A candle close above these levels could open up room for subsequent resistance levels

Key resistance levels:

- 1.3273

- 20-day EMA (purple)

- 1.3164 – 38.2% Fibonacci

Key support levels:

- Channel support 1 (black)

- 1.3000

Hesitant IG Client Sentiment

IG Client Sentiment Data (IGCS) shows retail traders are currently LONG on GBP/USD, with 72% of traders currently holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment however recent changes in net long and short positioning result in a cautious disposition.

Disclosure: See the full disclosure for DailyFX here.