Book Review: Key Takeaways From The Hour Between Dog And Wolf

Robert Shiller called it “irrational exuberance”. John Maynard Keynes called it “animal spirits”. John Coates, the author of The Hour Between Dog and Wolf, explains how testosterone and cortisol are the yin and yang of market sentiment. The book explains the link between hormones and markets and shows how an investor’s physiology changes throughout a market cycle. I finished the book having a better understanding of how our bodies respond to taking risk, and how to avoid the hormonal pitfalls that detract from performance.

Here‘s what I learned:

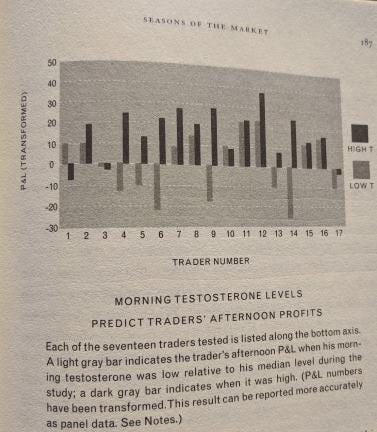

- The link between our body and brain isn’t a one-way street. There’s a significant amount of body-brain feedback and our physical hormonal response influences our mental decision making. Steroid hormones ensure our body and brain work together. Testosterone rebuilds energy stores and cortisol breaks down energy stores for immediate use. Testosterone and cortisol levels can wildly vary and shape investor behavior.

Source: Page 187 of The Hour Between Dog and Wolf

- Daniel Kahneman (of Thinking Fast and Slow fame) changed his stance on intuition. Kahneman initially thought intuition wasn’t that useful because he originally studied it in fields like political forecasting and stock picking. Kahneman partnered with Gary Klein (who mainly studied firefighters and paramedics) and they concluded that intuition can be relied upon, but only if two criteria are met: 1) Someone has to work in an environment that’s regular enough to produce repeating patterns, and 2) They need to encounter patterns frequently enough to learn from feedback on their performance.

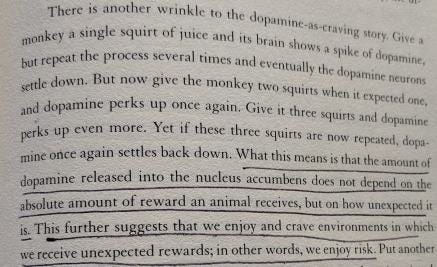

- Information is pleasurable. The novelty of new information is interpreted similarly to pleasurable activities like eating and drinking. These activities cause a release of dopamine which then motivates us to seek it out again. Give an animal the choice between eating or self-stimulating with dopamine and it will self-stimulate until it starves.

- We’re hardwired to crave risk-taking. Dopamine surges after a unique action leads to an unexpected reward. The amount of dopamine released is related to how unexpected a reward is. Dopamine is addicting. Profits gained after taking excessive risk leads to more dopamine when variance grants you the inevitable lucky coin toss.

Source: Page 149 of The Hour Between Dog and Wolf

- Testosterone is the molecule of irrational exuberance. The “winner effect” shows that animals who won a fight were more likely to win their next fight or competition. Winners had higher baseline testosterone levels and losers saw testosterone drop to 1/10th of pre-fight levels. The body chemistry of winning animals (and likely recently successful investors) is different than the body chemistry of the less successful. Eventually, this testosterone build-up raises the probability of excessive risk-taking.

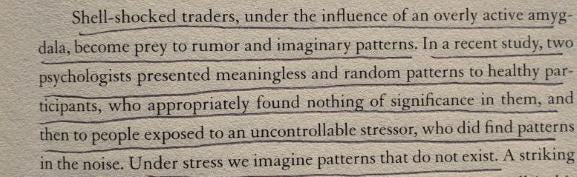

- Cortisol is the molecule of irrational pessimism. Chronic stress breaks down our bodies and detracts from mental performance. Three things trigger the stress response: novelty, uncertainty, and a sense of uncontrollability. Our stress response switches the body and brain from prioritizing everyday functions to an emergency state. In the stress response, cortisol production is triggered and the body demands glucose. The stress response is designed to fuel a muscular, not mental, effort. A prolonged stress response suppresses the immune system, reduces REM sleep, and raises your heart rate and blood pressure.

- The most experienced and profitable traders have different body chemistry than inexperienced traders. The author found that the most profitable traders had high and volatile steroid hormone levels. They had quick hormonal responses when challenged, but their stress response was less volatile. Inexperienced traders had chronically high cortisol levels, leaving them in a state of perpetual anxiety.

Source: Page 227 of The Hour Between Dog and Wolf

My two actionable insights from the book were:

- An information diet is good for your mental health. Investors have access to unlimited data, market commentary, and investment options. More information isn’t better (see: The Paradox of Choice by Dan Ariely). The Center for Humane Technology has a great video on how tech companies are engineered to steal your time and attention.

- Exercise, deep breathing, and cold water immersion physiologically toughen us and reduce chronic stress levels. Exercise expands the productive capacity of our amine-producing cells (therefore relying less on the stress response), and helps defend us against anxiety and stress. This is similar to the concept of hormesis that Nassim Taleb talks about in Antifragile. Basically, a little bit of a bad thing can be a good thing.

Taking risk in financial markets doesn’t just require an understanding of the cold data. Knowing why your body behaves the way it does, and how to balance it, is important to becoming a better investor.

Disclaimer: MVMT Capital LLC (“Movement”) is a registered investment adviser located in Jackson, MS and is registered in the state of Mississippi. Movement may only transact business in ...

more

I know I am lazy, but a link to buy the book would be helpful.

It is there. Click on the links underneath the images.