Your Gold Macro Playbook For 2022

We have spent quite a bit of time writing about the start of Fed rate hikes as a catalyst for the Gold market.

Gold bulls and gold bugs have latched onto this potential positive but without the qualification.

The Fed starting a new rate hike cycle is usually bullish for Gold because Gold declines at the start of the hiking cycle. If Gold does not decline before the beginning of the cycle, and inflation isn’t rising or accelerating, then the start of the rate hiking cycle isn’t bullish.

In other words, if Gold is trading around current levels when the Fed hikes, then the catalyst we’ve discussed isn’t viable.

However, fear not because what one should anticipate next is more important.

Although the Fed has not started hiking rates, market action reveals the Fed is way behind the curve and should be closer to the end, not the start of the rate hiking cycle.

On Thursday, the 2-year yield, which the Fed tends to follow, closed at 1.61%. For context, a month before the Fed executed its first rate hike in December 2015, the 2-year yield was at 0.90%.

Moreover, the yield curve (the difference between 10-year and 2-year yields) closed at 42 basis points. The average spread a month before the start of a Fed rate hike cycle is 115 basis points.

The Fed is way behind schedule. They should at least be in the middle part of the hiking cycle by now.

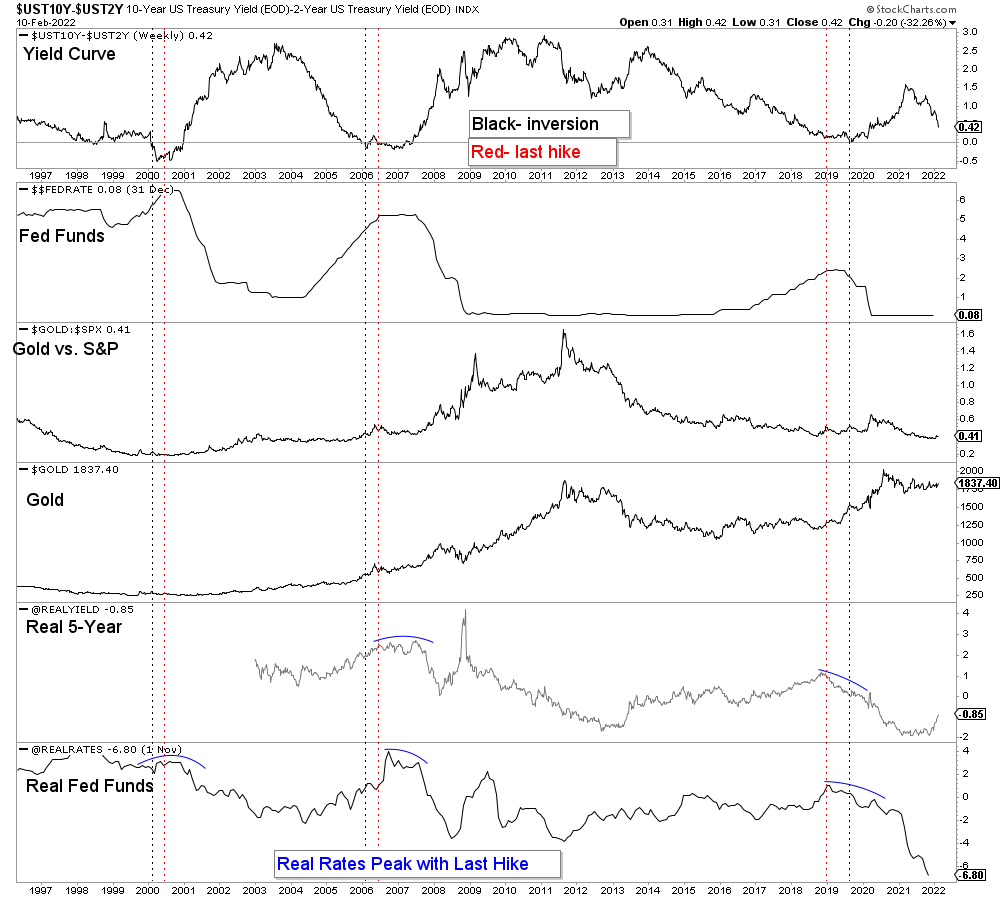

As you can see in the chart below, the Fed stops hiking when the yield curve inverts. There is a growing risk that will occur this year.

Here is where Gold comes in.

Real interest rates, which are inversely correlated to Gold, tend to peak when the Fed executes its last hike.

Thus, the inversion of the yield curve and the Fed executing its final hike are major catalysts for Gold.

(Click on image to enlarge)

Interestingly, in the last Fed rate hike cycle, Gold bottomed four months before the Fed’s final hike.

This rate hike cycle will not last long, judging from the current yield curve. We could see the Gold bottom a month or two after the March hike, which might be only a few months before their final hike!

Do keep mindful of the price action in precious metals and mind the downside risk. The macro fundamentals will soon shift in Gold’s favor, but not quite yet.

As I wrote last week, it would be perfectly in line with history to see a material decline before a major bottom. GDXJ has downside potential to $30-$32 but, on the other side, could rebound to $54 in the ensuing six to nine months.

Disclaimer: TheDailyGold.com and TheDailyGold Premium are not investment advice. The website, email newsletter and premium ...

more