Yields Surge After Ugly 2Y Auction As Foreign Demand Tumbles

Image Source: Unsplash

Today's first of two coupon auctions - the sale of $69 billion in 2Y paper (a 5Y auction follows at 1 pm) - priced at 11:31 am and it was ugly.

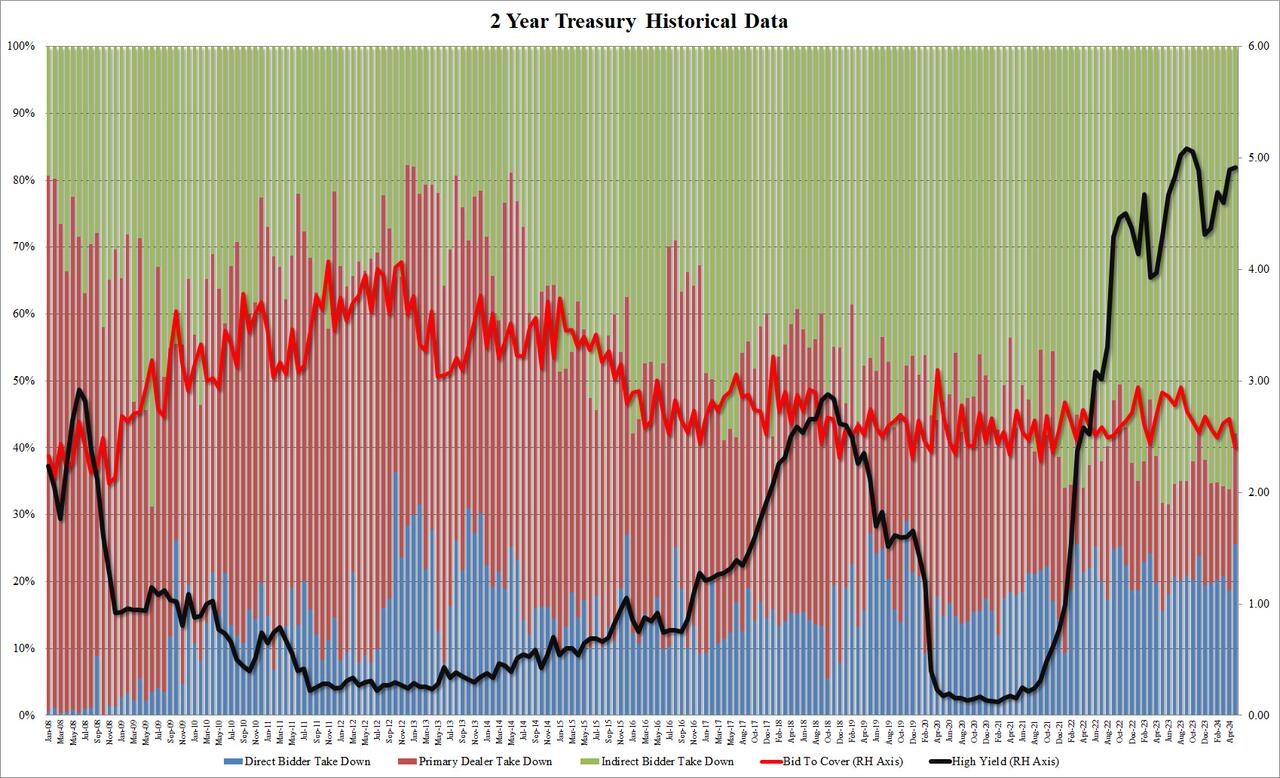

Stopping at a high yield of 4.917%, today's auction not only carried the highest yield since last October's 5.055% but tailed the When Issued 4.907% by 1 basis point (this was the 3rd tail in the last four 2Y auctions).

The bid to cover slumped to 2.41 from 2.66, and was not only below the six-auction average of 2.59 but was the lowest since November 2021.

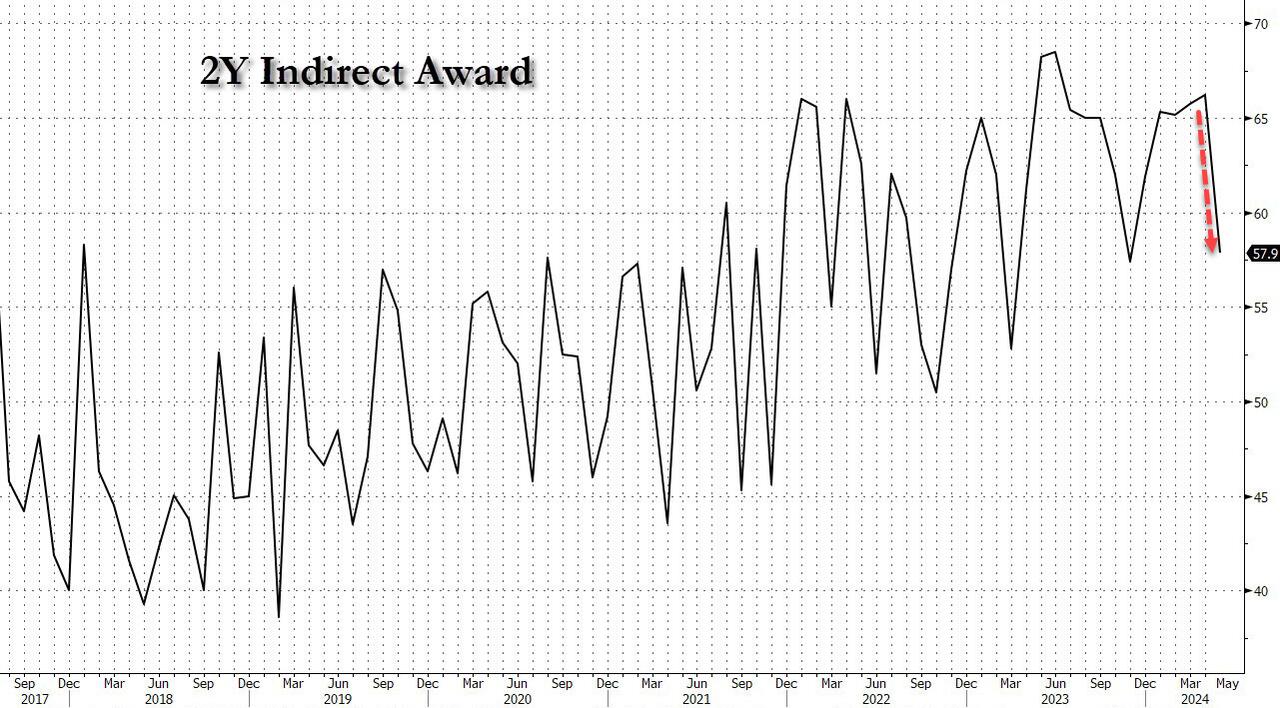

The internals were especially ugly, with Indirects awarded just 57.9%, down from 66.2% in April and the lowest since November's 57.4%.

(Click on image to enlarge)

And with Directs awarded 25.5%, the most since March 2022, left dealers holding 16.6% of the auction, the most since December 2023.

(Click on image to enlarge)

Overall, this was a very ugly auction which saw very weak demand from foreign buyers, forcing Direct bidders and Dealers to step in. No surprise then that 10Y yields spiked above 4.50% after the auction results were announced, hitting the highest level in two weeks as concerns about "higher for longer" refuse to go away.

More By This Author:

Boeing's Starliner Crewed ISS Mission Will Still Launch Despite Helium LeakRegular Cannabis Users Exceeds Drinkers For First Time Ever

First Time Since GFC: Holders Of AAA 'CRE-Backed' Debt Hit With Losses

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more