Yields Slide After Stellar 7Y Auction With Highest Bid-To-Cover Since March 2020

After two ugly auctions, at 1 pm ET the Treasury concluded the week's coupon issuance with the sale of $38BN in 7-year paper in what was actually a rather recent auction.

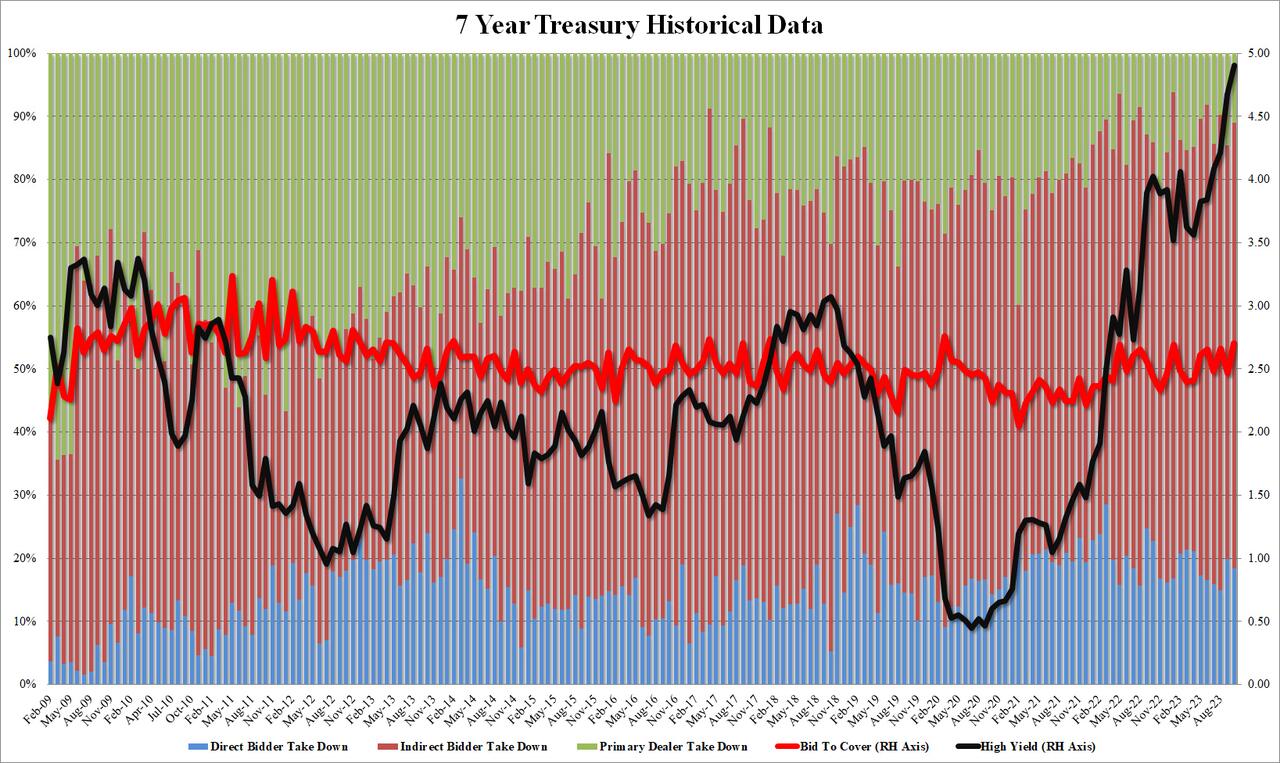

The high yield of 4.908% was above last month's 4.673% and was the highest on record, but more importantly it stopped through the When Issued 4.910% by 0.2bps, a reversal of last month's modest 0.3bps tail.

The bid to cover of 2.704 was a solid improvement to last month's 2.465 and was the highest going back to the March 2020 bond market rollercoaster.

The internals were also solid with Indirects awarded 70.6%, just above the recent average of 70.4%, and with Directs taking down 18.4%, Dealers were left holding just 11.0% below the 6-auction average of 12.0%.

(Click on image to enlarge)

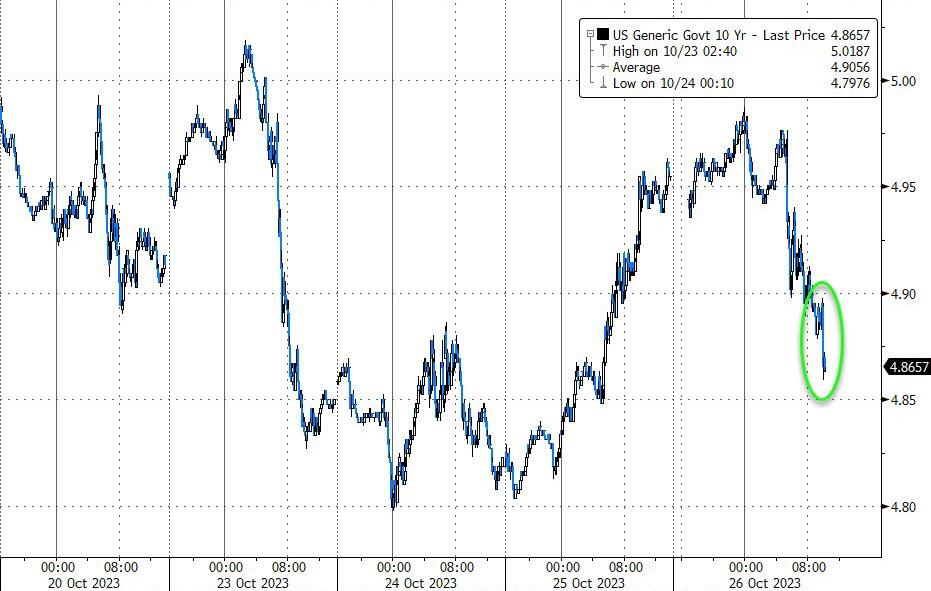

The strong auction took the market, which has gotten used to expecting fire and brimstone on every auction day, by surprise and pushed 10Y yields down to session lows around 4.86%, down more than 10bps from the session highs hit earlier in the session.

(Click on image to enlarge)

More By This Author:

Meta Jumps After Beating Estimates, Cuts Expense & CapEx Guidance, Sees Metaverse Losses Rising "Meaningfully"Yields Jump After Gruesome 5Y Auction Prices With Biggest Tail In 15 Months

IRS Collects $160 Million From Wealthy Taxpayers Amid 'Increased Compliance Efforts'

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more