Yields Slide After Solid 7Y Auction, First Stop Through Since October

After two lousy, record-large coupon auctions in Monday's two-for-one special, moments ago the Treasury issued a non-record $42BN in 7 Year paper (we saw far bigger 7Y auctions which hit a mindblowing $62BN during the covid crisis), in what was a solid auction to close the month.

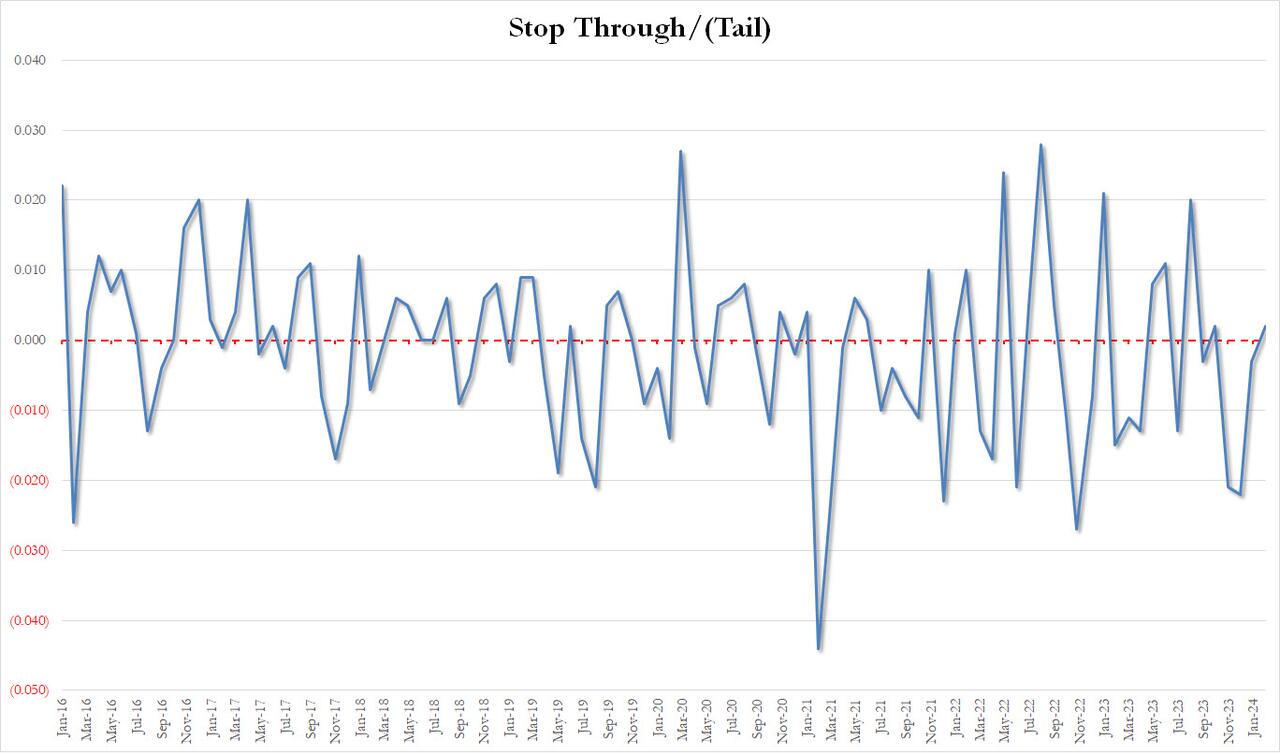

The high yield of 4.327% was above last month's 4.109% and on par with November's 4.399%. It also stopped through the 4.329% When Issued, a 0.2bps stop through which was the first since November, and followed three consecutive tails.

(Click on image to enlarge)

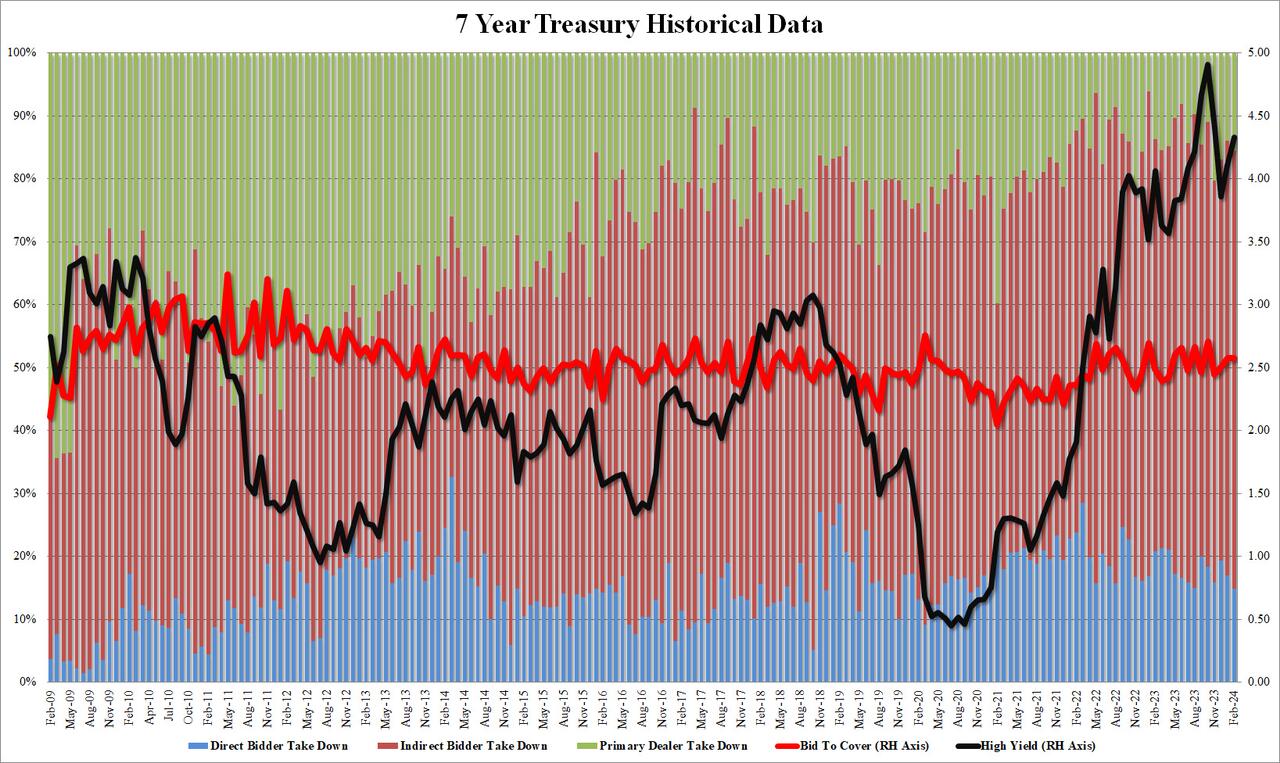

The bid to cover at 2.577 was flat vs last month's 2.574 and right on top of the six-auction average of 2.56.

The internals were solid with Indirects awarded 69.6%, the highest since October and also above the recent average of 68.0%. And with Directs taking down 14.8%, modestly below the recent average of 17.6%, Dealers were left holding 15.60%, the highest since December and above the average of 14.4%.

(Click on image to enlarge)

Overall, this was a solid auction, and a welcome reversal from the two subpar coupon sales yesterday which helpd push the 10Y as high as 4.3% yesterday. Not surprisingly, 10Y yields dropped to 4.28% after the auction, 2bps lower thanks to the strong auction results.

More By This Author:

US Durable Goods Orders Collapsed In January - Biggest Drop Since COVID Lockdowns

US New Home Sales Disappoint In January, Median Prices At 2 Year Lows As Supply Jumps

Have We Passed The Peak Of The Smartphone Era?

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more