Yields Rocket Higher On The Heels Of Powell

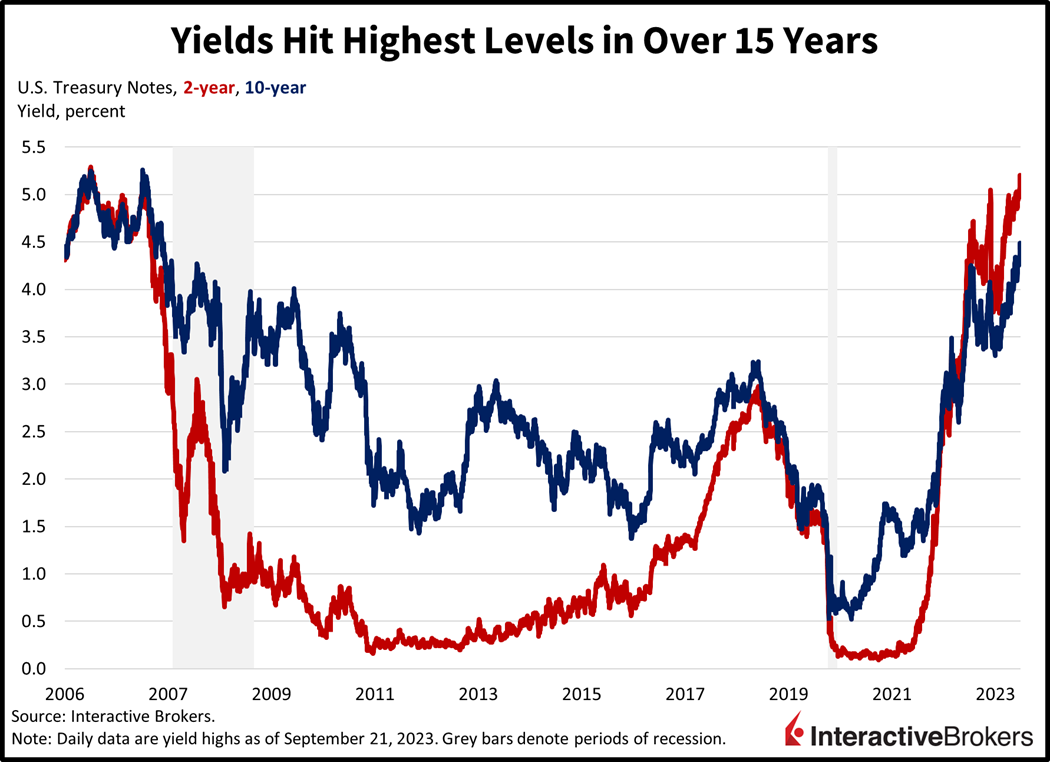

Markets are stumbling this morning on the heels of hawkish adjustments to the Federal Reserve’s Summary of Economic Projections (SEP) made yesterday. Chairman Powell’s presentation afterward failed to provide relief, with investors compelled to manage the turbulence that the higher-for-longer melody fosters. Yields are skyrocketing as a result, with the 2- and 10-year maturities at their highest levels since 2006 for the former and 2007 for the latter. Equities are suffering as well, with the S&P 500 now 5.2% below its year-to-date high reached in late July.

One More Time?

In a surprise to investors, the Federal Reserve appears ready to hike the fed funds rate one more time this year, according to the median expectation of policymakers as reported by the SEP released yesterday. Policymakers also anticipate holding rates higher and for longer than they forecasted in June and they have raised their outlook for the strength of the economy while lowering their unemployment rate expectations. Inflation projections were also lowered but with modest reductions.

Hawkish Adjustments

The median policymaker outlook for the fed funds rate for this year stayed at the same June forecasted rate of 5.6% but for next year and the year after, policymakers increased their projections from 4.6% and 3.4% to 5.1% and 3.9%. Fed policymakers revised the real GDP growth estimate to 2.1% for this year, up from 1.0% projected in June and they now expect 1.5% and 1.8% growth rates for the next two years. In another sign of the economy’s resilience despite tighter monetary policy, the median unemployment rate forecast for this year was reduced from 4.1% to 3.8% and from 4.5% for next year to 4.1%. The median Core PCE inflation forecast was lowered for this year from 3.9% projected in June to 3.7% and the June 2.6% inflation rate forecast for next year was left unchanged.

Real Rates and Purchasing Power

With the fed funds rate expected to remain higher while inflation slows down, the effective real rate, or the rate paid to lenders in excess of inflation will inevitably rise. The result incrementally incentivizes savings over investment, a stark contrast to the financial landscape of the last decade and a half or so. During the period, savers were unable to park cash in theoretically risk-free investments like Treasuries and gain purchasing power. In order to achieve a return in excess of inflation, investors were compelled to borrow at low rates and invest in projects that carry risk. As the landscape transitions towards one that encourages saving rather than investment, economic growth is likely to slow alongside inflation. Higher real rates are a critical aspect of the Fed’s inflation battle.

Businesses Fight the Fed

On the economic data front, existing home sales and unemployment claims both came in lower than expectations. While the real estate sector is feeling the effects of higher mortgage rates, businesses want to make money and are not laying off employees as they remember the troubles associated with acquiring and sustaining quality labor during the pandemic. Existing home sales fell to the lowest level since February, as only 4.04 million seasonally adjusted annualized units were sold in August. The figure fell short of the 4.1 million forecast and July’s 4.07 million. Initial unemployment claims came in at 201,000 for the week ended September 16 while continuing unemployment claims arrived at 1.662 million for the week ended September 9. Both figures reflected a solid labor market, coming in below anticipations of 225,000 and 1.695 million and less than the previous period’s 221,000 and 1.683 million.

Powell Sparks Volatility

Markets are getting punished today with players digesting the higher-for-longer theme. Many investors I’ve spoken with were hoping that the Fed would declare victory with inflation at 3%. In fact, the narrative of the Fed cutting sooner rather than later is an important ingredient to this year’s stock market rally. Unfortunately, Powell dashed those hopes yesterday as he refused to move the goalpost on inflation. All major equity indices are down, led by the Nasdaq Composite and Russel 2000 which are both down 1%. The S&P 500 and Dow Jones Industrial indices are down 0.9% and 0.4% amidst a broad move lower with all sectors firmly in the red. Bond yields are climbing to the highest levels in 17 and 16 years with the 2- and 10-year Treasury maturities up 2 and 7 basis points (bps) to 5.19% and 4.48%. The dollar is higher as well, as it appreciates against the pound sterling, euro, franc, yuan, and Canadian and Aussie dollars while it depreciates against the yen. Indeed, the Bank of England’s decision to leave rates steady this morning is punishing Great Britain’s currency while tonight’s inflation data out of Tokyo alongside the Bank of Japan’s interest rate decision is likely to draw the masses. The Dollar Index is up 6 bps to 105.49. Crude oil initially joined the risk-off sentiment on Wall Street but has since reversed as the supply story remains constrained. WTI crude oil is now up 91 cents to $89.90 per barrel as energy bulls fight to claim the important $90 level.

Dovish Fed Critical for Further Upside

Investors are still downplaying the likelihood of a Fed funds rate increase this year with the probability of a rate hike in November increasing to only 28.7%. Market players have been attentive to the Fed’s outlook as demonstrated by investors pushing their expectations for rate cuts to the second half of next year. Quite frankly, stock bulls need a dovish Fed to accumulate gains from here, as most of this year’s gains have come from valuation expansion rather than earnings performance. The former happens to be more sensitive to interest rates, with current levels unjustified as the 10-year knocks on the door of 4.5%.

More By This Author:

Looking Ahead To Wednesday’s FOMC MeetingThank Eisenhower For “Sell Rosh Hashanah, Buy Yom Kippur”

Oh, BTW, Tomorrow Is A “Triple-Witching” Expiration

Disclosure: INTERACTIVE BROKERS

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third ...

more