What Does It Mean If The Fed Might (Have To) Be Ready To Move Past IOER?

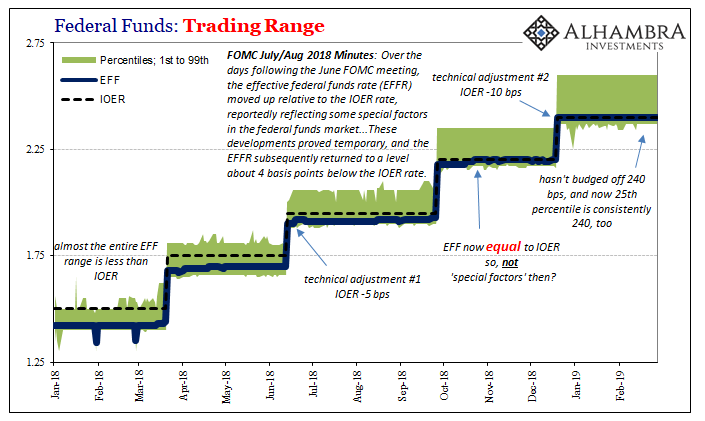

More than any conundrum in the bond market, the Federal Reserve has one on its hands much closer to home. Its home, anyway. The effective federal funds rate (EFF) has been stapled to IOER for each of the last fifty trading days. No variation whatsoever.

EFF had converged with IOER back in October. A lot of ugly things began to happen in October, this being only one. Still, it suggested the connection to them, not quite the one policymakers think.

Federal funds is a nothing market. If there is unruliness in it, that can only mean much greater difficulties out in the global “dollar” markets. In other words, how bad must it have been in money supply terms that it broke out in this distant, irrelevant corner, too? The answer to that question, obviously, is what happened in November and December.

But that isn’t the end of it. Markets have resumed reflation in 2019 as if all that was an isolated case. An interesting discussion that will plague only the weirdly obsessive. Even the Treasury market today has moved out of its inversion in the short middle part of the curve.

Still, something isn’t quite right. As noted above, EFF appears to be stuck. At least during November and early December there were a few days here and there back 1 bp underneath IOER. The last time was December 14 – just when things got serious around the world.

That’s not all. Going back to February 11, the entire distribution has shifted upward. Effective federal funds is a single rate pieced together from a wide(ish) variety of actual transactions. Even as FRBNY publishes 2.40% for EFF consistently day after day, there are some funding transactions pulled off both above and below the weighted average.

As the distribution settles upward, that would suggest a growing skew toward the upside, fewer actual trades below it. Furthermore, it raises the prospects, informally, of settling at an effective rate which would be above IOER. The 25th percentile, the rate below 75% of all dollars lent and borrowed here, since February 11 has been equal to both EFF and IOER. Before December 26, it had at least offered 1 bps of margin.

It doesn’t say much for either the Fed pause nor the coming end to balance sheet “normalization” (so-called QT). In fact, this puzzle in federal funds has gotten the attention of the FOMC.

According to Bloomberg today, FRBNY has sent out a questionnaire to all the primary dealers on the topic of money market rate ceilings. So much for IOER, big surprise.

The New York Fed’s markets group has sought feedback on how an instrument that keeps money-market rates from rising too far above the central bank’s target range should be designed, and how it would impact markets. That’s according to three people who attended meetings on the issue, who asked not to be identified because they’re not authorized to discuss them.

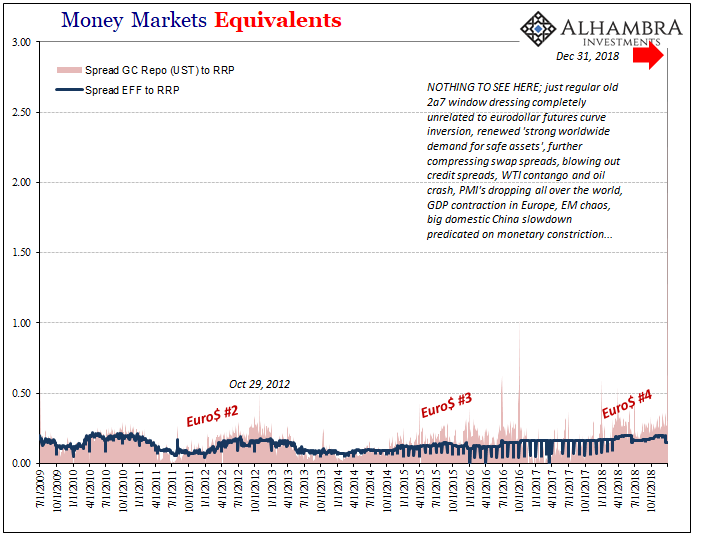

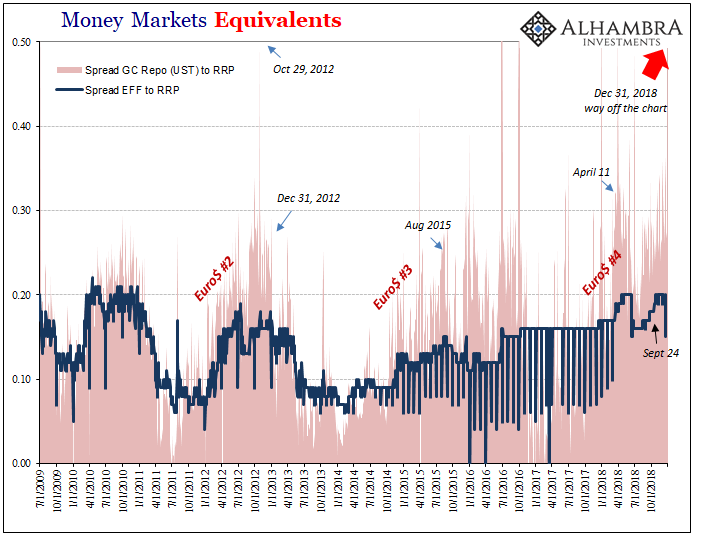

As the Bloomberg article also notes, there was mention in the last policy minutes of a probably lengthy discussion about repo. “An account of January’s meeting mentioned a year-end spike in rates for repurchase agreements, which occurred during a reduction in overnight lending as market participants shored up balance sheets for regulatory purposes.” This spike:

In some respects, we are back in 2011 all over again (for those who want the short version: in early August that year, just as the second bank crisis broke, the FOMC debated what amounted to a bailout of the repo market). The Federal Reserve has been at odds with repo because it is or should be clear how money market hierarchy broke down a very long time ago (on August 9, 2007, to be precise). This is no small matter.

For more than eleven years, however, policymakers have tried often desperately (especially in 2011) to just ignore it; preferring instead to dazzle you with trillions of bank reserves.

When considering any impact from QT and the Fed’s balance sheet, we have to keep in mind how the amount of them, the byproduct of the QE’s, was always immaterial. There was no better illustration of this fact than the official discussions which took place during the 2011 flareup:

MR. SACK [Mgr System Open Market]. Can I add a comment? In terms of your question about reserves, as I noted in the briefing, we are seeing funding pressures emerge. We are seeing a lot more discussion about the potential need for liquidity facilities. I mentioned in my briefing that the FX swap lines could be used, but we’ve seen discussions of TAF-type facilities in market write-ups. So the liquidity pressures are pretty substantial. And I think it’s worth pointing out that this is all happening with $1.6 trillion of reserves in the system. [emphasis added]

They kept claiming hierarchy didn’t matter, opting in 2012 instead for two more QE’s even though repo told them they hadn’t worked and that when you plot this very hierarchy problem it lines up exactly with all the bad things that have happened during the last eleven years – including both 2011 and today. And now they are back to discussing liquidity facilities again (or what would be this new “ceiling”).

In one sense, it represents progress in that officials aren’t simply dismissing what is obviously a mess (the repo rate should never, ever be above unsecured interest rates like federal funds; let alone persist this way for lengthy periods of time).

Realistically, though, the way in which this is being framed already suggests the same backward thinking. The private market is starved of money dealing capacity, that’s what’s missing showing up as the absence of predictable hierarchy; the very way in which it used to be enforced via strict arbitrate. What good is another central bank ceiling, how does it address this situation?

It wouldn’t.

Powell and his group need to realize this isn’t a central bank issue, it is an eurodollar bank imbalance. They won’t because when it comes down to it they continue to labor under the illusion (delusion) that the central bank is central – even when they openly question how it’s not.

Central bankers traded monetary competence for expectations policy (magic tricks) a very, very long time ago. It shows.

Obviously, there are implications about both the long run and short-term. In the short run, this hardly reflects better monetary conditions in the private system. If the Fed pause gamble had worked, or the now near-constant promises to stop QT, we would expect EFF to relax. It’s instead pressing even harder up against IOER (the now widely accepted joke). It sounds as if the Fed is a little worried it will push through to get above the “ceiling.”

Longer run, they are getting closer to the truth of the last eleven years. But if the current UST conundrum hasn’t opened their eyes, I sincerely doubt a more convoluted route to the same conclusion will do the trick. These two factors are very much related (the interest rate fallacy in both bonds and money markets; low UST yields suggest persistently tight money as does broken money market hierarchy). You can lead a horse to repo but don’t expect it do anything other than craft a dressed up “new and improved” IOER.

Instead of focusing on trying to fix EFF, maybe start by investigating (honestly) why it might be broken? You know, common sense.

It is, at the very least, a mark of Euro$ #4’s progress; last summer the FOMC claimed it was all just “special factors” not worth bothering about and now they blatantly plan for circumventing IOER.

That’s because, in the end, they really don’t know what they are doing. They never did. That’s how there was such a thing like 2008, 2011, 2014, 2018, etc. Even when it comes to federal funds, the one thing above everything else they were supposed to have mastered, they don’t get it. And if they can’t get the small things right…

Disclosure: This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more