What Do Credit Markets Know That Record-High Stocks Are Choosing To Ignore?

It's often said (or at least it was before The Fed killed every market signal) that 'Credit anticipates and equity confirms'.

If that is coming true right now, Powell and his tapering-pals may have a problem.

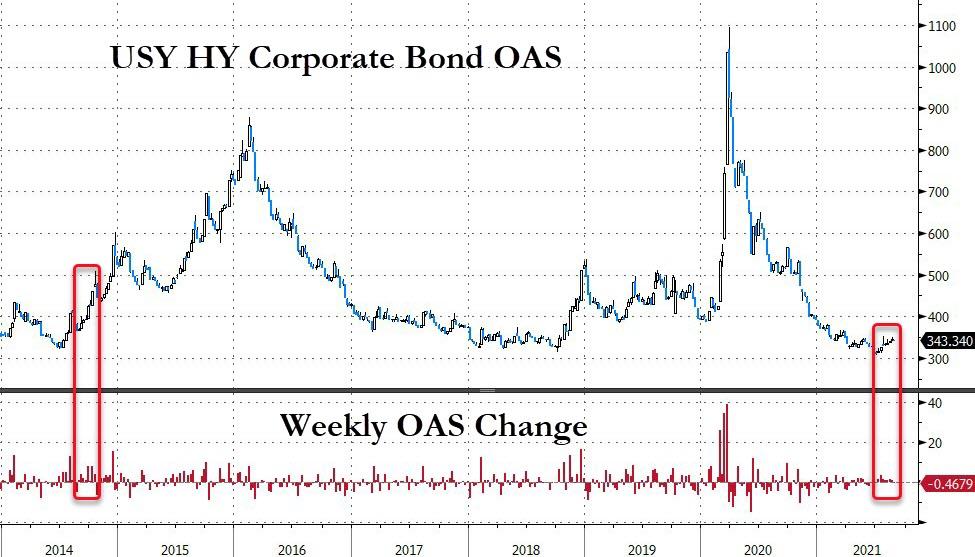

The US high yield credit market is trading at its weakest since March (despite stocks hitting record highs)...

(Click on image to enlarge)

Source: Bloomberg

We've seen this pattern before numerous times... and it generally didn't end well for stocks.

Most recently, in early 2020, credit sniffed out issues while stocks just ignored the fact that a global pandemic was looming...

(Click on image to enlarge)

Source: Bloomberg

When spreads keep widening as the VIX Index grinds lower that “is often a good warning sign of trouble to come – and the notoriously volatile September is just around the corner,” said Michael Purves, founder and chief executive officer at Tallbacken Capital Advisors.

“The rise and persistence of Covid variants is one obvious place to look for some fear, and the noisy jumble of economic data still points to a slightly muddy economic picture.”

More significantly, this is the 7th straight week of HY bond spread widening. That is the worst run since 2014...

(Click on image to enlarge)

Source: Bloomberg

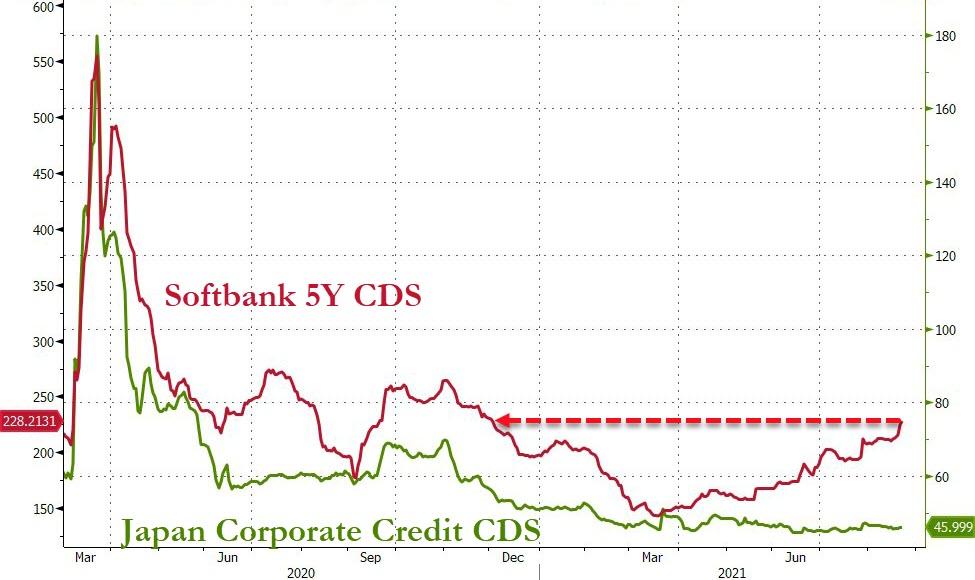

And it's not just the US, Softbank's CDS has been ripping higher recently, notably decoupling from the broad Japanese corporate bond market (as a Chinese regulatory crackdown sent its China portfolio into a tailspin).

(Click on image to enlarge)

Source: Bloomberg

Is it time for The Fed to start buying credit again? Or threatening to?

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more