Well This Looks Disturbingly Familiar

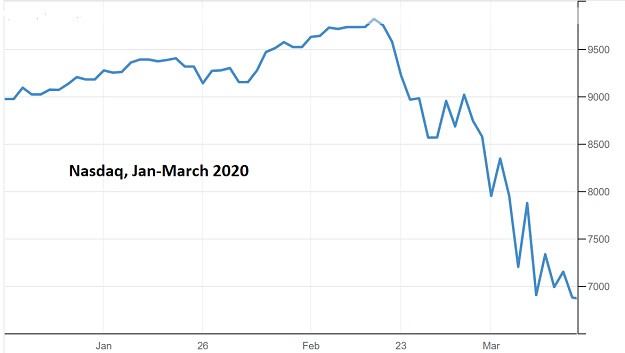

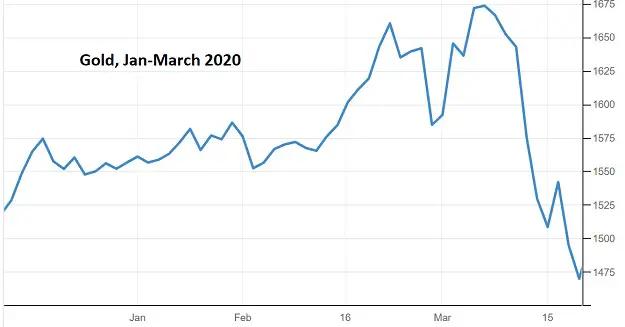

Last March, the financial markets were rocked by the emergence of a disease that public health officials defined as a pandemic. Stocks and gold both tanked, and the locked-down economy went into free-fall.

Here’s the Nasdaq …

… and gold:

This flash-crash was brutal but ultimately short-lived, as the world’s governments immediately stepped in with tens of trillions of dollars of new liquidity. By late May financial asset prices were headed back up, and for the owners of stocks, bonds, real estate, and precious metals, the good times were rolling again.

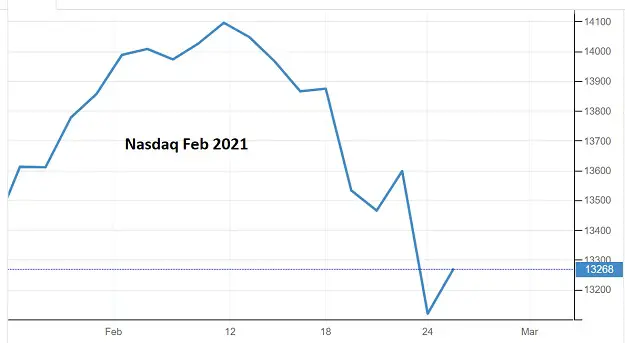

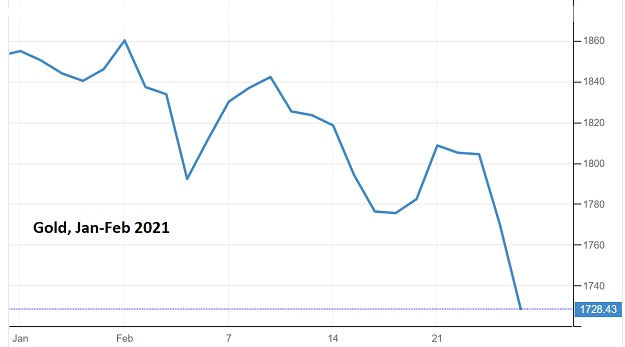

Now fast forward almost exactly one year. The financial markets are being rocked by rising inflation and surging interest rates, which in some ways present an even trickier challenge than COVID-19. Here’s this month for the Nasdaq…

… and gold:

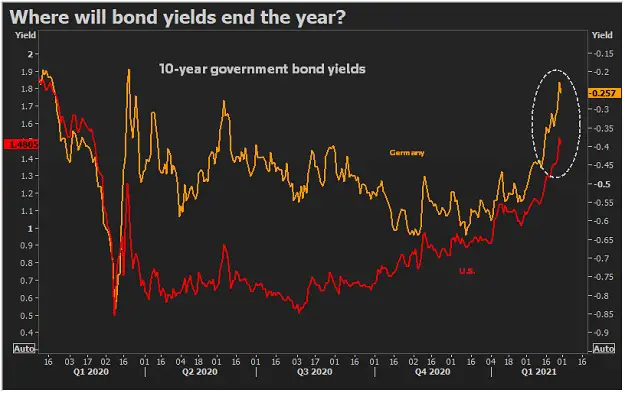

If history is repeating, a few more days of this and the federal government will feel obligated to intervene. But how exactly does it fix an interest rate spike caused by rising inflation? Here’s a Reuters article illustrating the global nature of the problem:

Bond markets left smarting from worst rout in years as reflation goes global

From the United States to Germany and Australia, government borrowing costs on Friday were set to end February with their biggest monthly rises in years as expectations for a post-pandemic ignition of inflation gained a life of their own.

Australia’s 10-year bond yield and Britain’s 30-year yields were set for their biggest monthly jump since the 2009 global financial crisis. Long-dated New Zealand yields were flirting with their biggest monthly surge since 1994.

For the United States and some European markets, the bond selloff was on the scale of late 2016, when Donald Trump’s election as U.S. President last triggered so-called reflation bets.

U.S. 10-year bond yields, up more than 35 bps this month and near one-year highs above 1.45%, are set for their biggest monthly jump since November 2016.

Britain’s 10-year bond yield, up 45 bps in February, was also set for its biggest monthly jump since 2016. Thirty-year yields headed for their biggest monthly leap since 2009 after rising 48 bps.

In the euro area, where German Bund yields were set for their biggest monthly jump in three years, the European Central Bank has said it is monitoring the rise in rates closely.

Normally, this kind of crisis is emphatically NOT to be met with massive infusions of newly created currency. But that’s exactly what the US and many other countries are offering. See House set to pass Biden’s $1.9T pandemic relief package.

The dilemma facing Washington – really the whole world – is that the past four decades of wildly excessive borrowing had left huge sections of the global financial system vulnerable to higher borrowing costs – before the pandemic lockdown. Now huge sections of the global economy are functionally bankrupt.

So either they’re bailed out immediately or they fail.

But bond buyers are responding to the prospect of another year of insane borrowing and currency creation by running for the exits. And – again – a big part of the global economy is too fragile to handle the resulting higher interest rates.

So here we are “Capital D” Depression if governments rein in their spending and borrowing, and a spike in interest rates followed by a Depression if governments continue on their present course.

This day was always coming, but the lockdowns moved it from “inevitable” to “imminent”. Buy gold (after it bottoms).

#Gold has diverged heavily.

The fact is that gold is always different. While the "price" may dance around, the value is stable. We should always be thankful that gold was created for us so long ago. It could not have been a random thing.

Perhaps a start would be to hold the federal bankers personally liable for the damage and demand that they pay. And then raise the interest rates just a bit. And then realize that what is good for the financial sector may not be good for the rest of humanity, and let those folks suffer a bit. Not taking from them, just not hurting the rest to protect them.Certainly a radical concept,

And then change the rules so that constant inflation is no longer the policy of choice.

Agreed.