Weak Economic Reports Didn’t Stop The Market From Rallying

Weak Economic Reports - Another Rally On Wednesday

S&P 500 increased 0.58% on Wednesday which was surprising to me because retail sales and industrial production missed estimates. Economic growth could end up being below 2% in Q2. That doesn’t correlate with a rising stock market.

Headlines state the stock market rallied because President Trump delayed the auto tariffs. This was widely expected. To me, weak economic reports should move the market more than and a trade move that everyone thought would happen.

If the economy goes into a recession, stocks will be much lower and this small rally will be long forgotten. I’m not saying there will be a recession this year. But these negative reports and the ones from China, don’t paint a good picture of the global economy. This slowdown is why expectations for Fed rate cuts would probably increase.

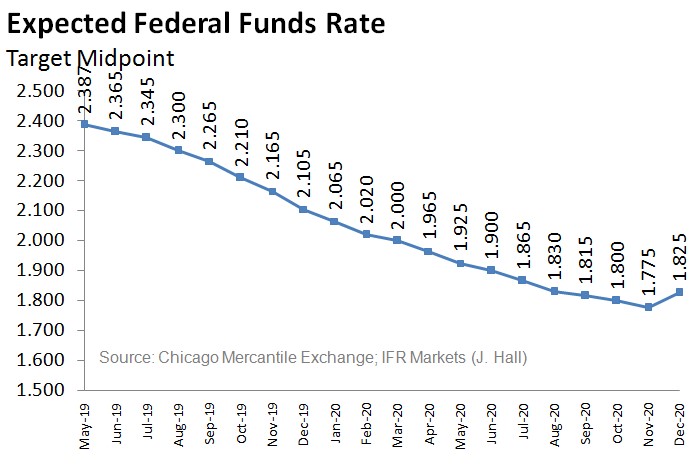

As you can see from the chart below, the expected mid-point of the Fed funds rate in November 2020 is 1.775%. That would be about 2 cuts. Ultimately, I see a recovery late in the year which prevents cuts. For the market to stop expecting cuts, the 2-year yield would need to have a powerful selloff.

(Click on image to enlarge)

Underlying Market Performance

Nasdaq increased 1.13% and Russell 2000 increased 0.34%. VIX fell 8.97% to 16.44. Probably because of the volatility earlier in the day, the CNN fear and greed index stayed at 35 which is fear.

SOXX semiconductor ETF increased 0.77%. The best 2 sectors on Wednesday were communication services and tech which increased 2.11% and 0.98%. The worst 2 were the financials and materials which fell 0.48% and 0.24%. Financials don’t like the decline in treasury yields which occurred because of the bad economic data. The 10-year yield fell 3 basis points to 2.38% and 2-year yield fell 4 basis points to 2.16%.

As you can see from the chart below, the Merrill Lynch survey showed over 70% of fund managers think the 10-year yield will trade between 2% and 3% in the next year. That’s a pretty big range, so I’m not surprised by this result. Both bulls and bears can agree on this answer.

(Click on image to enlarge)

Lyft and Uber have been rallying

These firms are too new to have them crater this quickly. There was a report that market makers pushed UBER stock higher to make the IPO look good.

Specifically, underwriters employed naked short selling to support the stock. This technique lets underwriters sell more shares than their typical overallotment and buy the stock back in the public market. I think the stock is up because it was oversold as Lyft rallied as well. Specifically, Uber was up 3.33% on Tuesday and is up 11.29% in the past 2 days. LYFT was up 6.97% and is up 12.23% in 2 days.

Weak Retail Sales

Some economists are blaming lower than expected tax refunds and others are blaming the late Easter holiday for the weak April retail sales report that missed estimates solidly across the board.

Headline monthly retail sales growth was -0.2% which missed estimates for 0.2% and the low end of the estimate range which was -0.1%. I said this report would be weak on a monthly basis because of the tough comps, but I didn’t expect a decline. The March reading was revised up from 1.6% to 1.7%.

(Click on image to enlarge)

One of the reasons the report missed estimates was the housing market led to weak spending on furniture and building equipment. Furniture sales were flat on a monthly basis after falling 3.1% in March. Building materials sales fell 1.9% monthly after 1.2% growth.

Retail sales without autos were up 0.1% which missed estimates for 0.7% and the previous reading of 1.3% growth. That was also 0.1% below the low end of the estimate range. This reading was above headline growth because auto sales fell 1.1%.

Weak Economic Reports - Excluding autos and gas sales growth was -0.2%.

This was lower than the reading that only excluded autos because gas station sales were up 1.8%. That reading missed estimates for 0.4% and was 0.2% below the low end of the estimate range. The only reading that didn’t miss the low end of the consensus range was the control group which had no growth which missed estimates for 0.4% and the previous reading of 1.1%.

The chart below can be considered biased because it includes the worst parts of this report. That being said, these groups don’t all show weakness if the economy is accelerating. Most economic reports show this is a slowdown. Housing could recover later in the year. But results haven’t recovered as much as investors expected. Electronics and appliance store sales fell 1.3% in April after declining 4.3% in March.

(Click on image to enlarge)

The best part of this report was the 0.7% growth in department store sales which helped general merchandise growth get to 0.2%. Restaurant sales growth was 0.2% which is impressive because March had monthly growth of 5.7%.

The positive revision to March retail sales will help Q1’s GDP reading, but this weak April reading could mean GDP growth will be below 2% in Q2. It all depends on if the weakness was catalyzed by cyclical issues or the late Easter messing with seasonal adjustments and disappointing tax refunds.

This report caused the Atlanta Fed Nowcast’s estimate for real consumer spending growth in Q2 to fall from 3.2% to 3%. That would still be higher than Q1’s growth of 1.2%.

Weak Economic Reports - Conclusion

With the stock market opening down, I think investors interpreted the retail sales report as bad news. The market regained form because of the trade news which I argue should have been priced in.

To be fair to the bulls, the Easter holiday affecting the seasonality of the retail sales report could have made it look worse that it was. The effect on GDP growth will be negative unless there is a positive revision. However, I care more about the trend. We will need to wait another month to see if this somewhat weak report was a blip.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, ...

more

I think the stock market going up in support of Trump. It is a phony rally and likely engineered. Trump cannot really win the trade war, so it is a delusional and pathetic display of American desperation. Sad.