Uptrend May Be Short And Choppy

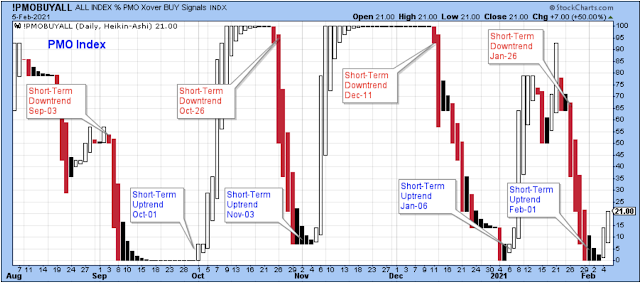

A new short-term uptrend started early this past week. I wasn't expecting a new uptrend so soon, but I have learned the hard way to be open to unexpected possibilities in the stock market. So on Monday, when I saw the market strength, I deployed my cash.

The chart below helps confirm the new uptrend. It shows a nice reversal of NASDAQ stocks trending above their 50-day average. Also, it shows the NASDAQ composite closing at the high and above its 5-day average.

I would have liked to have seen the market take another week to correct stock prices in order to build a better, more reliable base to begin this new uptrend. Without an adequate base, it means that this uptrend may be shorter and choppier, so I will be keeping that in mind. Also, my thinking is that the market is setting up for another mini melt-up in the months ahead similar to early 2018, and we'll need to raise cash into that strength when it occurs.

The Longer-Term Outlook

The ECRI index has reached up to a level similar to the 2009-2010 period after the financial crisis. I'm a bit uncertain what to think when it eventually reverses and heads lower, but when that does happen it will be important to listen to the ECRI commentary to understand the implications for the economy. For now, the strength of the index points to economic strength and favors higher stock prices longer-term.

There can't be much doubt at this point that the trend for bond prices is lower (higher longer-term rates). Lower bond prices help to confirm the economic expansion, and help to channel funds out of bonds and into stocks. So, at the moment, this downtrend for bonds helps stock prices, but if the trend moves too far and too fast, it will scare investors and potentially start to work against stock prices. Also, higher rates have the potential to depress PE multiples which works against many technology stocks.

This bitcoin index looks like it may be ready for another short-term move higher. I know nothing about Bitcoin except to say that the chart looks constructive.

The regional banks also look interesting. This could be a powerful break into new highs.

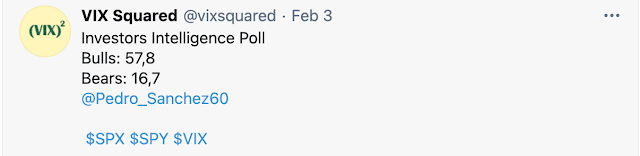

Excessive bullish froth eased just a bit last week, but it is still way into the upper end of the range. The market has continued to rise despite this excessive bullishness, but I don't think it means that we should ignore sentiment. Instead, I think it means that we need to be alert because the strength of this market is going to start to make us think that we can buy any stocks at any price and not worry about losing money.

Outlook Summary

The short-term trend is up for stock prices as of Feb. 1 <-- change in trend

Contrarian sentiment is unfavorable for stock prices as of Nov. 14

The economy is in expansion as of Sept. 19

The medium-term trend for treasury bonds is down as of Oct. 10 (prices lower, yields higher)

Strategy During a Bull Market

- Buy large-cap stocks and ETFs at the lows of the medium or short-term market trends

- Buy small-cap growth-stocks on breaks to new highs in the early stages of market trends

- Reduce buying when the market trend is at the top of the range

- Take partial profits when the market uptrend starts to struggle at the highs

Disclaimer: I am not a registered investment adviser. My comments reflect my view of the market, and what I am doing with my accounts. The analysis is not a recommendation to buy, sell, ...

more