Ugly, Tailing 10Y Auction Sees Lowest Foreign Demand Of 2024

After yesterday's stellar, stopping through 3Y auction, moments ago the Treasury completed its 10Y reopening of 9-year, 11-month Cusip JZ5, in an auction that was mediocre at best.

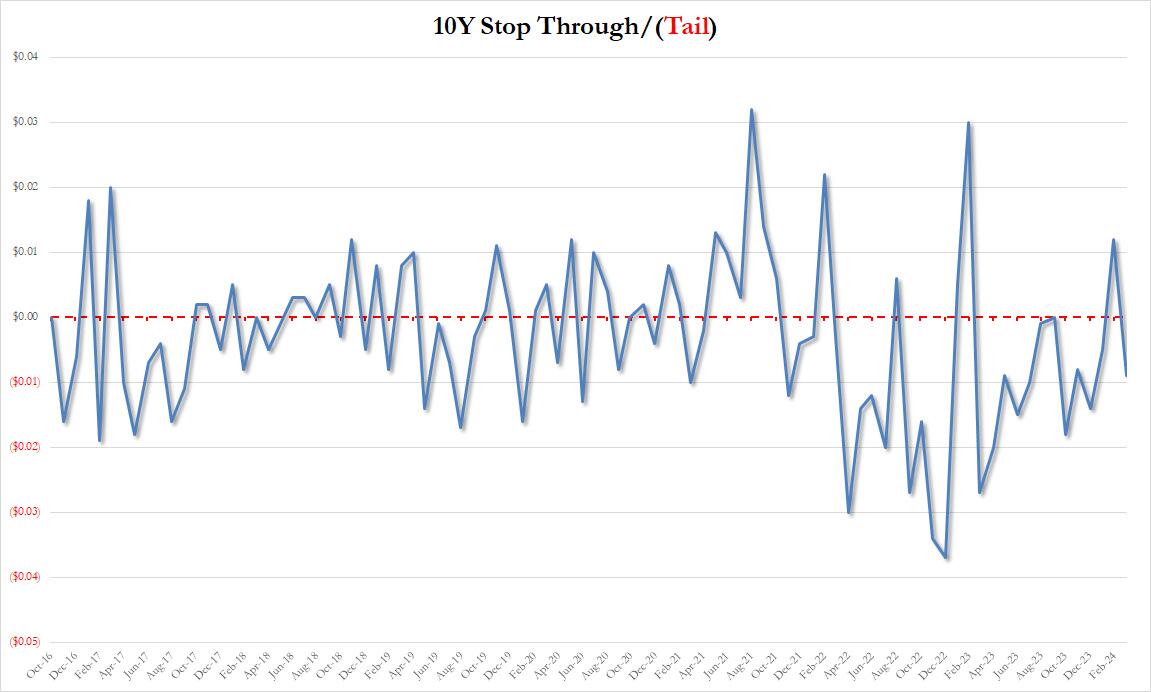

The high yield of 4.166% was above last month's 4.093% (in fact it was the highest 10Y auction stop of 2024) and also tailed the When Issued 4.157% by 0.9bps, the biggest tail since December 2023.

(Click on image to enlarge)

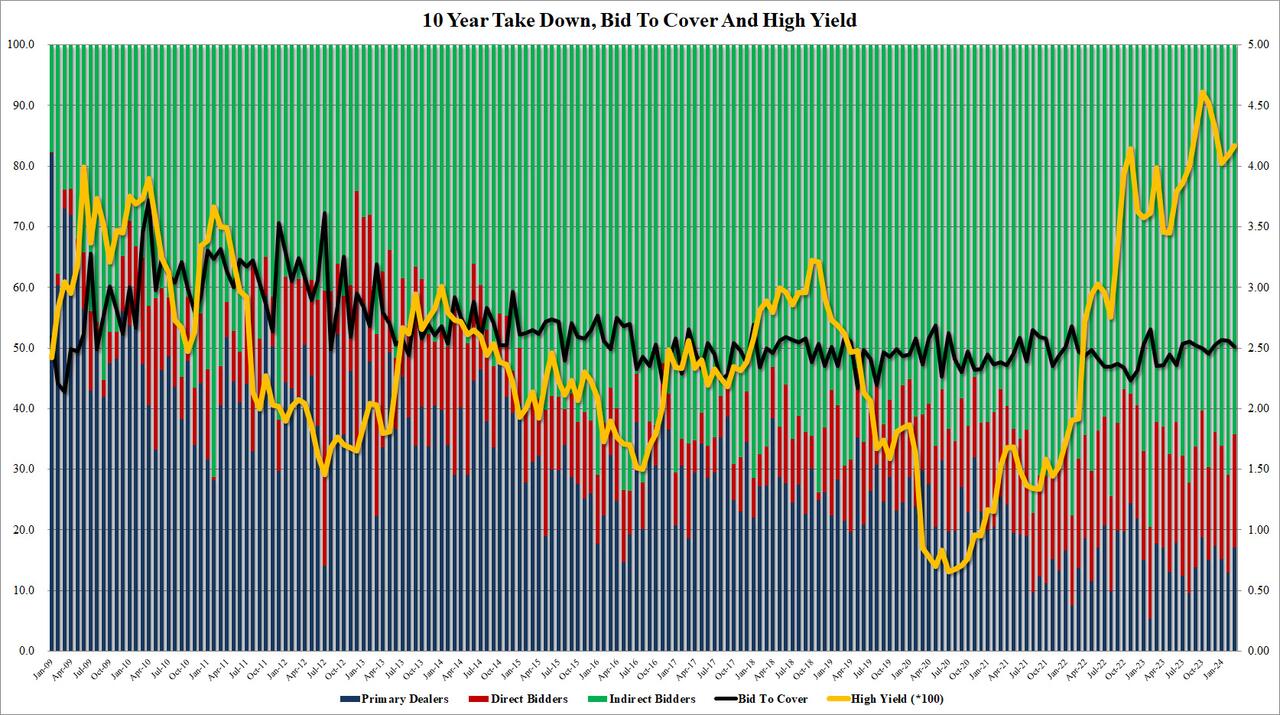

The bid to cover was 2.51, a drop from last month's 2.56 and the lowest since November 2023; it was also below the six-auction average of 2.52.

The internals were also subpar with foreign buyers less excited as Indirects took down just 64.3%, down from 71.0% last month and the lowest since December, not to mention below the 66.2% recent average. And with Directs awarded 18.6%, up from 16.1% last month, Dealers were left holding just 17.1%, up notably from last month's 13.0%.

(Click on image to enlarge)

Overall, this was an ugly, tailing auction despite the generous concession which saw 10Y yields move almost 10bps higher on the day after the hotter-than-expected CPI print, which while slamming bonds did just the opposite for stocks where both good news and bad news just serves to drive equities higher.

More By This Author:

Boeing Whistleblower Found Dead In A Truck From "Self-Inflicted Gunshot Wound"

Crypto Crack-Up Continues As Stocks & Bonds Sink Ahead Of CPI

Bitcoin Surges Past Silver As World's 8th Largest Asset After UK Greenlights Crypto-Backed Notes

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more