Ugly 10Y Auction Hit With Biggest Tail In Years As Post-CPI Rally Fakes Out Buyers

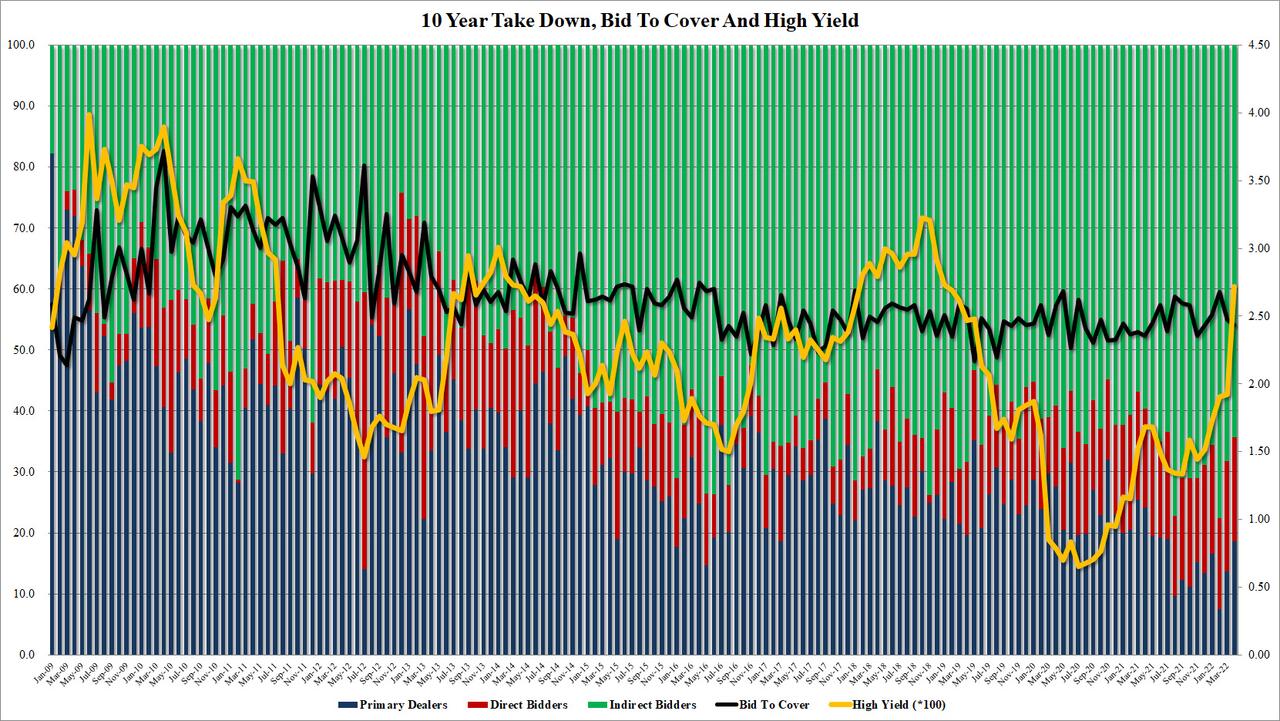

Far uglier than yesterday's 3Y auction, in fact far uglier than any 10Y auction in the past 5 years, moments ago the Treasury sold $34 billion in 10Y paper in a reopening auction at a high yield of 2.720%, 80bps above last month's 1.92%, and a whopping 3bps tail to the 2.69% When Issued - the biggest tail on our record which goes back to 2016 - as buyers balked at purchasing the benchmark paper with yields trading near session lows following the "not as bad as expected" CPI print.

The bid to cover was also a disappointing 2.43, the lowest of 2022 and well below the 2.50 six-auction average.

The internals were likewise ugly, with Indirects taking down just 64.3%, the lowest since July 2021, and with Directs awarded 18.7% (the most since last July), meant Dealers were left with 18.0%, just modestly above the recent average of 16.7%.

(Click on image to enlarge)

Altogether, an ugly auction which however was not structurally bad - unlike the infamous 7Y auction of Feb 2021 which broke the bond market - and which can be attributed to the sharp drop in yields post today's CPI print which according to some may have set the peak in inflation for the current cycle (we doubt it).

In any case, in kneejerk reaction, 10Y yields spiked from 2.68% to 2.72%, which while a notable move is well below the highs of the day hit just before the CPI report when the 10Y printed at 2.83%.

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more