Trump Tariffs Go From Terriying To Indispensable To Prevent A Bond Market Crash

Image Source: Pixabay

How long does it take for conventional wisdom to make a 180 degree U-turn? In the case of anything Trump related, it's just under 6 months.

It was in early April, just after Liberation Day's reciprocal tariffs were announced, that US bond markets suddenly cratered, sparking a collapse in hundreds of billions of basis trades, and triggered fears of a global economic shock. That's when tariffs were widely seen as bad and anyone who dared to say it's never that black or white - such as this website - were blasted as economic illiterates. Well, fast forward to today when quietly conventional wisdom has been turned on its head and the mere possibility of tariffs getting pulled is now seen as one of the biggest threats to the stability of the bond market!

That's right: if the Financial Times is to be believed - and it is, since it loathes Trump with a passion and would never say anything even remotely complementary if it could avoid it - Trump’s tariffs are now a key factor keeping Treasury investors on board (the same tariffs that were widely blamed for the relentless selling back in April). According to the paper, the tariff revenues - which so many of the establishment economists never even considered in April - are now seen as a crucial income stream that offsets the costs of the Big Beautiful Bill, and investors are now counting on hundreds of billions of dollars raised by the remaining tariffs to offset Trump’s tax cuts and keep a lid on US borrowing.

“The only way I can see for the US government to reduce its outstanding debt in the near term is to use the tariff revenue,” said Andy Brenner, head of international fixed income at NatAlliance Securities, citing also revenues from chipmakers’ China sales. “If all of the sudden the tariff revenue will not be there, that is a problem.”

Not only that, but as we noted two weeks ago, both S&P and Fitch recently conceded that tariff revenues for the US federal government were one factor that prevented them from downgrading the sovereign.

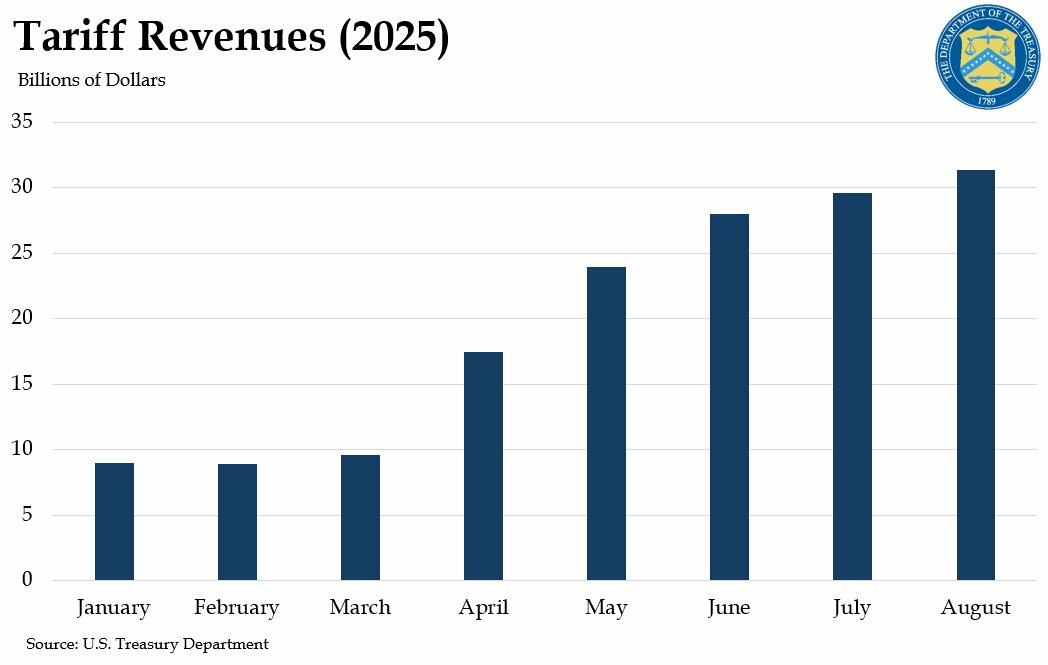

The Congressional Budget Office last month forecast Trump’s tariffs would boost US government revenues by $4tn over the coming decade. That would help pay for tax cuts in Trump’s One Big Beautiful Bill Act, which is projected to increase borrowing by $4.1tn over the same period.

The shift in market sentiment comes after months of turmoil in Trump’s economic strategy, including his trade war with trading partners such as China and his attacks on the US Federal Reserve.

Indeed, the appeals court ruling - which overturns Trump's tariffs - was the catalyst behind the US Treasury bond sell-off on Tuesday and Wednesday, analysts said, as investors worried that reduced tariff revenues would lead to a greater glut of Treasury issuance.

Thierry Wizman, a global rates strategist at Macquarie Group, said: “If the bulk of Trump’s tariff programme is nullified by the courts some analysts will cheer, inflation will subside, growth may improve, and the Fed may be more inclined to ease monetary policy. But if the focus is on debt and deficits at that time, the bond market may riot.”

He added: “The risk that tariffs go away but the [One Big Beautiful Bill Act] stays may become the dominant risk for [US Treasuries] over the next few weeks.”

Robert Tipp, head of global bonds at PGIM Fixed Income, said there was “a hope that tariff revenue can help control the budget deficit”.

To be sure, even with tariff revenues, investors warn about the daunting scale of the US government’s borrowing needs.

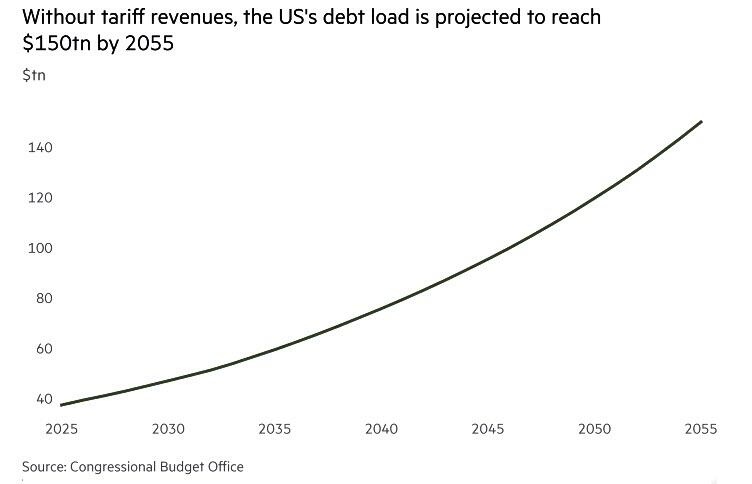

Des Lawrence, senior investment strategist at State Street Investment Management, said if the tariffs “were put on pause, it deprives Uncle Sam of a revenue source”. But the “bigger negative picture” is the sheer scale of government spending, he said. Without tariff revenue, the CBO expects US debt relative to GDP to surpass its second world war peak by 2029.

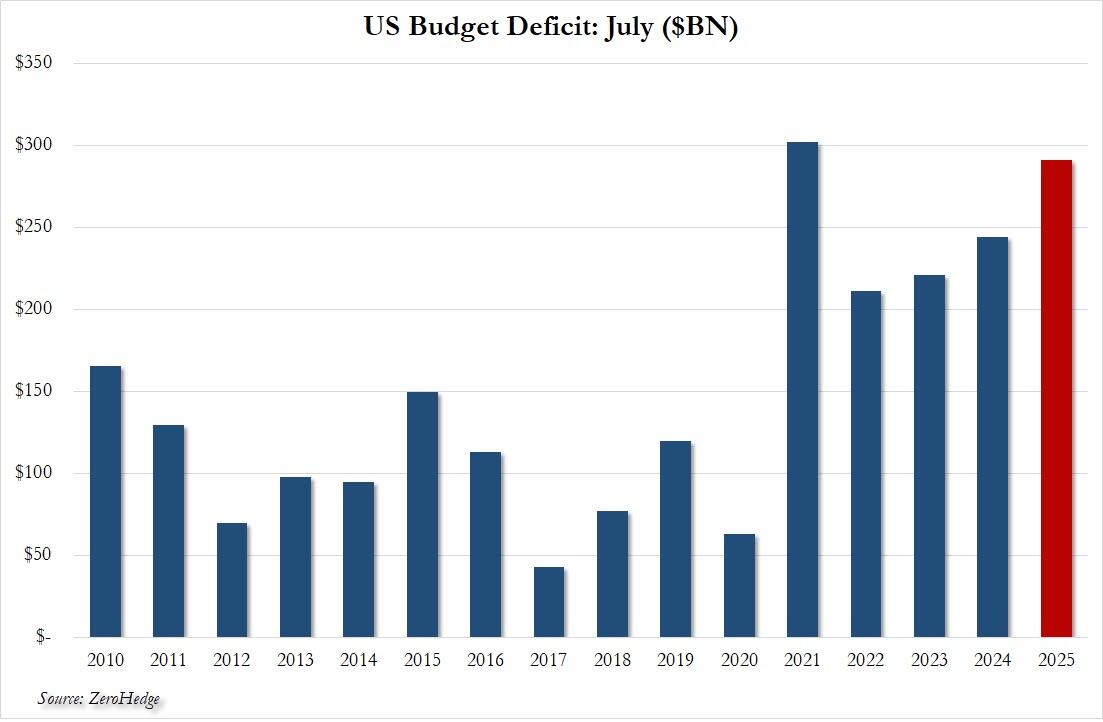

“It’s helpful in plugging a gap, but there’s still a big issue in America spending much more than it’s receiving,” Lawrence said, and he too is right as we showed a few weeks ago when we demonstrated that despite record tariff revenue, the US budget deficit hit a whopping $291bn in July, the second highest deficit for the month on record.

And now the fate of the US bond market is in the hands of a handful of Supreme Court justices, whose decisions are never taken on the merits of the underlying argument but are purely and unapologetically political. Last week, the Court of Appeals ruled against the Liberation Day tariffs, arguing that the emergency powers law did not give the US president the legal authority to impose these tariffs. Last evening, the Trump administration appealed this decision before the Supreme Court, and the enforcement of the earlier ruling has been delayed until the Supreme Court can review the case. So, pending the Supreme Court decision, tariffs remain in effect.

But if Trump loses this appeal, that key source of revenue would quickly dry out. Undoubtedly, the administration will already have alternatives up its sleeve –with sectoral tariffs a key candidate– but it would unleash a new wave of uncertainty that could sap confidence. No wonder Trump has said that if the Supreme Court does not overturn the Appeal court decision, the consequences would be catastrophic for the US: he is, after all, correct.

More By This Author:

Initial Jobless Claims Rise To Highest Since JuneUS Factory Orders Dropped Again In July As Tariff Front-Running Hangover Lingers

30-Year Gas Export Deal, Power Of Siberia 2, Belatedly Inked Between Russia & China

Disclosure: Copyright ©2009-2025 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more