Treasury Runs Largest August Deficit Ever As Interest Costs Soar

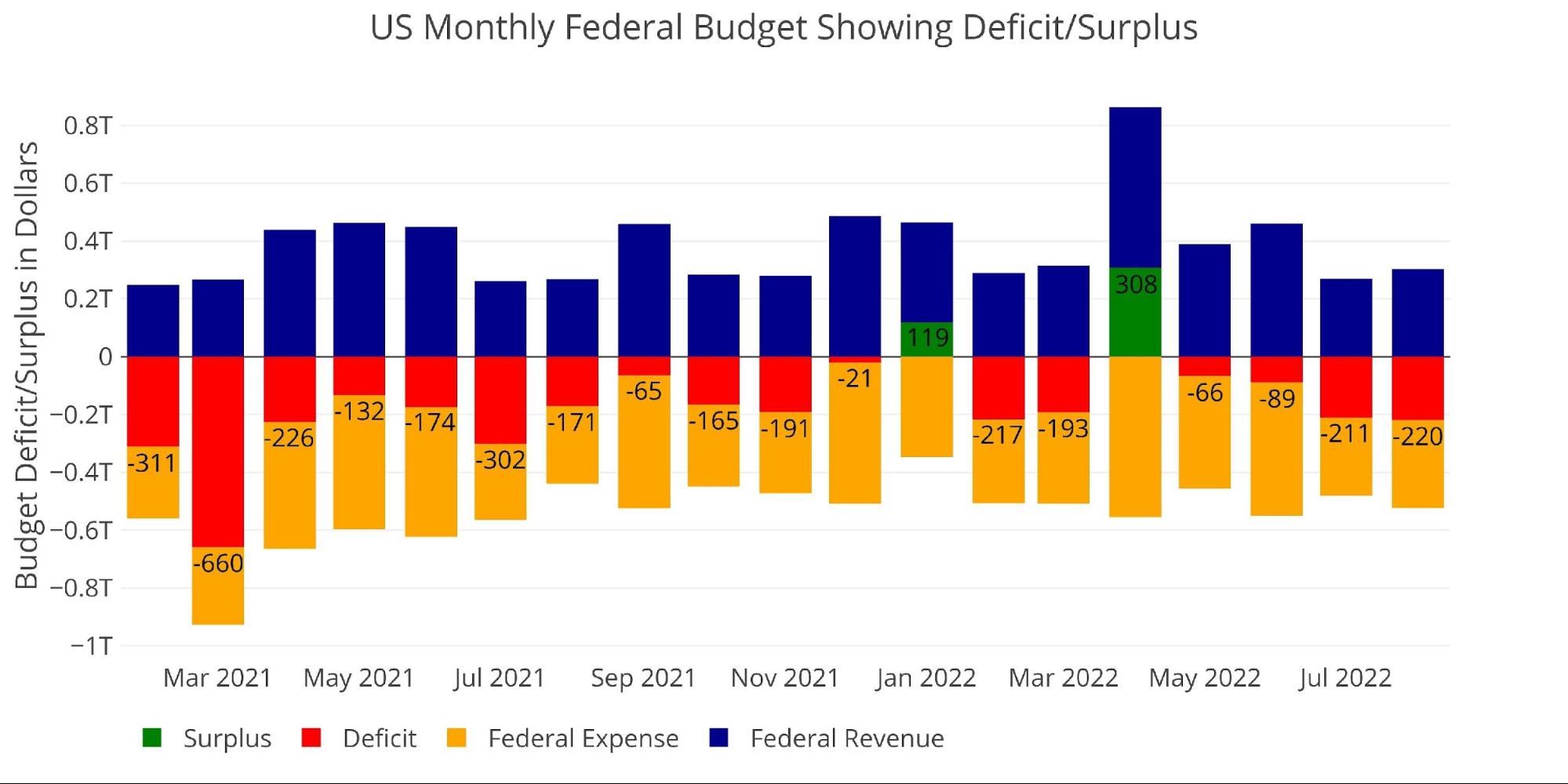

The Federal Government ran a $220B deficit in August which is the largest monthly deficit since last July.

Figure: 1 Monthly Federal Budget

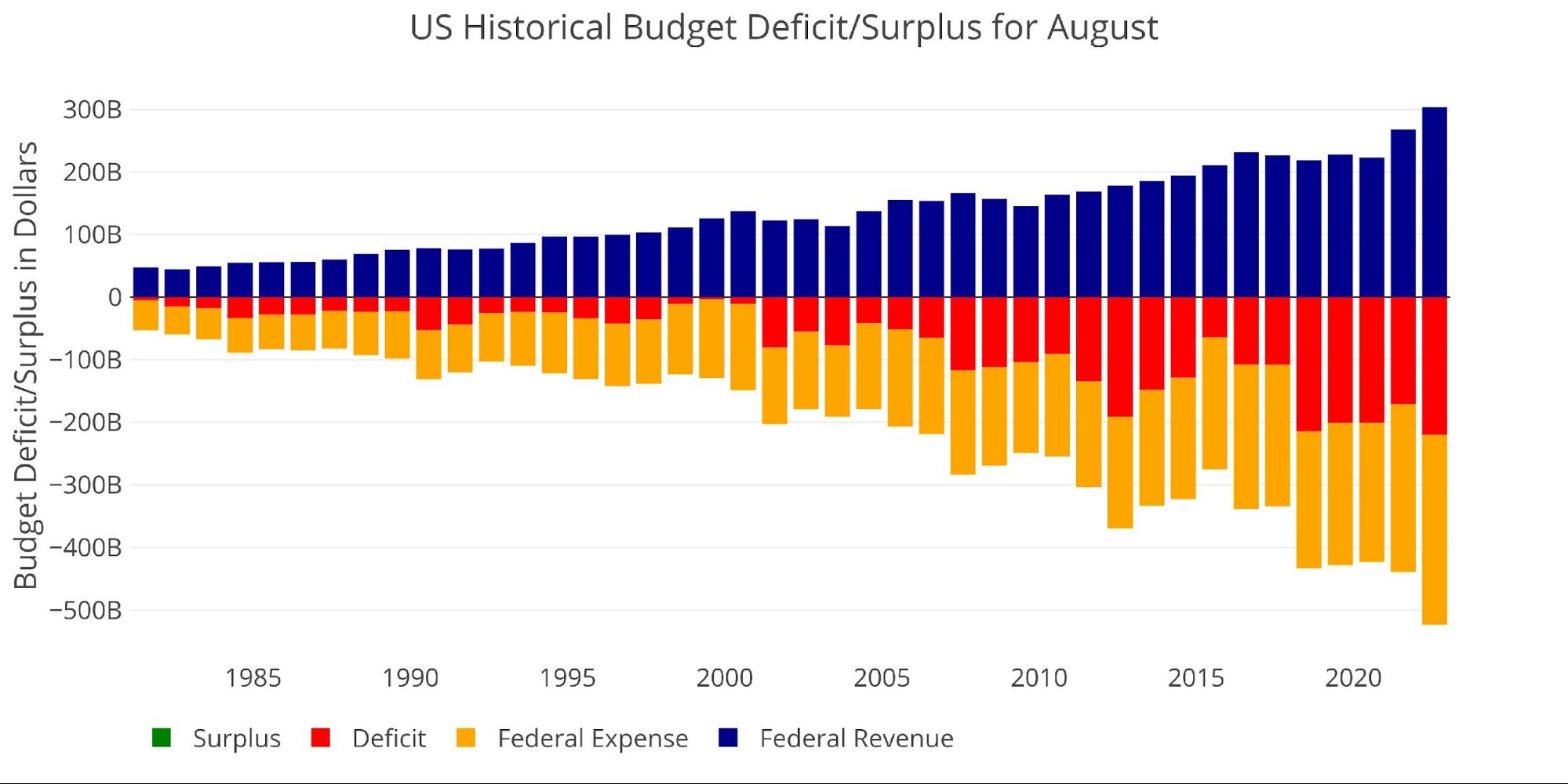

Looking historically at the month of August shows this month as the largest ever (red bar). Despite all-time record revenues for August, spending jumped from $439B last August to $523B this August, a YoY increase of almost 20%.

Figure: 2 Historical Deficit/Surplus for August

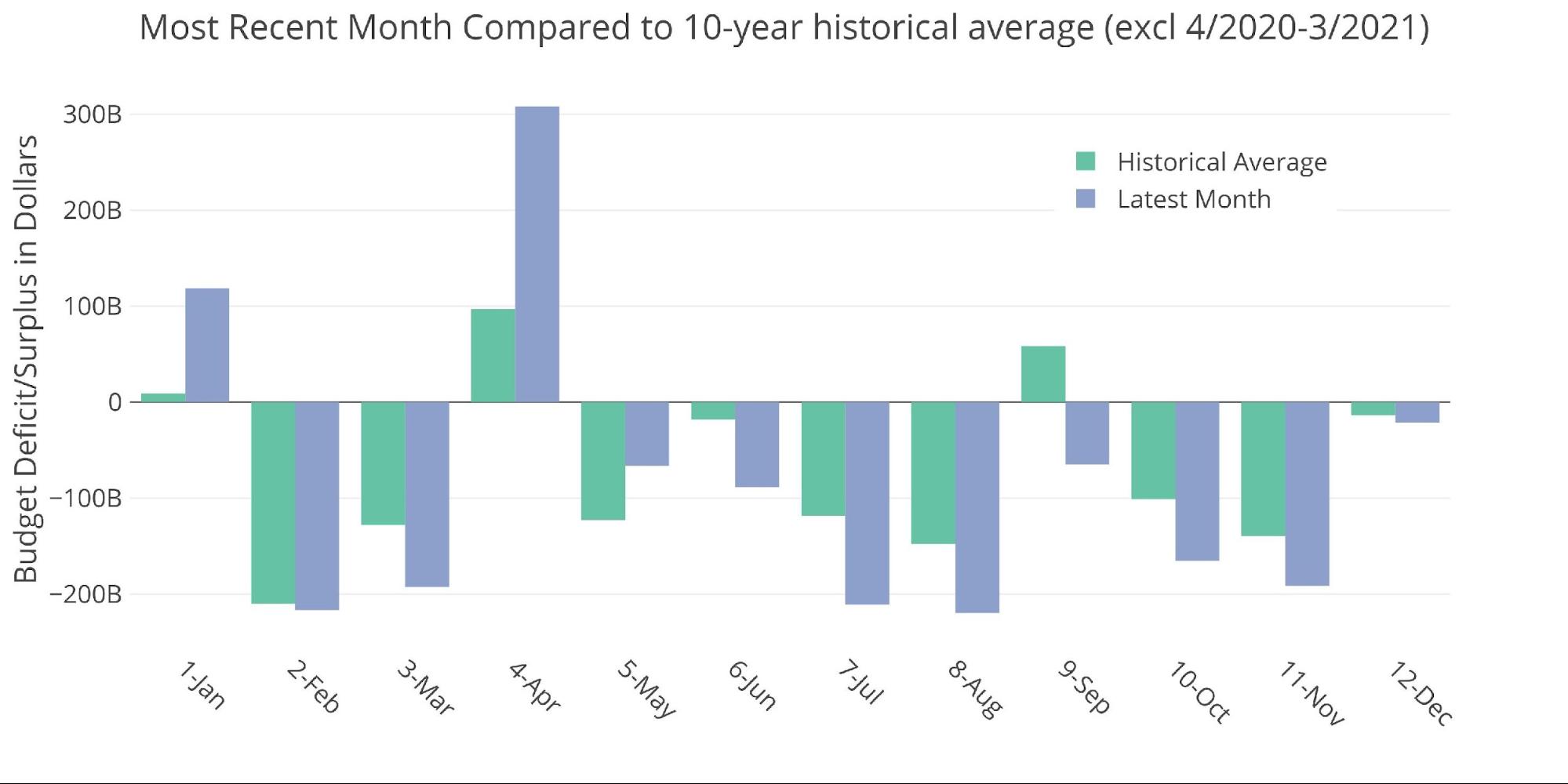

The historical average for August is $147B, which makes this August 50% larger than the 10-year average!

Figure: 3 Current vs Historical

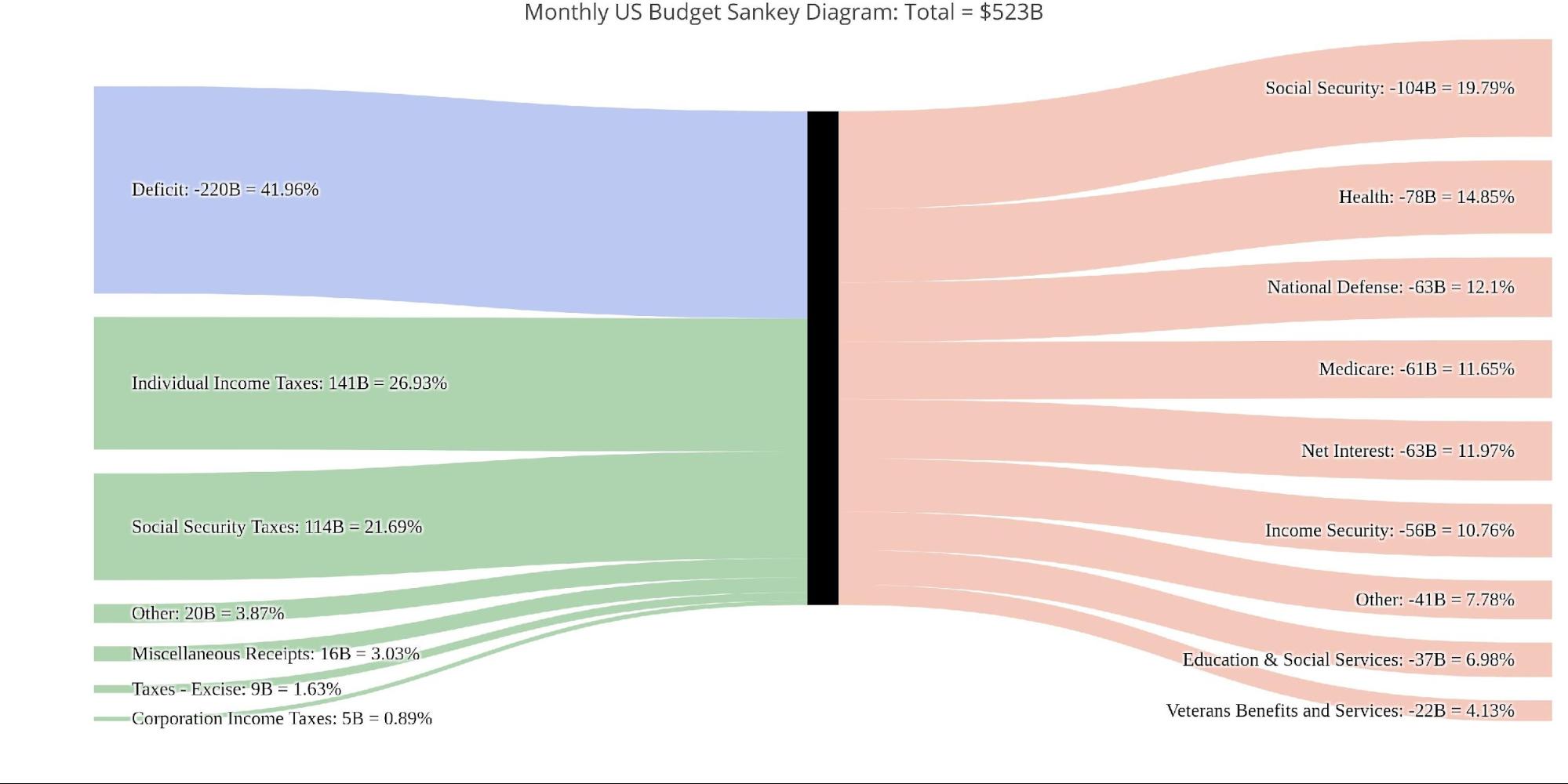

The Sankey diagram below shows the distribution of spending and revenue. The Deficit represented 42% of spending in the most recent month and was larger than both Social Security and Health combined!

Figure: 4 Monthly Federal Budget Sankey

The monthly figure was significantly larger than the TTM deficit 17.14% of total spending, or $1T of $5.8T.

Figure: 5 TTM Federal Budget Sankey

Total revenue increased some MoM, driven by a slight uptick in Individual Income Taxes and Excise Taxes.

Figure: 6 Monthly Receipts

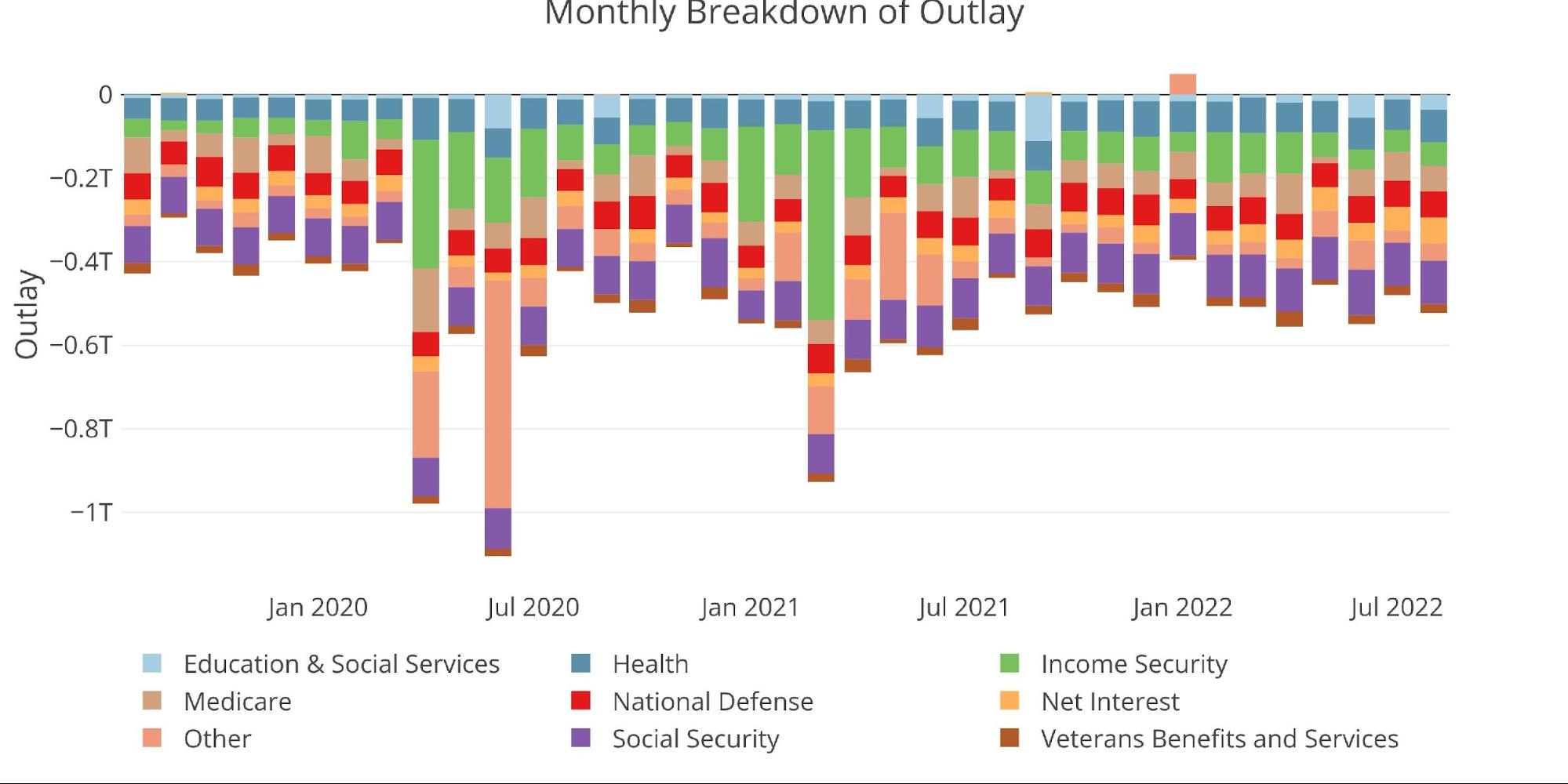

Total Expenses for August were higher than July but below both June and April.

Figure: 7 Monthly Outlays

Perhaps the most important expense to take note of is Interest Expense. As explained in the debt analysis, interest costs have been soaring lately. Last August, TTM interest expense was $356B. That figure now stands at $465B or 30% higher in one year! Since July, TTM interest has increased by $21B.

As interest rates continue to rise, this trend is likely to continue getting worse. Interest Expense is the 6th largest budget expense, nearly $250B below the next expense of Medicare. If interest rates stay elevated or continue rising, it’s quite possible that Interest Expenses could start to climb rapidly into the top 3.

Figure: 8 TTM Interest Expense

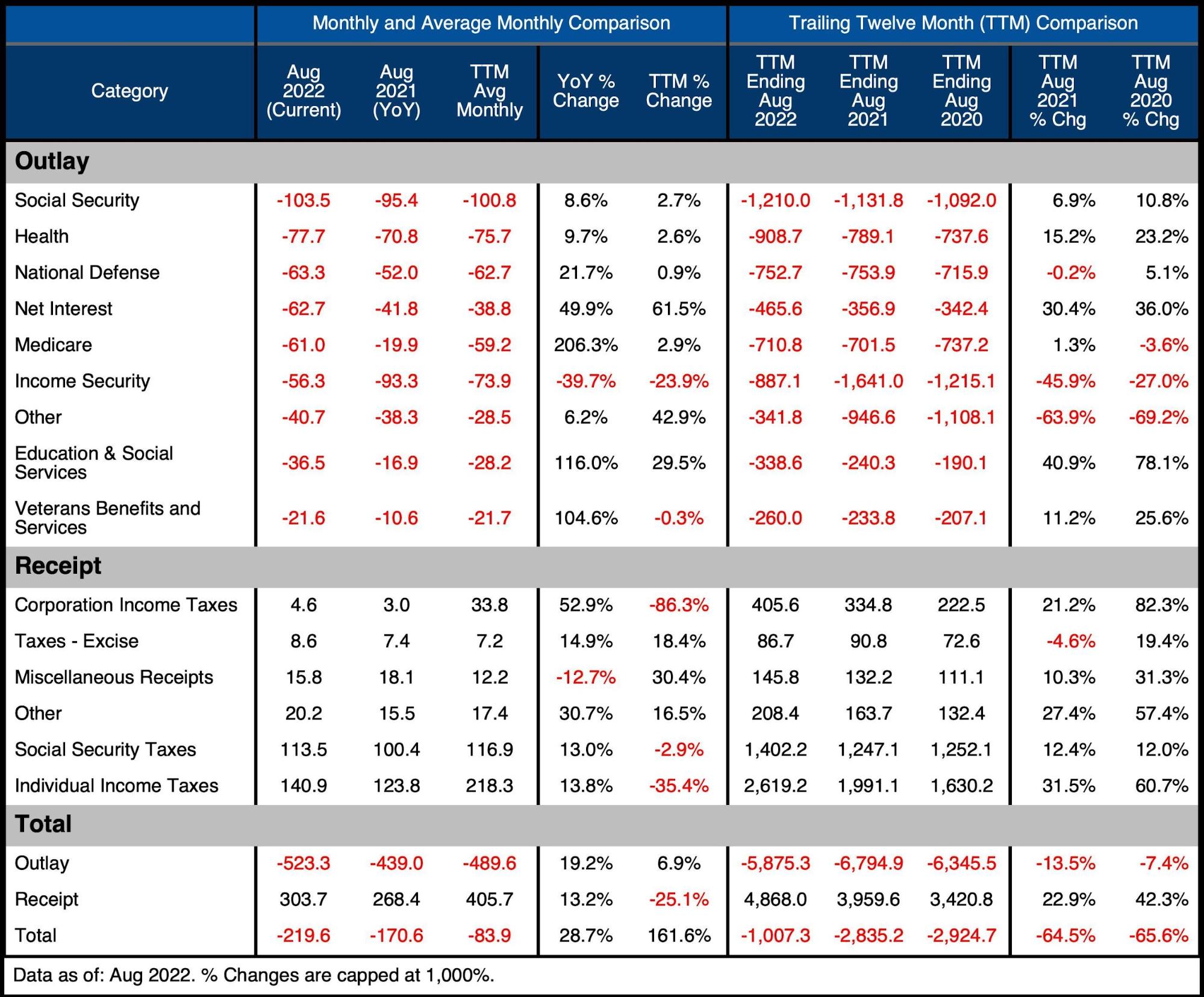

The table below goes deeper into the numbers of each category. The key takeaways from the charts and table:

Outlays

-

- Monthly Net Interest is 61% above the 12-month average

- Income Security has fallen 40% YoY and 46% on a TTM basis

- On a TTM basis, Education and Interest increased the most: 41% and 30.4% respectively

Receipts

-

- Individual Income Taxes are 35.4% below the 12-month average but up 14% YoY

-

- On a TTM basis, they are up 31.5%

-

- Corporate Income Taxes are up 21.2% on a TTM basis

- Individual Income Taxes are 35.4% below the 12-month average but up 14% YoY

Total

-

- The Total TTM Deficit went back above $1T after dipping slightly below last month

- Receipts are up 23% as Outlays have fallen 13.5%

- The Total TTM Deficit went back above $1T after dipping slightly below last month

The recent drop in Individual Income Taxes is extremely important to watch going forward. That has been a massive, unexpected windfall for the Treasury. If it starts to drop, budget deficits will explode well past $1T in the near future.

Figure: 9 US Budget Detail

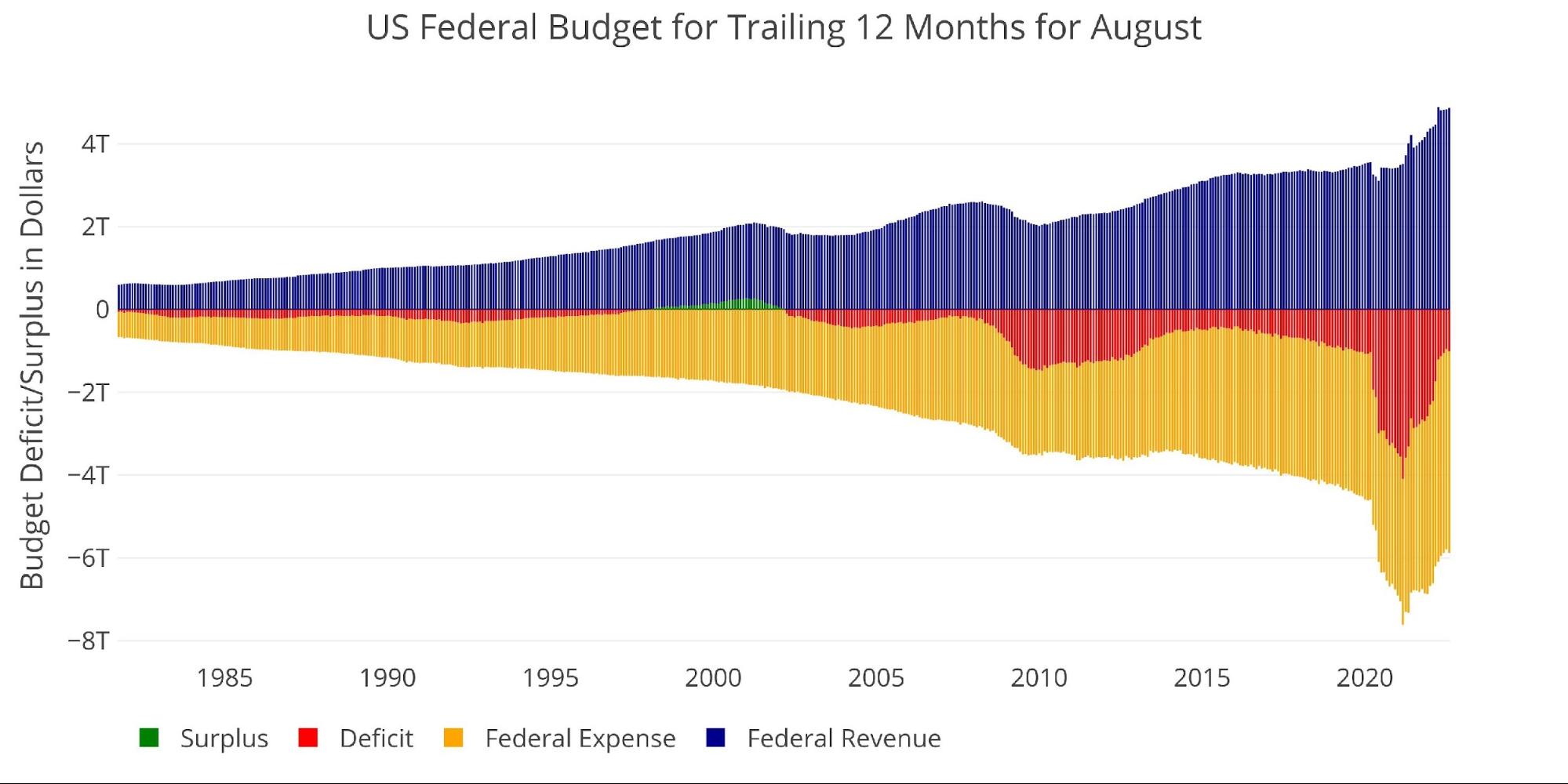

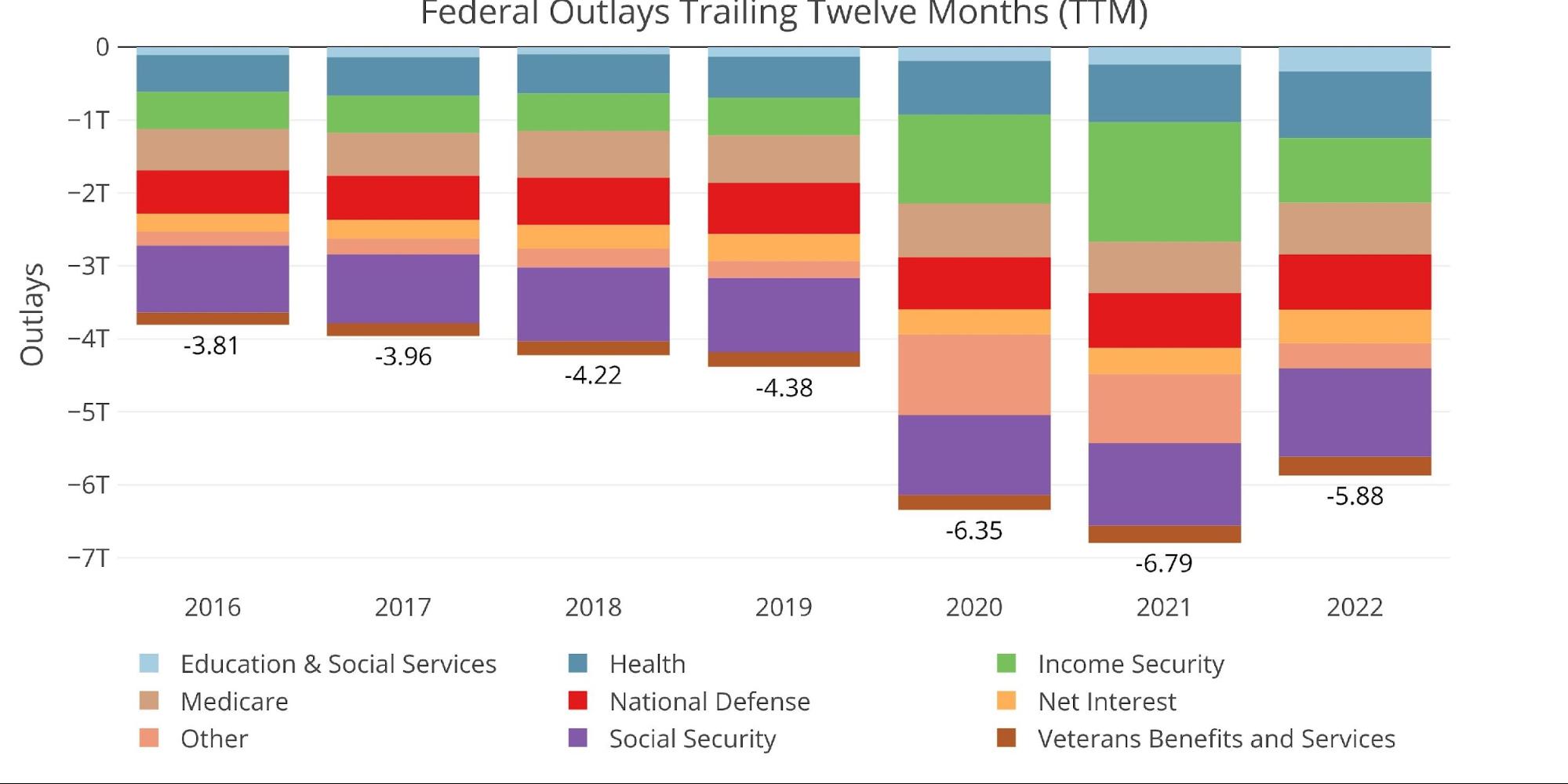

Historical Perspective

Zooming out and looking over the history of the budget back to 1980 shows a complete picture. It shows how a new level of spending has been reached and is only being somewhat supported by a major surge in tax revenues.

While the deficit has fallen in response, it remains quite elevated.

Figure: 10 Trailing 12 Months (TTM)

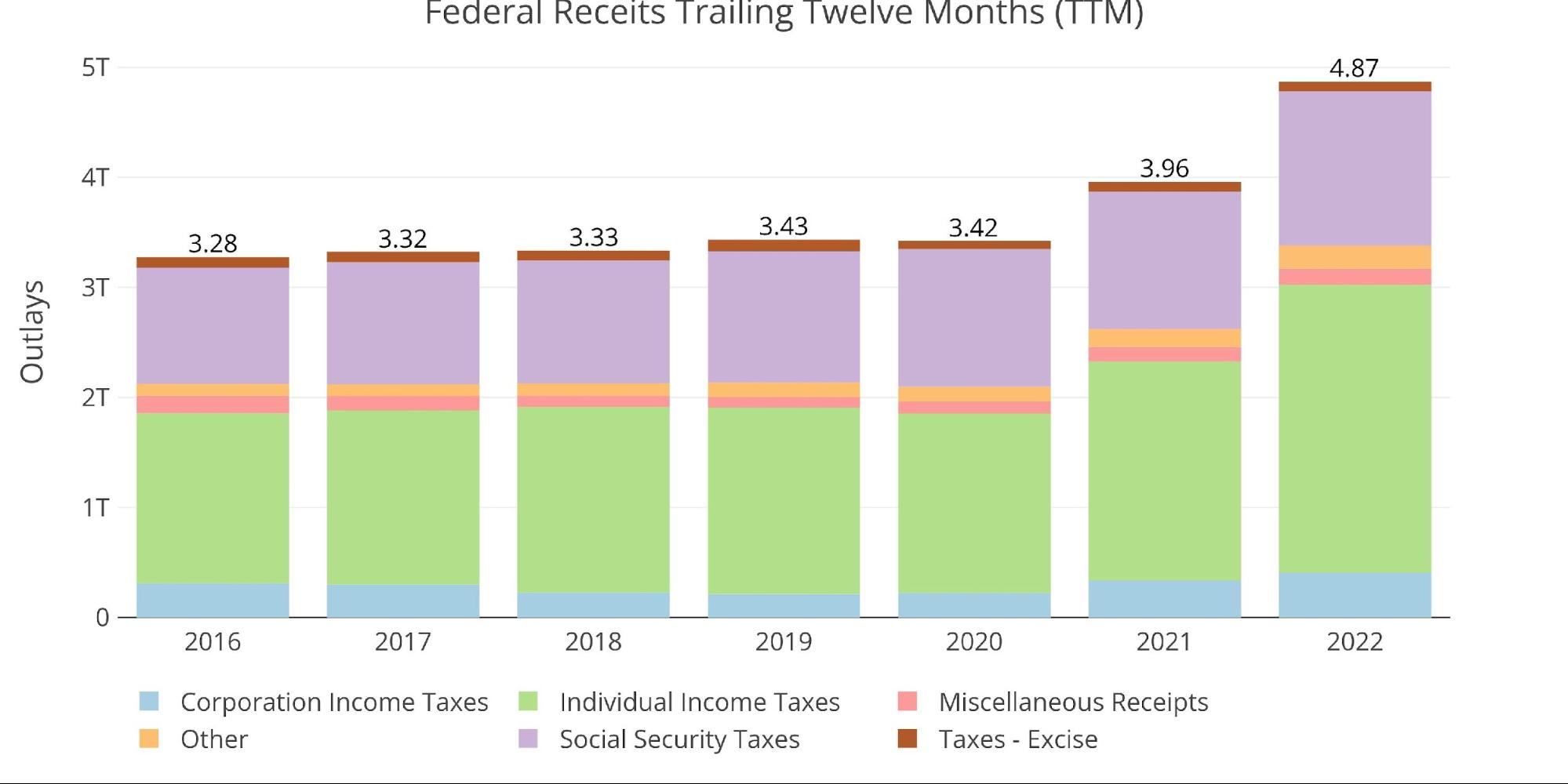

The next two charts zoom in on the recent periods to show the change when compared to pre-Covid. The current 12-month period is $1.4T bigger than pre-Covid levels of 2019. Individual Taxes make up the vast majority of the difference, with 2022 exceeding 2020 and 2019 by almost $1T.

Figure: 11 Annual Federal Receipts

Unfortunately, the major windfall from this tax revenue surge is being consumed by massive spending. Income Security and Others are the only categories getting noticeably smaller.

Figure: 12 Annual Federal Expenses

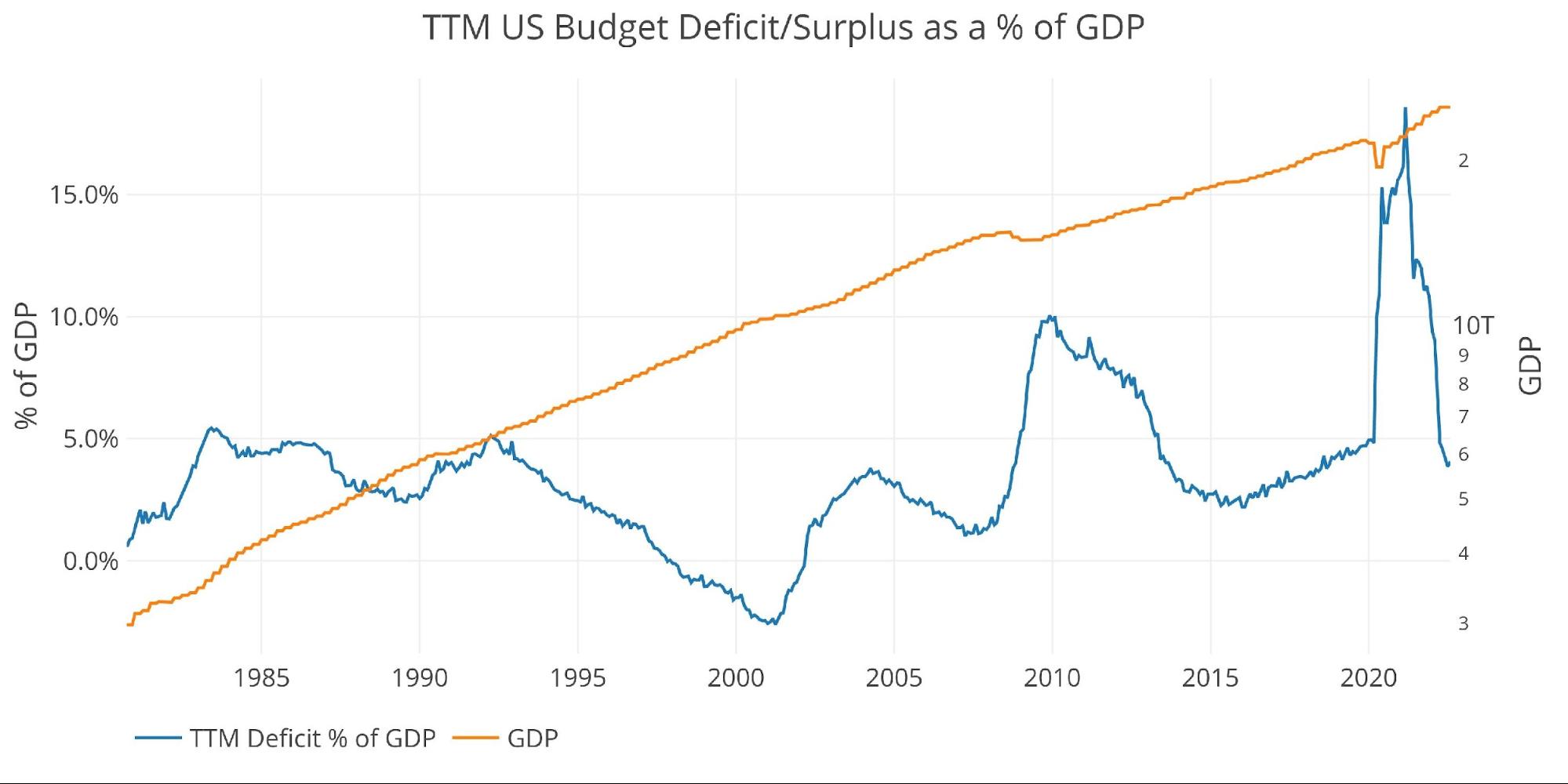

Due to the changing dynamics, TTM Deficit compared to GDP has returned to pre-Covid levels of 3.9%, the lowest value since October 2018.

Note: GDP Axis is set to log scale

Figure: 13 TTM vs GDP

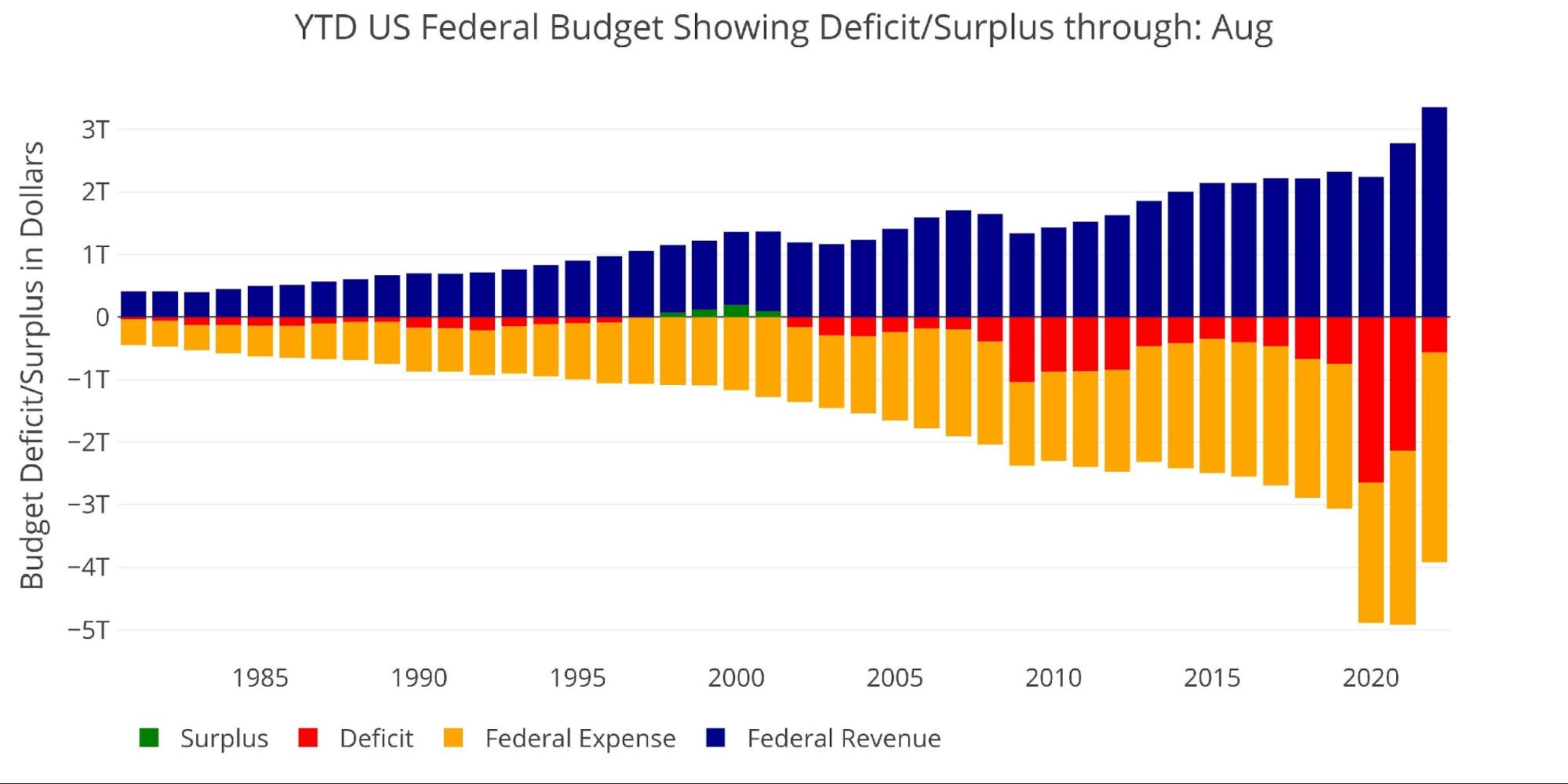

Finally, to compare the calendar year with previous calendar years, the plot below shows the YTD figures through August. Looking at just the annual calendar, this would be the smallest YTD deficit since August 2017. It will be interesting to see how the final 4 months play out from here.

Figure: 14 Year to Date

Wrapping Up

The Treasury has benefited from massive increases in Individual Taxes over the last 18 months. The CBO cannot explain all of the surges and thinks it may not all be permanent. Revenues could start to drop soon, especially with a recession imminent or ongoing. Expenses continue to grow with higher interest rates and new spending bills. This combination will keep large deficits going indefinitely.

The Treasury continues rolling over debt at higher rates and could find itself in a debt spiral sooner rather than later. The Fed has stepped away from the market which has created major liquidity issues in the Treasury market. The Fed will likely have to step in sooner than later to keep the market standing and prevent the Treasury from becoming insolvent.

When the Fed steps back in, the repricing of assets could occur rapidly. Gold and silver will be major beneficiaries of such a move. Given the soaring interest costs and lack of liquidity, it’s only a matter of time before the Fed pivots, regardless of where inflation stands (which is proving way stickier than anticipated). The smart money continues to drain the Comex of physical inventory. The market dynamics are setting up for a major move, get physical metal while it’s still available at these prices!

Data Source: Monthly Treasury Statement

More By This Author:

August CPI Shows Inflation Getting Stickier

The CPI Is Not Cooling And That’s A Big Problem For The Fed

Americans Continue To Pile On More And More Debt