Treasuries Continue To Fall, Gold Rises Amid General Indifference

In Japan, the price of gold re-entered its parabolic uptrend channel, breaking through the 300,000 yen per ounce :

(Click on image to enlarge)

Since 2019, the duration of consolidation phases has been steadily decreasing, while the intensity of upward movements from successive bullish flags has become increasingly intense.

Gold reacts to the ongoing collapse of the Japanese currency.

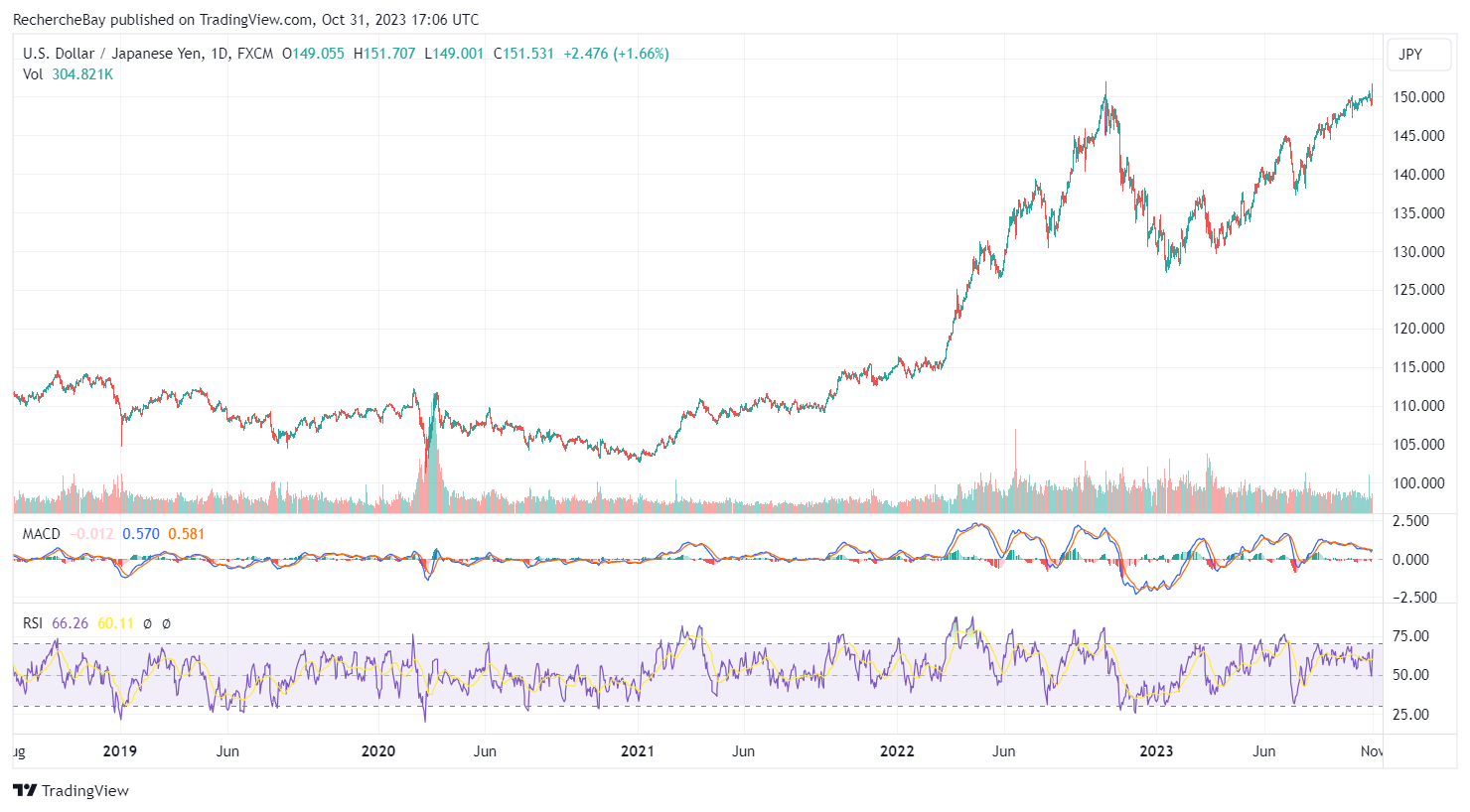

The USD/YEN chart has just broken through the 150:

(Click on image to enlarge)

The market interpreted the BoJ's recent announcement as a new accommodative signal, and the impact on the yen was not long in coming. The 150 mark was crossed, without any intervention from the BoJ on the foreign exchange market.

Paradoxically, rather than falling in response to this sign of easing, Japanese yields are rising at a steady pace. Japanese 10-year yields are rising rapidly towards the 1% mark:

(Click on image to enlarge)

The BoJ has announced the end of its rate control policy, suggesting that the 1% limit will no longer be defended through the central bank's bond-buying programs.

As I explained in early September in my article, the BoJ has reached an impasse in its monetary policy. This situation is leading the country towards a sovereign crisis, impacting both the value of its currency and its bonds.

The price of gold in yens is now rising exponentially, just as it would against any currency of a country in a sovereign crisis.

Only an easing by the Fed could help the BoJ break this impasse.

To make this change, the Fed needs clear signals of a trend towards disinflation.

However, current U.S. economic data show continued solid economic activity, and even growing signs of inflationary pressure.

This Wednesday, the US central bank decided to maintain its rate range between 5.25% and 5.5% for the second time in a row, which does not seem to suggest an immediate pivot by the Fed towards a more accommodative monetary policy in the short term.

The US economy benefits from the support of government spending, with the Treasury offsetting the effects of the restrictive monetary policy of quantitative tightening and rate hikes.

US GDP grew by 4.9% in the third quarter, double that of the second quarter. US public debt increased by $835 billion in one quarter. With a $266 billion increase in GDP in the third quarter, US debt jumped by $835 billion, representing $3.10 of debt for every $1 of GDP.

This increase in GDP is reflected in the performance of industrial companies, which benefit greatly from the support of public orders.

Eaton, the electrical equipment specialist, recorded a rise of around 10% in the space of two sessions after raising its earnings forecasts. This type of adjustment is relatively rare for this company, which generally takes a conservative approach to its forecasts. Buoyed by the industry's renaissance in the United States, Eaton's share price has tripled in just three years.

(Click on image to enlarge)

With debt levels set to rise, it is even possible that US GDP will continue to grow.

The U.S. economy continues to grow, but this growth is accompanied by an increase in public debt.

Who is financing this new debt?

Certainly not China!

In August, China liquidated a record volume of US Treasuries in the space of four years, disposing of $17 billion of these assets.

And certainly not the banks, nor the Fed.

Between Q2 2022 and Q2 2023, the major banks and the US Federal Reserve were net sellers.

The main buyers were U.S. individuals, who added $1.46 trillion of U.S. Treasuries to their portfolios.

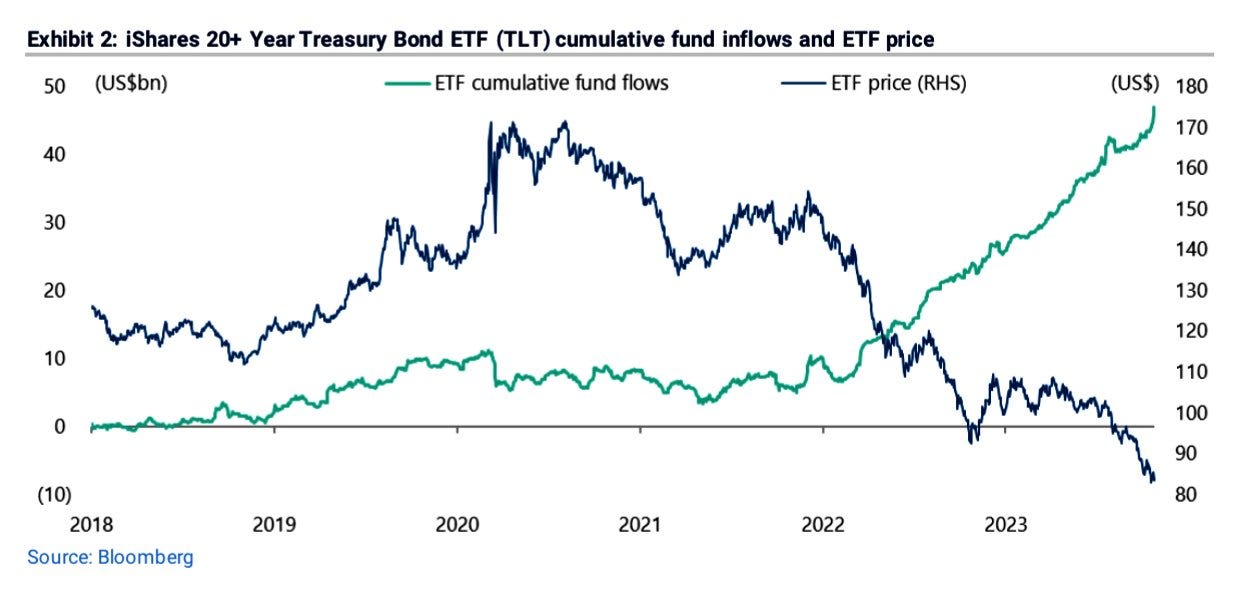

The TLT index, which measures the performance of 20-year US Treasuries, has fallen -20% since the start of the year. However, this decline has not dampened investor appetite.

Funds have also flocked to these products, and have recently stepped up their purchases significantly. Assets invested in TLT have never reached such levels, and surprisingly, as losses mount on this index, investments continue to rise.

(Click on image to enlarge)

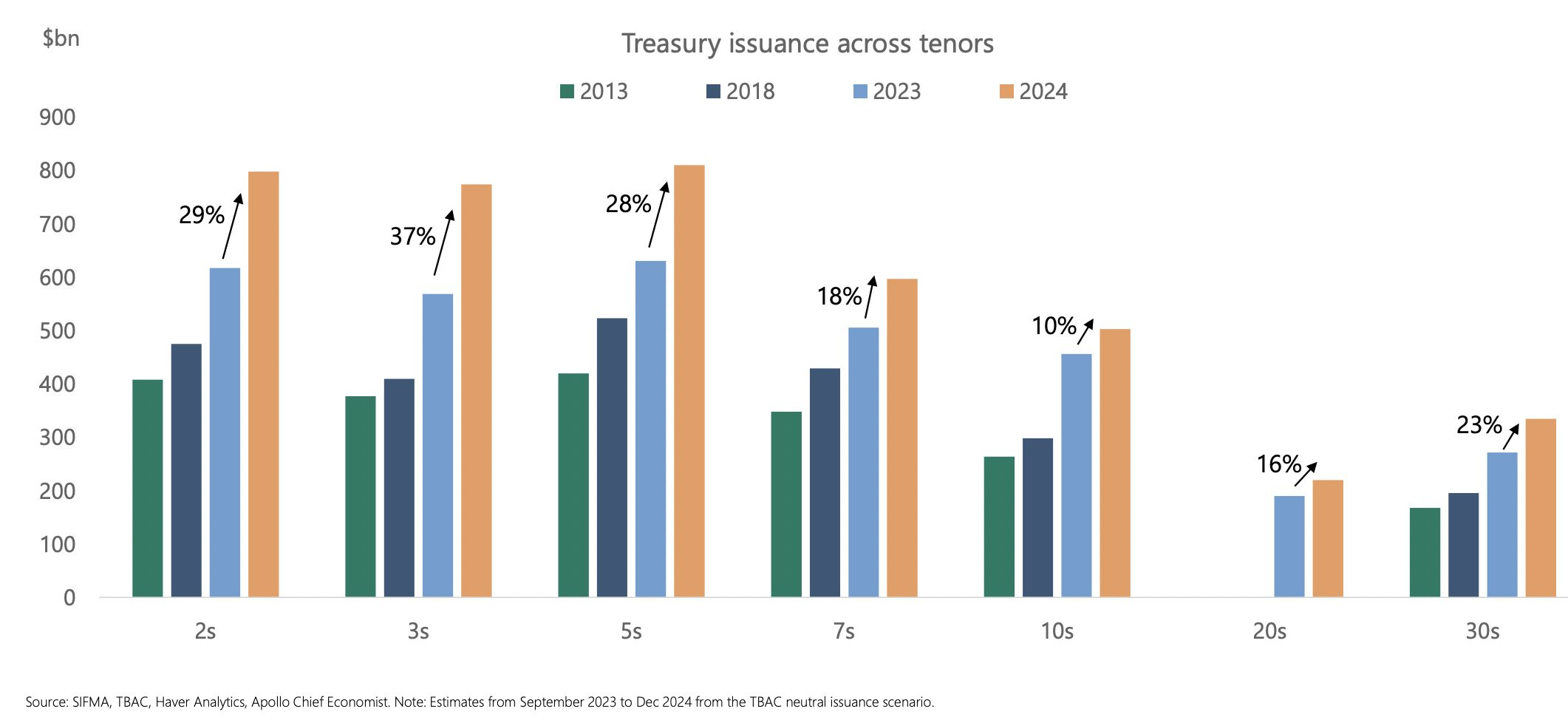

Problem: US bond issuance is set to explode next year due to the rising cost of refinancing debt.

(Click on image to enlarge)

Without Fed intervention, the increased supply of bonds is likely to deter investors.

These conditions are likely to put further upward pressure on interest rates, resulting in additional losses for recent buyers.

Ignoring the negative dynamics of bond yields could trigger a massive margin call for participants who have taken major risks by going against market trends.

What we are currently seeing in the bond market resembles what emerged in 2007 with US mortgage-backed securities. The denial that prevailed in 2006-2007 concerning the decline in the value of MBS securities ultimately triggered the crisis of 2008. It seems that the current denial on debt markets is even more pronounced than it was then.

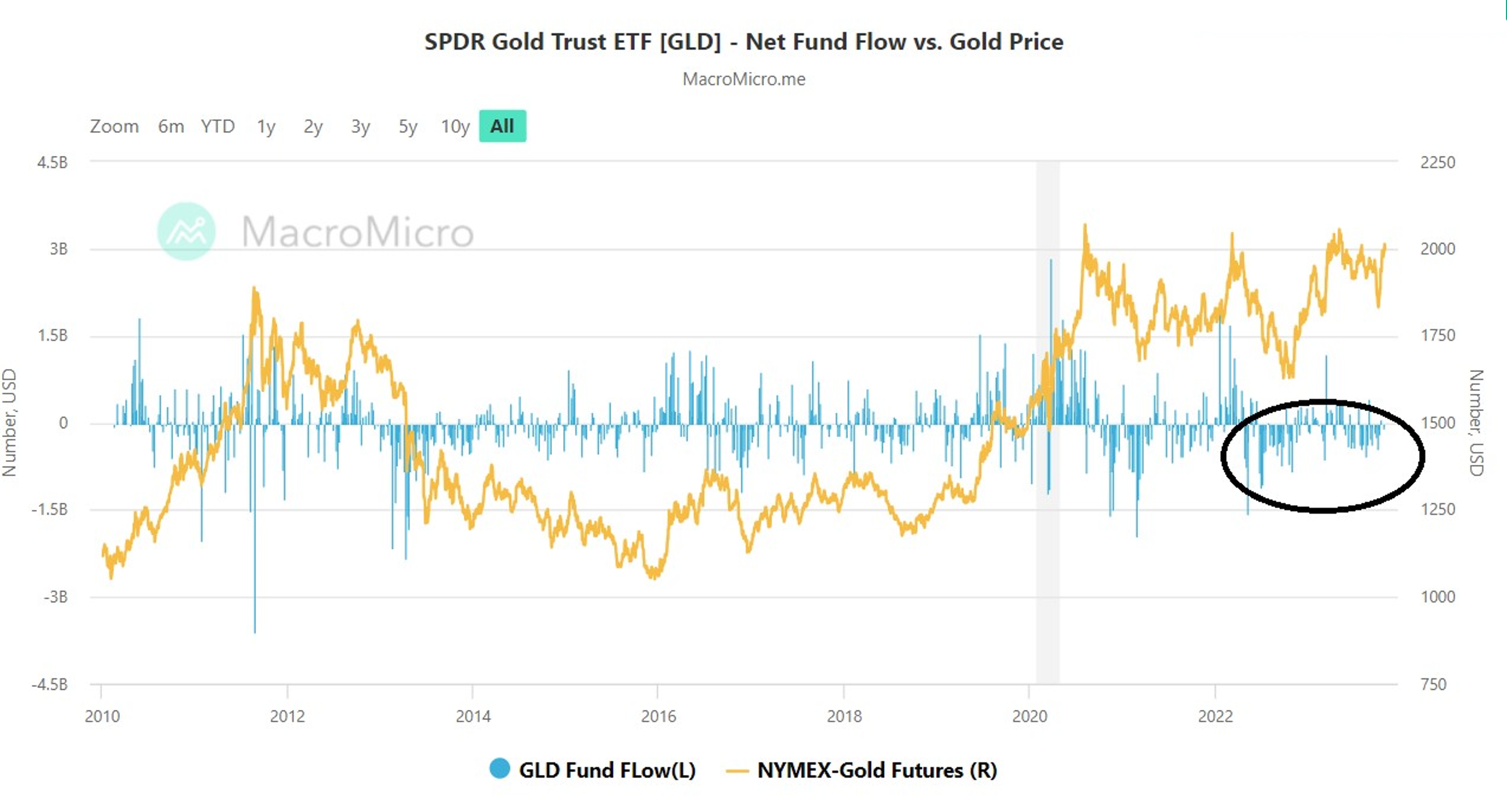

For gold, the opposite is true: despite a net outflow of capital from the ETF GLD, the price of gold continues to rise.

(Click on image to enlarge)

Far removed from the turmoil of the bond markets, gold continues to move ahead without the slightest speculative excess, and in a climate of general indifference.

More By This Author:

Economic Outlook On The Israeli-Palestinian ConflictGold Breaking Out Vs. US Banks

The Relationship Between Gold And Real Rates Is Broken

Disclosure: GoldBroker.com, all rights reserved.