TLTW: A High-Yield, Covered Call ETF With "Safe Haven" Appeal

Image Source: Pixabay

Several of the single-stock, covered call ETFs launched this year have become household names, but broader strategies have also garnered a lot of interest. Among the more interesting launches is the iShares 20+ Year Treasury Bond BuyWrite Strategy ETF (TLTW), notes Michael Gayed, editor of The Lead-Lag Report.

Even though Treasuries have gotten bounced around quite a bit over the past few years, they remain one of the best long-term risk-off assets. When the market makes a true flight to safety shift, long-term Treasuries could be one of the best risk balancers and upside opportunities available.

Covered call strategies have been in demand. Fund issuers used to almost exclusively center their covered call strategies around equities. However, iShares changed the game. The TLTW ETF has since been able to deliver huge yields, but total returns have been mixed. If market volatility picks up and yields start to head lower again, there could be a big return opportunity here.

The TLTW ETF seeks to track the investment results of an index that reflects a strategy of holding the iShares 20+ Year Treasury Bond ETF (TLT) while writing (selling) one-month covered call options to generate income. The index aims to use options that are approximately 2% out-of-the-money, limiting income potential somewhat, but providing the opportunity for some capital growth along the way.

The primary gripe about funds using covered call strategies is that a lot of them use options that are roughly at-the-money. Those options often come with higher premiums, but it also means that capital appreciation is essentially fully capped. I prefer the 2% out-of-the-money strategy used by TLTW because it strikes a better balance, if only a modest one.

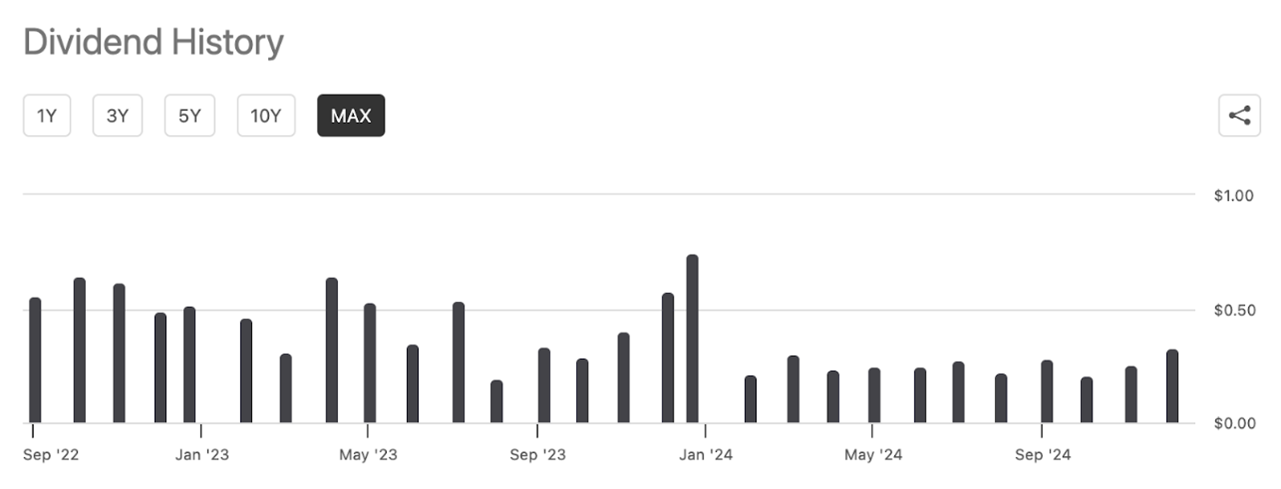

The TLTW ETF was launched in August 2022. Since its inception, the fund has returned a total of -9%, which translates to around -4% annually. Obviously, this fund launched at a bad time.

However, monthly distributions have become relatively steady over the last year. Bond market volatility has been slowly coming down, although the possibility of a re-acceleration due to rising inflation is very much in play. Still, yields on the TLTW fund should be well into the double digits for the foreseeable future.

Conclusion

The difference between a 14%-15% yield on TLTW and a 4% yield on TLT is substantial. That gives the TLTW fund a lot of wiggle room to experience some share price contraction, yet still outperform the underlying fund. I like the TLTW ETF as a high yield opportunity.

My recommended action would be to consider buying the TLTW ETF.

About the Author

Michael A. Gayed is a portfolio manager and author of five award-winning research papers on market anomalies and investing. He has a BS with a double major in finance and management from NYU Stern School of Business and is a CFA charterholder.

Mr. Gayed is the publisher of The Lead-Lag Report, focused on helping investors outperform in all market conditions. It offers a tactical, data-driven approach to investing to achieve long-term success even in the face of uncertainty. With increasing market volatility, it's essential to understand risk-on/risk-off signals, seize high-yield opportunities, and leverage award-winning research to maximize returns.

More By This Author:

Can The S&P 500 Notch Another 20%-Plus Gain In '25?

XSMO: A Momentum Fund Capitalizing On The Solid Economic Backdrop

DGII: A Growing IoT Stock Undergoing A Successful Transformation

MoneyShow editor’s note: Michael Gayed is speaking at the 2025 MoneyShow Las Vegas, which runs Feb. 17-19. more