TLT: Bonds Selling Off For These Reasons. So, What Does It Mean For Stocks?

Image Source: Pixabay

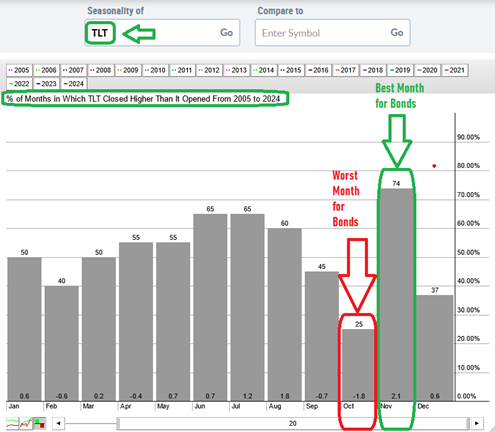

I recently joined the great Stuart Varney on Fox Business to discuss bond yields, the election, the Fed, the market outlook, misconceptions about the “Trump Trade,” and a lot more. Here are a few things to keep in mind about the iShares 20+ Year Treasury Bond ETF (TLT) and stocks.

Money is moving out of bonds. The last time we saw this abrupt of a move (two standard deviations) out of bonds in one month was 2001-2003. That preceded some of the biggest moves in history for US small caps and emerging markets equities.

Meanwhile, I told Stuart we have a tale of two cities in markets. Indices look a bit stretched in the short term, but many individual companies look like bargains. Markets SEEM to be pricing in “pro-business” policies coming to the White House (i.e. a Trump win). And if so, these newer themes will persist:

- Un-Magnificent 493 will outperform Magnificent 7 (earnings growth accelerating for 493, decelerating for 7).

- Small caps will outperform large caps by 11% in the first 12 months following the first rate cut.

- Value will outperform growth in the first six months following the first cut.

- Emerging markets will outperform developed markets as the US dollar continues to weaken.

More By This Author:

XMMO: A Momentum ETF To Buy On The Market's Rate-Related PullbackAlamos Gold: A Mining Stock To Target As Central Banks Pile Into Gold

Enerflex: An International Energy Infrastructure Play That's On The Right Track

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more