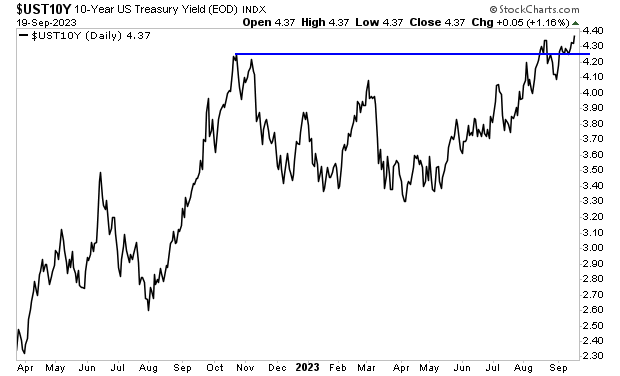

The Single Most Important Bond In The World Is Breaking Down

The most important bond in the world has just broken to a new low.

Our financial system is backed by debt, specifically, U.S. Government debt or Treasuries. These bonds are the senior-most assets in the world, representing the bedrock of our banking system and financial markets. The yield on these bonds represents the risk-free rate of return against which all risk assets (stocks, real estate, oil, etc.).

Now, when we talk about Treasuries, we are actually talking about a series of bonds of different duration ranging from 4-weeks to 30 years. The total list is below.

Treasury Bill Maturation Periods:

- 4 Weeks

- 13 Weeks

- 26 Weeks

- 52 Weeks

Treasury Note Maturation Periods

- 2 Years

- 3 Years

- 5 Years

- 7 Years

- 10 Years

Treasury Bond Maturation Periods

- 20 Years

- 30 Years

Of these bonds, the 10-Year U.S. Treasury is the single most important one. The reason for this is that 10 years usually encompasses an entire economic cycle. This is the bond used to determine mortgage rates as well as pricing all longer duration assets (tech stocks).

I mention all of this because the yield on the 10-Year U.S. Treasury has just broken to new highs.

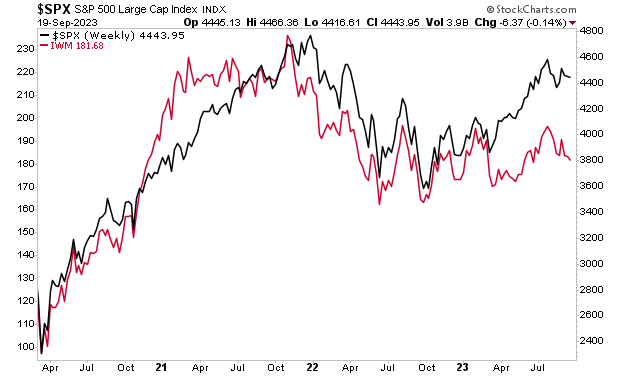

This is a HUGE deal. The risk free rate of return is rising… which means ALL risk assets will be repriced to lower levels in the near future. Small cap stocks, which are closely aligned with the real economy have already figured this out. The S&P 500 will soon follow.

That’s not the worst of it either. As I wrote in yesterday’s article, the Great Debt Crisis of our Lifetimes is fast approaching. I’ll explain precisely how the 10-Year U.S. Treasury fits into that in tomorrow’s article. In the meantime, if you’re looking to prepare yourself and your family for what’s coming, the time to take action is NOW before it hits.

More By This Author:

The Great Debt Crisis of Our Lifetimes Is Just Around the Corner - Are You Ready?Three Charts Every Investors Needs To See Today

Warning, The Second Wave Of Inflation Has Arrived