The Short-Term Trend Continues Once More

The Short-Term Trend

The short-term downtrend continues. The PMO index isn't quite at the bottom of the range, but it isn't too surprising considering that the general market really hasn't corrected despite this loss in momentum. The pullback in this index sets us up nicely for another rally.

The general market was extended in late November and ready to pause for a bit, but now it looks like the better part of the pause is complete. Time to start looking for signs of the next short-term rally. Any break above the December high for this index would be a buy signal for stocks.

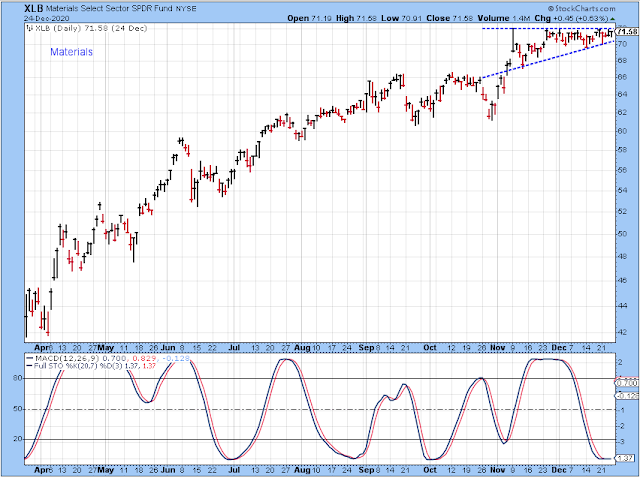

There are so many bullish sector and industry charts that I'm not even sure where to start, but here is one that I really like and it could pop into new highs soon. I like the combination of a resistance level ready to be taken out while the momentum indicator is at the bottom of the range.

In the short-term, I'm bullish towards stocks despite overbought levels of market breadth. Generally, with 87% of the NYSE stocks above the 50-day, I would be more cautious -- and that has me worried because I'd much rather be a buyer with this chart near the 27% level, as seen in late-October.

Bottom line: the market looks like it could be setting up nicely for another rally, but I'm watching out for my own over-confidence. Am I complacent about the risks?

The Longer-Term Outlook

I'm going to skip the money supply and ECRI charts this week because they haven't changed from last week. The trend is higher for both charts and favors stock prices longer-term.

I think this chart of the VIX is bullish for the general market. It has been trading at an elevated level for most of the year, but it looks poised to move back down into the pre-COVID-19 range. I view this as favorable for stock prices longer-term.

10-Year yields look ready to break higher and I'm worried about this. I don't know what the impact will be on stocks, or more specifically, I am not sure which stocks might benefit and which stocks might be hurt. I suppose it depends on why yields are moving higher, and my assumption is that it is both because of a strong economy, but also because fiscal and monetary policies may be weakening the strength and stability of US Treasuries.

Regarding the latter issue, there is a bit of my personal political view slipping into the analysis, and I need to make sure that I don't let that cloud my judgment regarding which stocks to buy (basically, I like there to be enough taxes to cover most of our spending).

For now, let's assume that higher yields accompanied by stronger economic growth will help the çyclical stocks and hurt the defensive stocks. Also, higher rates will ultimately hurt the high PE growth stocks, but we just don't know when or how long that will take. We also need to keep in mind that many of the high PE stocks are technology, and technology is high growth as well as cyclical.

Outlook Summary

- The short-term trend is down for stock prices as of December 11.

- Contrarian sentiment is unfavorable for stock prices as of November 14.

- The economy is in expansion as of September 19.

- The medium-term trend for treasury bonds is down as of October 10 (prices lower, yields higher).

Disclaimer: I am not a registered investment adviser. My comments reflect my view of the market, and what I am doing with my accounts. The analysis is not a recommendation to buy, sell, ...

more

Sure in the COVID-19 era, but now we have COVID20 from Houston/UK variant much more contagious and so things with global lock down will be much quicker than last year then watch the VIX rise.