The Poverty Of US Interest Rates

Poverty in the financial system can be measured by interest paid on treasury bonds. This can be discussed before a comment or two on the Naked Capitalism interview with Michael Hudson at the end of this article. Wear a jacket or be close to a heater because the understanding revealed about Donald Trump's economic plan is chilling.

Interest Rate Poverty in the US

Will Rogers once said in August, 1929, before the Great Crash:

The whole financial structure of Wall Street seems to have fallen on the mere fact that the Federal Reserve Bank raised the amount of interest from 5 to 6 per cent. Any business that can't survive a 1 per cent raise must be skating on mighty thin ice... But let Wall Street have a nightmare and the whole country has to help get them back in bed again.

We are far from 5 percent, and the Federal Reserve Bank cannot even raise rates by 1/4th of a percent without Wall Street having that nightmare. The attempted normalization of rates caused the stock market to dip violently in early 2019, and Wall Street has not let the Fed forget that mistake.

The truth is, the trade war, financial inequality, and fear of driving collateral yields up has made an already weak interest rate scenario much worse for the US financial system. The Fed wants some inflation as a sign that the economy is prospering. But under the new normal, it fears inflation at the same time. Bonds as collateral are a major factor in bond demand these days.

So, the Fed is back to lowering rates in an already low rate environment, despite warnings that doing so would give it no ammunition to lower as rates approach the zero lower bound. Make no mistake, as Tim Duy pointed out, data pointed to the need to lower rates as the Fed ultimately did.

Scott Sumner says the Fed is still too tight!

So, what is the problem here with bond yields? The Fed does not have control over the 10 year but it is the benchmark they seek to encourage the market to push up in yield. The rate has dipped far below 2 percent. But look at China. Rates are declining there as well, yet the 10 year is over 3 percent and far above the US rate.

That 3 percent yield in China is not that great, compared to other times in China's history. Yet it is far more stable than bond yields in the USA, especially going forward toward recession. After all, China is growing faster than the USA.

So, the press always says that poor, slow growth Europe is struggling because of 10 year yields that are very close to zero bound, to go with all the shorter yields being in negative territory. As we can see in the Fred chart below, the weakness of Europe is manifested and it presents grave problems for stimulus in any future downturn.

Organization for Economic Co-operation and Development, Long-Term Government Bond Yields: 10-year: Main (Including Benchmark) for the Euro Area [IRLTLT01EZM156N], retrieved from FRED, Federal Reserve Bank of St. Louis, August 5, 2019.

So Europe is the weak sister according to bond yields. The USA is a stronger brother according to bond yields. And China is the strongest of the three, but would not have pleased Will Rogers at all.

Still, if a recession hits the world, China may be able to avoid it as it was able to avoid the Great Recession. China was able to bail out the USA from the Great Recession. As long as Chinese interest rates remain stronger than US rates, China will likely prosper going forward.

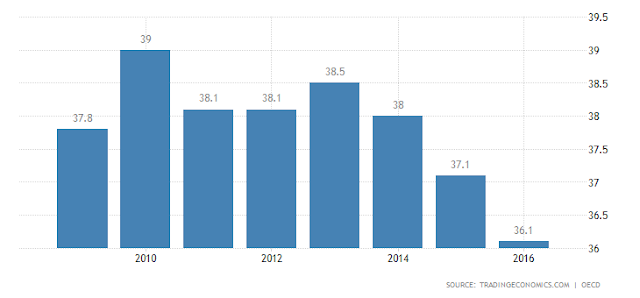

But make no mistake, the risk is there for China too. The trump card that China has, pun intended, is the personal savings rate. It is dropping but is still very strong at 36 percent of income, although the data is lagging. The Chinese have some money to spend if asked to by government, at least short term. This compares to Eurozone savings of 12.6 (latest figures) and US at 8.1:

There is always worry, mostly from Bloomberg, that steepening of the Chinese yield curve is not a sign of growth. We know the flattening of the yield curve is a sign of slowing US growth. While the Chinese bond market may not be telling us what is happening in China, it would seem that Chinese banks can borrow short and lend long in a way that US banks find difficult these days. The steepening yield curve in China has to help banks there.

It just seems like the trade war coming from a nation like the USA, which is so weak regarding interest rates and savings rates, is happening at the wrong time. The US government did not even wait to see if the apparently ill fated stimulus for the rich would work out sans a massive trade war.

The US is operating from a position of weakness in relation to China and Trump started this trade war with no ammunition. The US savings rate is a paltry 8.1 percent. And that rate is skewed towards the top of the income chain. You can't start a war if your soldiers aren't fed and cared for, with a reserve in their personal budgets. At least that is my take on the tariff mess when looking at rates.

Naked Capitalism Interview with Michael Hudson

So, why would the president of the United States go to war with a nation that appears to be more prepared for a trade war. China has better savings, better interest rates, better purchasing power parity. The US has a service economy. We don't make stuff much anymore, at least compared to China. As Yves said:

The US moved away from having rising worker wages as the key metric of sound economic policy in the 1970s, when labor was blamed for stagflation (too powerful unions supposedly hobbling US manufactures, when the performance of Toyota at the famed NUMMI joint venture showed that to be false; formal or informal cost of living adjustments to pay credited with institutionalizing inflation). Recall also that the Democrats had started to abandon labor unions even before that.

The United States moved away from unions, away from insuring that labor had an adequate share of GDP!

In the Naked Capitalism interview with Michael Hudson cited in the above link, we see what Donald Trump's plan is. It is similar, in some ways, to the Japanese plan. Hudson says:

Trump is criticizing the Federal Reserve for not keeping interest rates even lower than those of Europe. He thinks that if interest rates are low, there will be an outflow of capital from this country to buy foreign stocks and bonds that pay a higher interest rate. This financial outflow will lower the dollar’s exchange rate. He believes that this will increase the chance of rebuilding America’s manufacturing exports.

It is pretty obvious to see the danger in this plan. Trump has said in the past that he wants to default on American bonds. However, since he can't do that what is the next "best" thing? The next best thing is to charge interest on the bonds by pushing them into negative yields. This is the Donald Trump plan in a nutshell. He is willing to rip apart the world economy in order to not pay China back for all the bonds they hold!

We can understand why Europe is austere (as is Japan) with negative rates. They don't want to pay anyone interest and are so slow growth they can't afford to. But we can't understand why the Fed is tight, unless we consider that the Fed is still fighting to ultimately offer bonds that pay interest. But that is becoming difficult to do when wages never go up and prosperity is tamped down by the new normal.

And we can see why China and Russia and everyone are buying gold, just in case the US goes negative on interest rates just so we don't have to pay up.

Michael Hudson goes on to talk about Trump's discouraging of the recycling of dollar inflows. Trump wants to destroy the reserve currency, the glue that holds other nations to the USA, ultimately making them independent of the USA. This will isolate the USA. This is a very dangerous doctrine Trump is planning.

This is economic fascism, in my opinion. Trump does not want countries buying US bonds! Even Hillary Clinton was talking about other nations holding too many US bonds. While the system was not perfect, it was working. It is an easy fix to increase aggregate demand through helicopter money. Why break down the entire system of relative prosperity risking financial ruin, when all the Federal Reserve has to do is share helicopter money to the people now and then.

I have written many times that the Fed has suppressed, pruned wages over time. And now on top of that, Trump wants to further destroy the purchasing power of those declining wages. It seems like madness.

Disclosure: I have no financial interest in any companies or industries mentioned. I am not an investment counselor nor am I an attorney so my views are not to be considered investment ...