The Newsletter For August 2024

Image Source: Unsplash

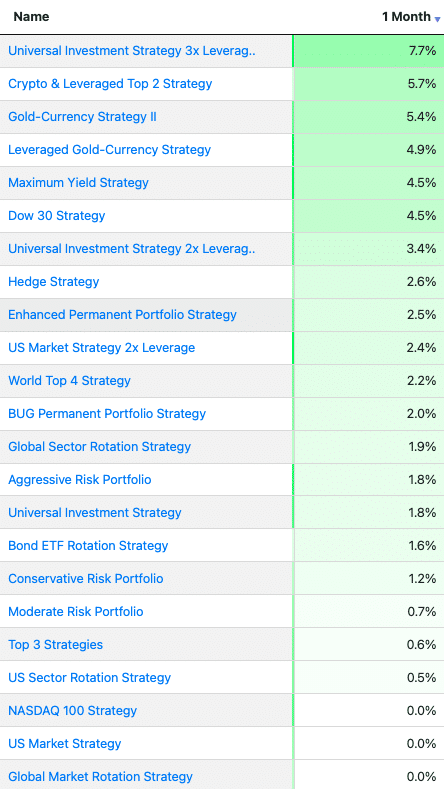

For the month of July, many of our strategies outperformed the S&P 500 (SPY +1.2%), including our Universal Investment 3x Leveraged Strategy (+7.7%), the Crypto & Leveraged Top 2 Strategy (+5.7%), the Gold-Currency Strategy II (+4.5%), and the Dow 30 Strategy (+4.5%). The year-to-date best performer, the Maximum Yield Strategy, continued its strong performance, adding 4.5%.

Below are the monthly returns for these strategies.

(Click on image to enlarge)

Market Outlook

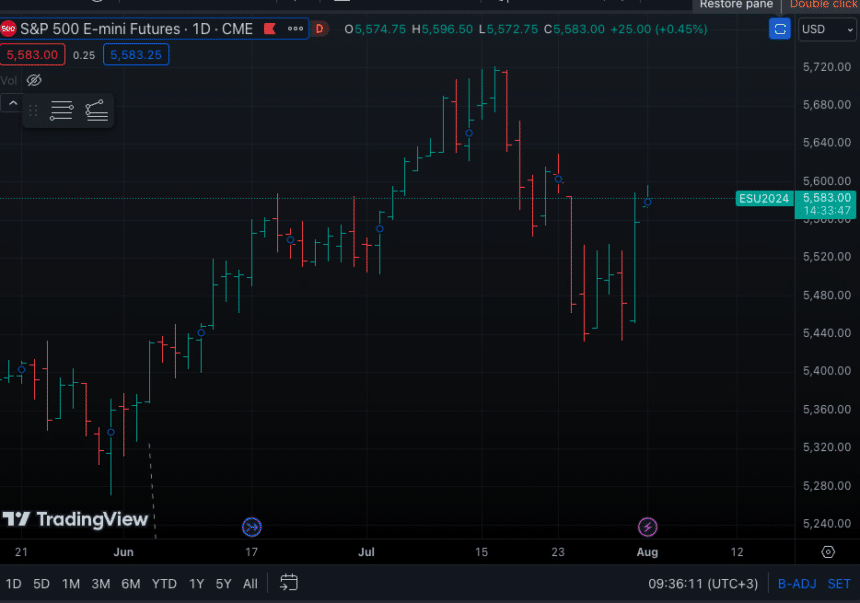

The S&P 500 witnessed a rather varied performance throughout the month of July. The month started with upward momentum from late June, before peaking around mid-July at approximately 5,680.

S&P 500 Futures

(Click on image to enlarge)

The latter half of July saw increased volatility, with the index dipping below 5,480. On the last day of the month, the S&P 500 had it’s best intraday performance in months after Federal Reserve chair Jerome Powell said an interest rate cut “could be on the table as soon as September,” if data on inflation and the labor market continued to improve.

Gold also had a volatile performance in July, reaching upward resistance around $2,500 before correcting, only to show strength in the last two days of the month.

Gold Futures

(Click on image to enlarge)

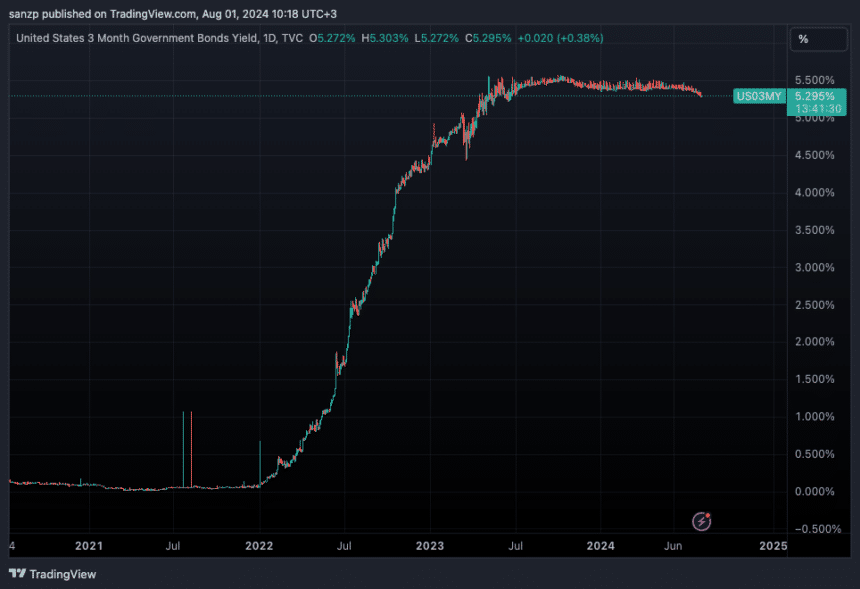

Treasuries have also been on the move, as short-term rates are starting to price in a potential Fed cut in September. The yield of the 3-month Treasury is finally dropping after being steady at around 5.4% for the past year.

3-Month Treasury Yield Percentage

(Click on image to enlarge)

Rate cut expectations have also been affecting longer-term Treasuries. This can be seen in the long Treasury ETF, TLT, which we often use as a hedge. As long-term Treasury yields fall, the price of the TLT ETF rises. It seems to be trying to break out from its recent price range.

Long-Term Treasury ETF (TLT)

(Click on image to enlarge)

More By This Author:

The Newsletter For July 2024The Logical-Invest Newsletter For June 2024

The Newsletter For April 2024

Disclaimer: Logical-Invest.com is not a registered investment advisor and does not provide professional financial investment advice specific to your life situation. Logical Invest is solely an ...

more