The Market Is Still Vulnerable To Disappointments

Written by Scott Grannis

It's likely that close to half the population of the U.S. is still fearful of what Donald Trump will do once he becomes the most powerful man on earth but, to judge from the reaction of the stock and bond markets, the other half is ecstatic. The question is, though, "Has the market has gotten ahead of itself?"

Since November 4th, when expert opinion held that Hillary Clinton was almost sure to win:

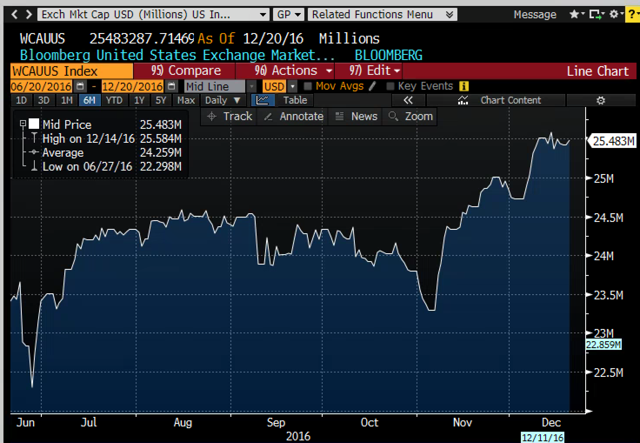

- the value of the U.S. stock market has increased by just over $2 trillion, according to Bloomberg,

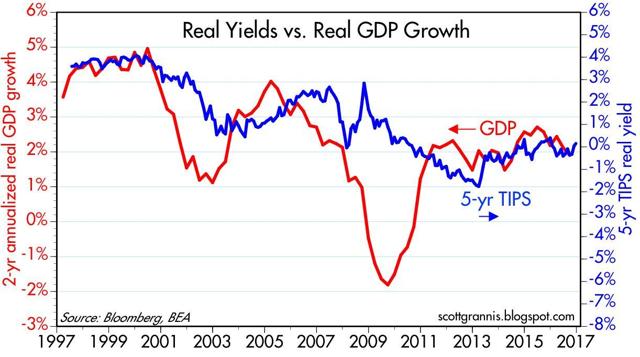

- the expected real growth rate of the U.S. economy has increased by roughly 0.5% per year according to the bond market, which translates into an additional $1 trillion per year in national income, and

- the global purchasing power of U.S. residents has increased by about 6% according to the foreign exchange markets.

You might call those gains Trump-Trillions.

The chart above shows the value of the U.S. stock market (in trillions of dollars).

The chart above shows the real yield on 5-yr TIPS, which is a good proxy for the market's economic growth expectations. About two-thirds of the 80 bps increase in 5-yr Treasury yields since the election has been due to an increase in real yields.

The chart above shows the trade-weighted value of the dollar vis a vis other major currencies, which is up about 6% since the election.

In a sign that the world's general level of discomfort has eased measurably, gold is down over 13% since the election.

The question now becomes whether the market has gotten ahead of itself. According to Mohamed El-Erian, the market has "priced in no policy mistakes ... no market accidents ... [and] ignored all sorts of political issues." I'm not sure I'd put it the same way, but it's undoubtedly the case that the market has priced in good things that have not yet happened, and that leaves the market vulnerable to disappointments. Further gains over the six months or so will probably require concrete achievements, not to mention a pickup in corporate profits and an actual reduction in tax and regulatory burdens.

[So, while it is true that] the market has priced in good things that have not yet happened that leaves the market vulnerable to disappointments, over the long haul, I think there's still lots of upside potential. To support that assertion, I offer the following chart, which suggests that the real yield on 5-yr TIPS would have to increase significantly if the market were to price in a booming economy with 4-5% real growth rates.

This article may have been edited ([ ]), abridged (...) and/or reformatted (structure, title/subtitles, font) by the editorial team of munKNEE.com (Your Key to Making Money!) to provide a faster ...

more

Thanks for sharing. Merry Christmas