The Helicopter Paradigm

Jim Grant made a most interesting call on the markets back in September. He is something of a perma-contrarian residing out of the box in his thinking. According to a recent article in the Dallas Morning News, "Wall Street Stars Look For Truth In Packaging," Jim Grant and his Interest Rate Observer have a "star quality" track record. Of the Observer's editor Will Danoff, the newspaper said he "manages Fidelity's $110 billion Contrafund and has one of the best track records on Wall Street over the last 25 years."

So what did Jim say recently that was so interesting? Clear back in September, 2015, when everyone and their dog was debating the only important topic of the day - how many times and when will the Fed hike rates because the economy is so good on its own now - Grant wrote an article titled "Jim Grant On Helicopter Money And The Comeback Of Gold". Mind you this was back when gold was still dead, buried, and detested, and very few were buzzing about helicopters. On the free credit binge of recent years leading to malinvestment and mismanagement, resulting in mass loan troubles resulting in more stimulus needed, he said:

So it’s seemingly a never ending, circular process of so called stimulus leading to still more stimulus and unconventional ideas leading to radical ideas. I dare to say that we have not yet seen the most radical brainwaves of the mandarins running our central banks.

What do you think this will look like? They don’t keep those things as a secret. They talk quite openly about "direct monetary funding" which is what Milton Friedman had in mind when he coined the phrase “helicopter money”. So the next idea is just bypassing the banking system altogether and mailing out checks to the citizens.

Would something like that even work? All this monetary stimulus does two things in a reciprocal way: It pushes failure into the future and brings consumption into the present. Providing marginal businesses with very cheap credit is inviting companies that have passed their useful days of their commercial lives to pretending some kind of an afterlife thanks to the subsidies from the central banks. But capitalism is inherently a dynamic system based on entrepreneurship and to new inventions. It’s a little bit like the forest for the trees: You need life but you also need death. Without death there is no room for a new generation and what you get is Japan ...

According to Grant, we have arrived at what Marc Faber has been projecting in monetary policy now for the last 15 years, and I've been writing articles about for the last 7 years - something he has been calling "zero hour", where a law of diminishing returns for each new monetary debt dollar added gets lower real economic return, which goes to zero in 2015. It has happened to the year per Faber's projection 15 years ago! In the September, 2015 article, Grant said:

This is a monetary moment. I think we are looking at the beginning of the world’s reappraisal of the words and deeds of central bankers like Janet Yellen and Mario Draghi. What we’re waiting for is a sufficient recognition of the monetary disorder. You see monetary disorder manifested in super low interest rates, in the mispricing of credit broadly and you see it in the escalation of radical monetary nastrums that are floating out of the various central banks and established temples of thought: Negative real rates, negative nominal rates and the idea of helicopter money. So you need some hedge against things not going according to the script and that makes gold and gold mining equities terrifically interesting now.

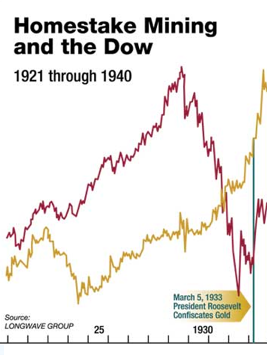

"Now" meaning last September, and he was so right. There are many now saying that the coming helicopter era means a booming stock market again, and this must be the end of gold's upstart bull market. This is the old teeter totter thinking on gold and the stock market. If one goes up the other must go down. I beg to differ. It's not that simplistic and history proves it. There are many different gold measures over history. You could just look at the gold price, but before 1971 you had a government set gold price and the only investment available was the gold miners. All the miner indices have originated long after 1971 except the Barron's Gold Mining Index BGMI. So to compare apples to apples, let's look at this index:

Here we see two cases of raging bull stock markets being shaded only by two raging bull gold markets. The 1960s stock market was glorious, rivaling any period in history. During this time, gold was set at $35 an ounce, but was highly sought after for currency purposes. It was becoming more and more of a strain to gold back currency until, finally, Nixon "closed" the gold window and gold was set by market forces. Here was a clear case of the miners strongly leading the metal price. It was a currency thing back then.

Another case of gold bull and stock bull living in harmony was this:

A five year bull market existed from 1924 to 1929 in both stocks and gold miners. The BGMI didn't exist back then, but Homestake Mining was a behemoth that represented what the miners did. Dome Mines was another giant that was a remarkable performer during those years. Here again, as FDR confiscated and revalued gold, it was a currency thing.

In the 1990s, the Alan Greenspan Fed made loose money and the "Greenspan put" the modus operandi of the markets, including the housing market. During 2002 to 2008, as this currency debasement proceeded into a debt crisis, it was again a currency thing.

Now with helicopter money, it looks to be yet another currency thing that will drive gold, and again we see the miners very strongly leading the metal price, just as they did in the above graph going into the banking failure epidemic of the early 1930s.

It seems more likely that, instead of a simplistic teeter totter relation between the stock market and gold, we will see the more historical relation play out. Jim Grant was spot on with his September call on the turn to helicopters and gold, and that relationship will probably continue.

So we would be "pushing failure into the future" as Jim Grant puts it, but how far into the future? Well, all kinds of instability develops with all this pushing. Deutsche Bank is often discussed as the "too systemic to fail" entity. Doesn't this just guarantee a helicopter bail out, even though it's supposed to go directly to the people? The people will have to be protected against frozen ATMs won't they? DB is a bank, and it is just the poster child for all the big banks, and in our digital, derivative laced world, all of our banks. The people will function only if their banks function. The bank stocks, by the way, have sunk far, far below their all time highs, and many critical bank shares are falling fast.

So how far can all this go? I don't know, but I can't help but consider a simple thought experiment. Picture if you will, the following scene. You are taking your hard earned money to your trusty bank and are greeted with the pretty sign out front that says something like "Yada Yada Bank and Trust". That's what banking is all about, you know - trust. When you sign to create your account, the fine print actually says you are giving your money to them as their property to do with as they please. Traditionally, this meant the bank loaning it out and making profits with interest, and giving you back your money, all of it, whenever you say.

In this post-Glass-Steagall, negative interest rate age, it doesn't mean that anymore. It means they are thinking, as they are in that bold frontier in creative socialism, Greece, that a bank's depositors are legally bound to bail out a management sinking from derivatives gone awry or whatever other problems crop up from their stupidity. "Bail-in" is the new buzz word for it. They used to call it bank robbery.

So as you stroll past your bank's trust sign, now picture a helicopter chopping the air, and you see that it is unloading an emergency shipment of money to your trusted bank. This is because the trusted management of your trusted bank has so screwed up that the chopper load is its only way to survive. As you carry your load past the sign, with the helicopter landing on the roof, you hesitate with your bundle of hard earned money.

The printing presses can seemingly fix anything forever, but the ultimate end in all this may be evident at what Jim Grant referred to above as the leading edge of all this monetary lunacy, Japan. There we see home safe sales are skyrocketing. And in another avant-garde corner, we have a recent piece on Italy's banks and who and how to bail them out of their mismanagement and insolvency. After exploring all the paper-over "emergency liquidity" options, the article concluded:

The real threat is if the local population wakes up to the risk of holding their savings in a financial system that is now teetering on the edge, something Renzi [ Italy's prime minister ] himself admitted when he said that he "hoped to use a liquidity backstop to contain investor panic, which could result in a run on deposits and affect banks’ liquidity." Because even if it buys up every bond, loan and stock in the world, the ECB will not be able to fix the public's loss of trust in fractional reserve banking.

As it was in the aftermath of the "speculation" market foolishness of the Roaring '20s, the debt game-over moment may now lie with the banks and what depositors will think of the helicopters on the roof.

I am long gold and silver coins and an assortment of gold miners

Alternative options to helicopter money for boosting the economy are perhaps by lowering taxes and /or adding incentives in the consumer sector. Give the people "deals" and they will come out and buy more. This worked with the auto sector where manufacturers gave large trade in incentives, it worked in a similar way with appliance trade in programs. Next stop, lower taxes on gasoline, air travel, and large appliances. I foresee people will spend more, adding more money to the economy. This might not be enough to change the big picture but it will provide an initial boost of stimulus. Worth a try, no?

Grant makes his points, but you seem unwilling to draw conclusions. Do you think helicopter money will make the average bank depositor feel more secure, or less?

Also, I believe the phenomenon is will work based off the low global #GDP growth and the fact companies store funds overseas and they do not repatriate the funds in order to not pay #taxes. Therefore, companies save significant sums of money in potential tax fees by taking a loan against the funds stored overseas and using that money for operations.

Only #JimGrant would lump #HelicopterMoney with negative interest rates. The goal of helicopter money is to push us off of negative interest rates. I am disappointed in his analysis.

I can see assets and yields heading up in tandem.

We are being compelled to speculate. That is what the CBs are doing; making speculators of us all. The last thing they want is prudent saving. It's all in, baby. #Gold is a form of savings in this environment. A way station.