“The Final Countdown” Stock Market (and Sentiment Results)…

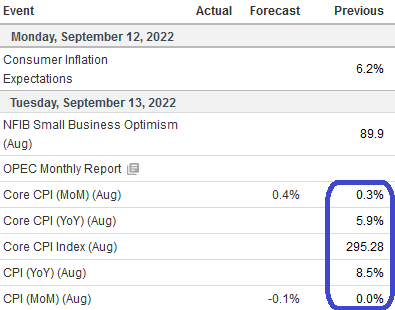

As I have been saying since before Jackson Hole, the most important data point for 2022 will come on September 13 when CPI data is released.

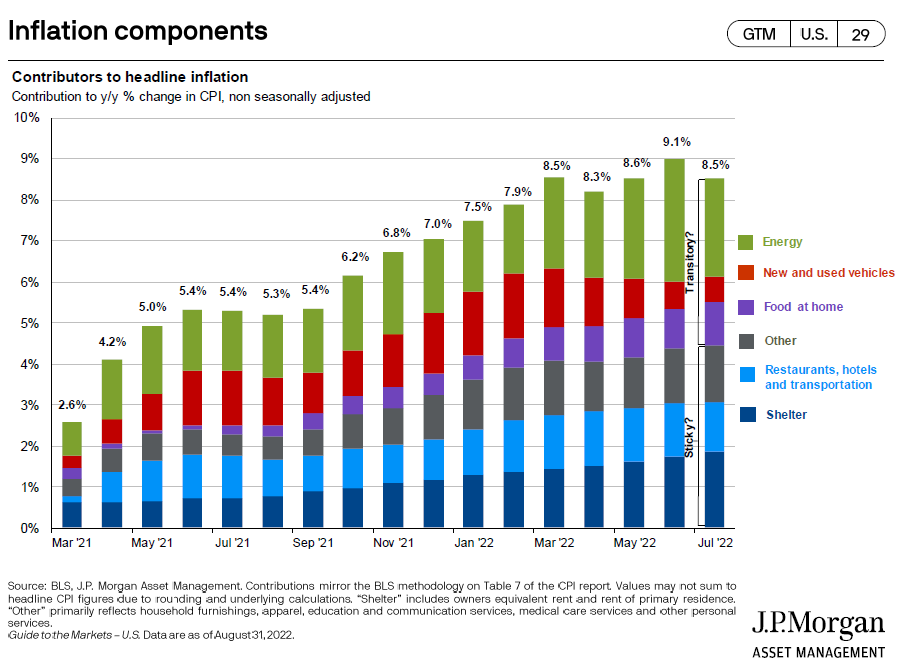

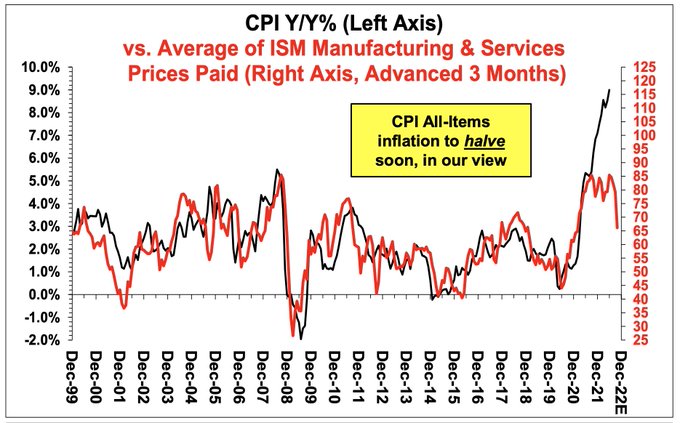

Expectations are high, but as we covered in last week, the underlying data points to a downside surprise (inflation coming in lower than expected)

Chart from Barry Bannister, Stifel

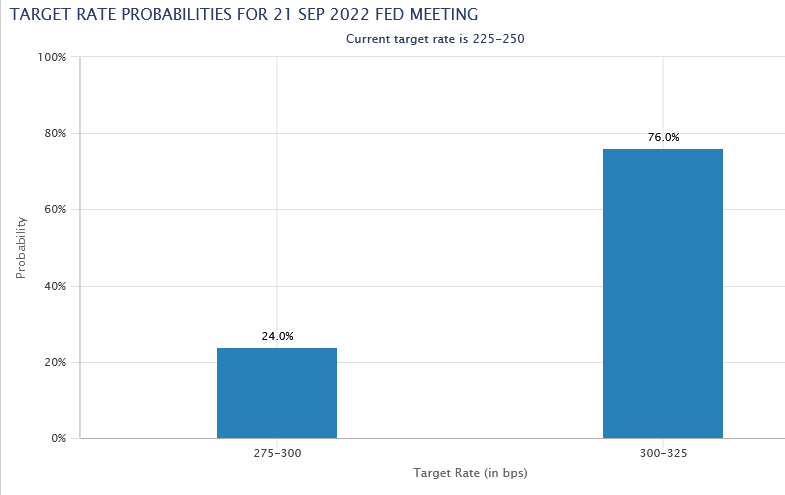

The key will be whether the numbers come in low enough for the Fed to raise 50bps (or less) on Sept 21 – versus consensus (75bps):

In late August two Fed Presidents made the following statements:

*Fed Pres (KC) Esther George said, “lags (from policy) are long and variable”

*Fed Pres (Philly) Harker said, “86 hikes since 1983. 75 were under 50bps. 75bps is unusual. 50bps is STILL SUBSTANTIAL”

- Implication is they want to see the lagged effect of recent 75bps hikes before going too aggressively on 75bps or QT schedule.

This was reiterated on Wednesday (yesterday):

Fed Pres (Cleveland) Mester: OUR CHALLENGE IS TO ENGINEER A SLOW DOWN IN ACTIVITY WITHOUT CAUSING A RECESSION

*Mester: Fed Not Aiming for Recession or Tanking Any Markets

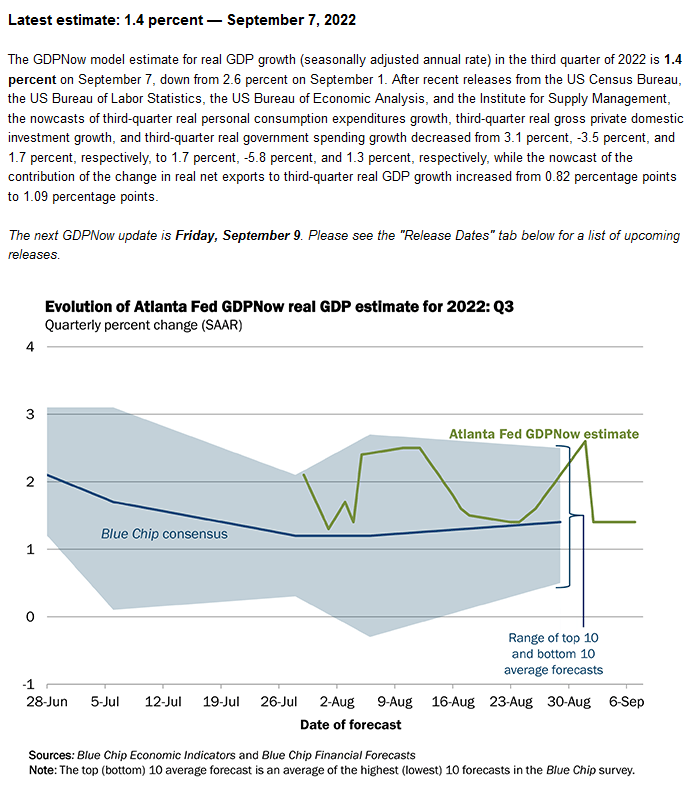

After two quarters of negative GDP growth this year, Mester said she expects positive growth in the last six months.

- “But for this year as a whole and for next year, I expect growth to run well below 2%, which is my estimate of trend growth.”

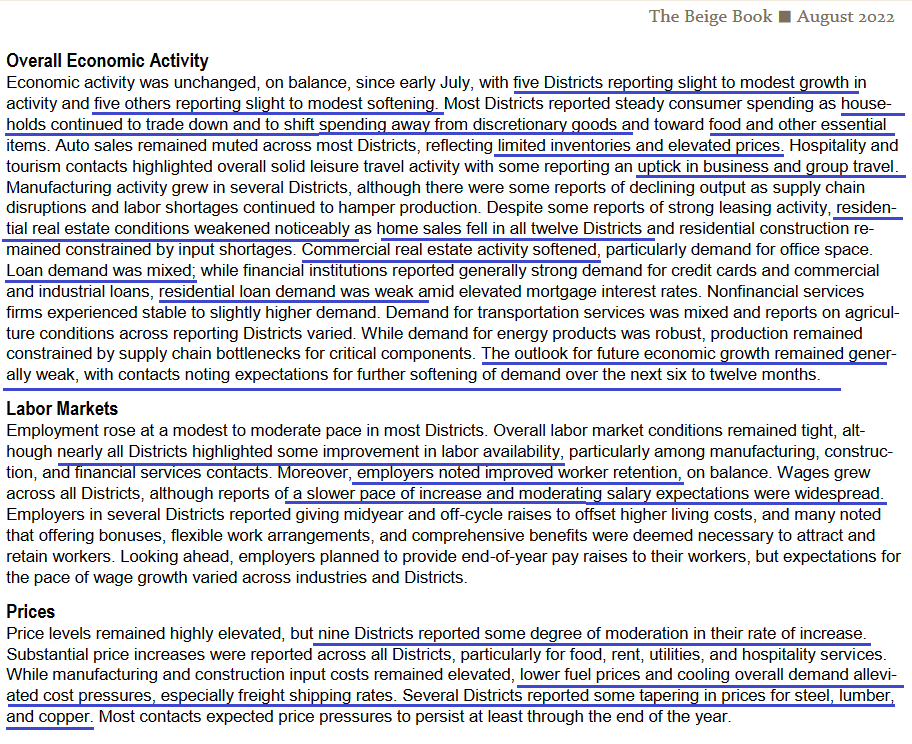

Beige Book

We’ve pounded the table in recent weeks’ podcast|videocast(s) and media appearances that the playbook is to “Talk Hawkish and Act Dovish.” In a regime where CPI was 9% and the Fed Funds rate was 2.25%, that’s all you need to know. This strategy has not only worked to bring down demand and inflation (without having to aggressively tighten), as we covered in last week’s note (above), it worked post WWII as well. Same plan, different decade…

If we are correct and the Fed raises less than 75bps, the market will view this as a pivot from “extreme measures” to a more moderate stance (i.e. “The Beginning of the End”).

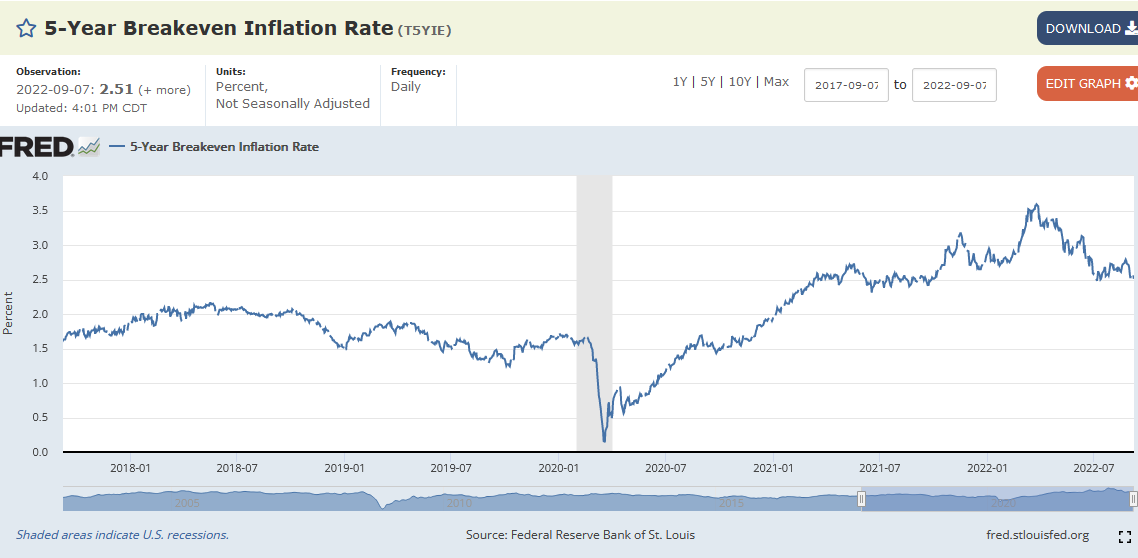

For anyone doubting the efficacy of the Fed’s plan, one only need look at 5yr inflation breakevens – which have collapsed from 3.59% in March to 2.51% today:

GDP also remains BELOW TREND:

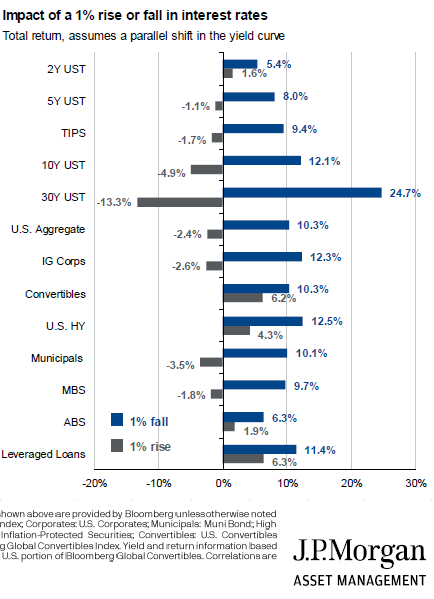

If the Fed goes less than 75bps on September 21, it will catalyze the following:

1) USD Weakness

2) High Yield Credit Markets Reopening (for companies to refinance debt)

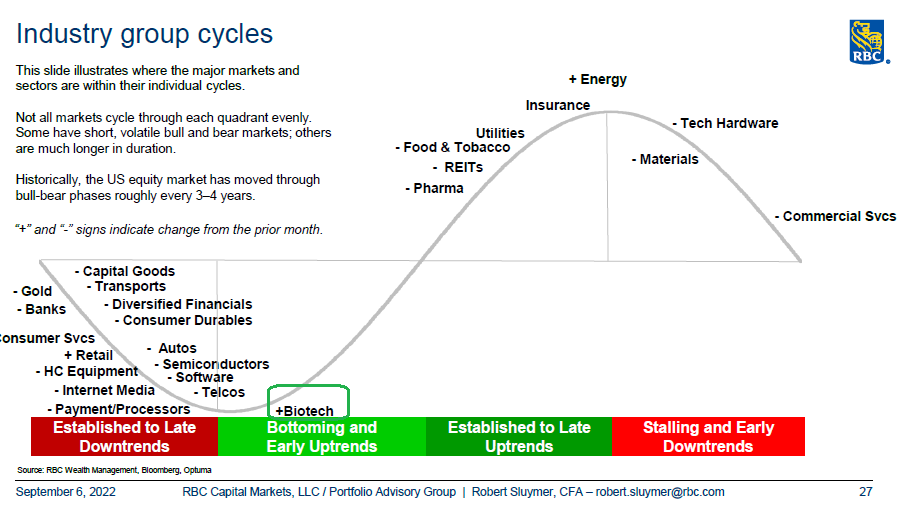

3) A bid in risk assets (Equities, Emerging Markets, China, Biotech, etc).

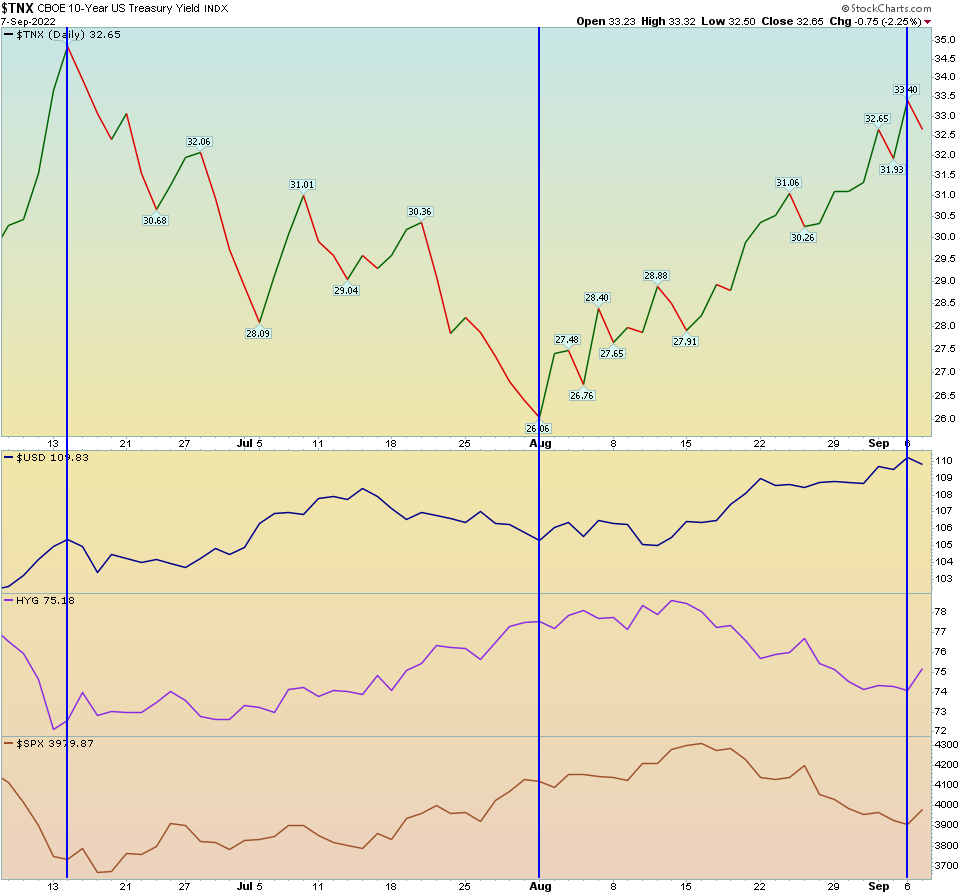

You can see this clearly demonstrated from the June lows (SPY) to the August highs. As rates came down, High Yield (HYG – Junk Bonds) and Equities were bid higher.

The set up for a pivot is ideal as most managers are still off-sides and hiding in cash after chasing the top in early August (and getting flushed).

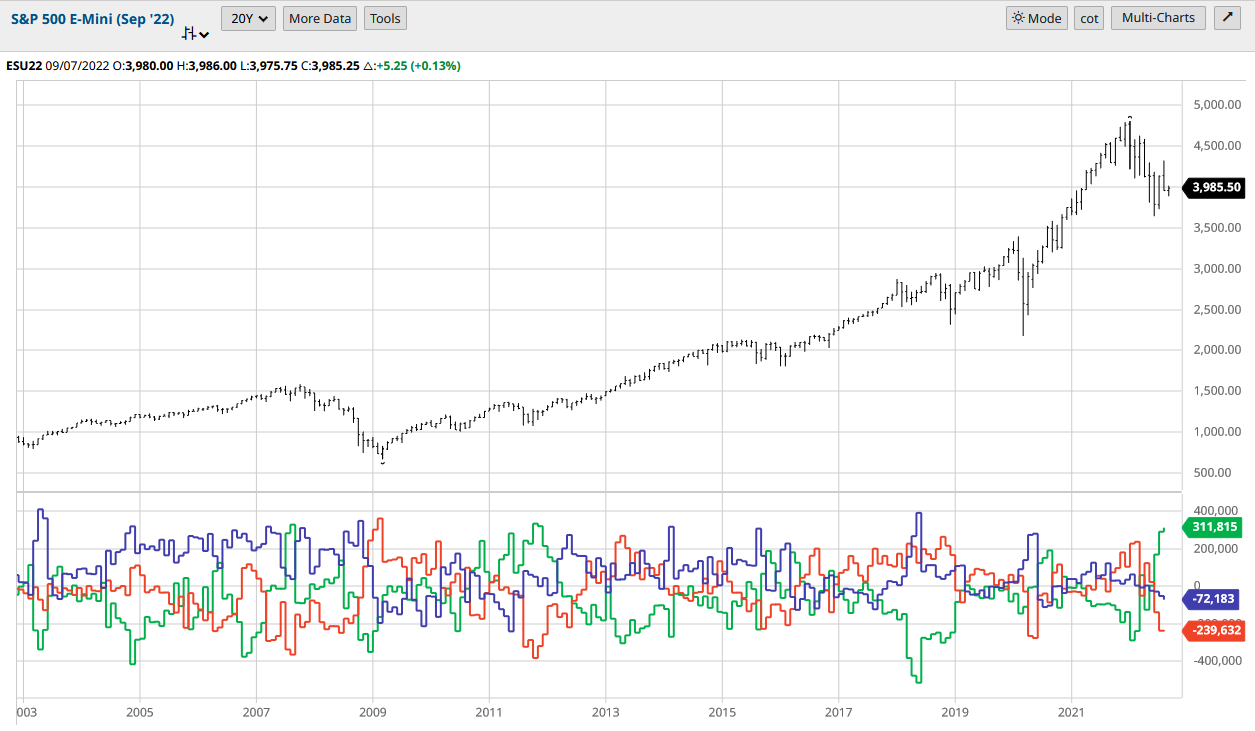

While “Dumb Money” (Large Traders – Red line at bottom of chart) are the most short equities since the pandemic lows, “Smart Money” (Commercials – Green line at bottom of chart) are the most aggressively long equities since the 2011 lows:

h/t Michail B and Presley M

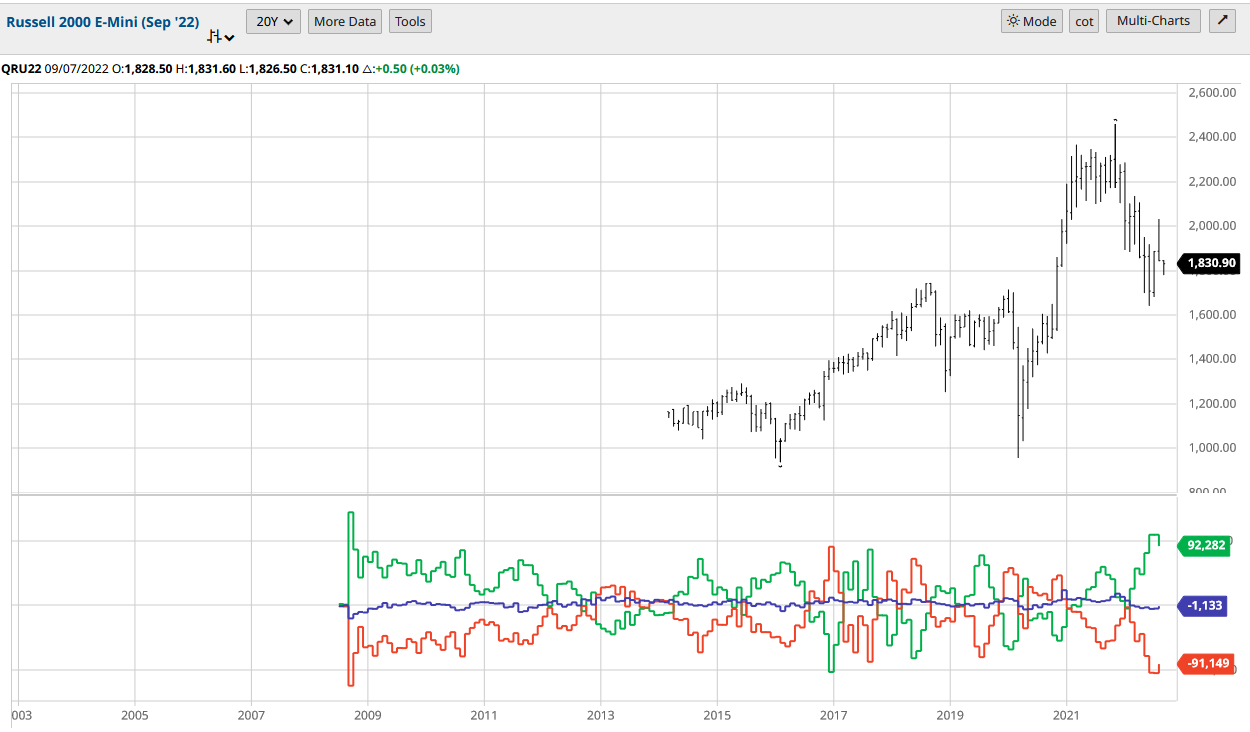

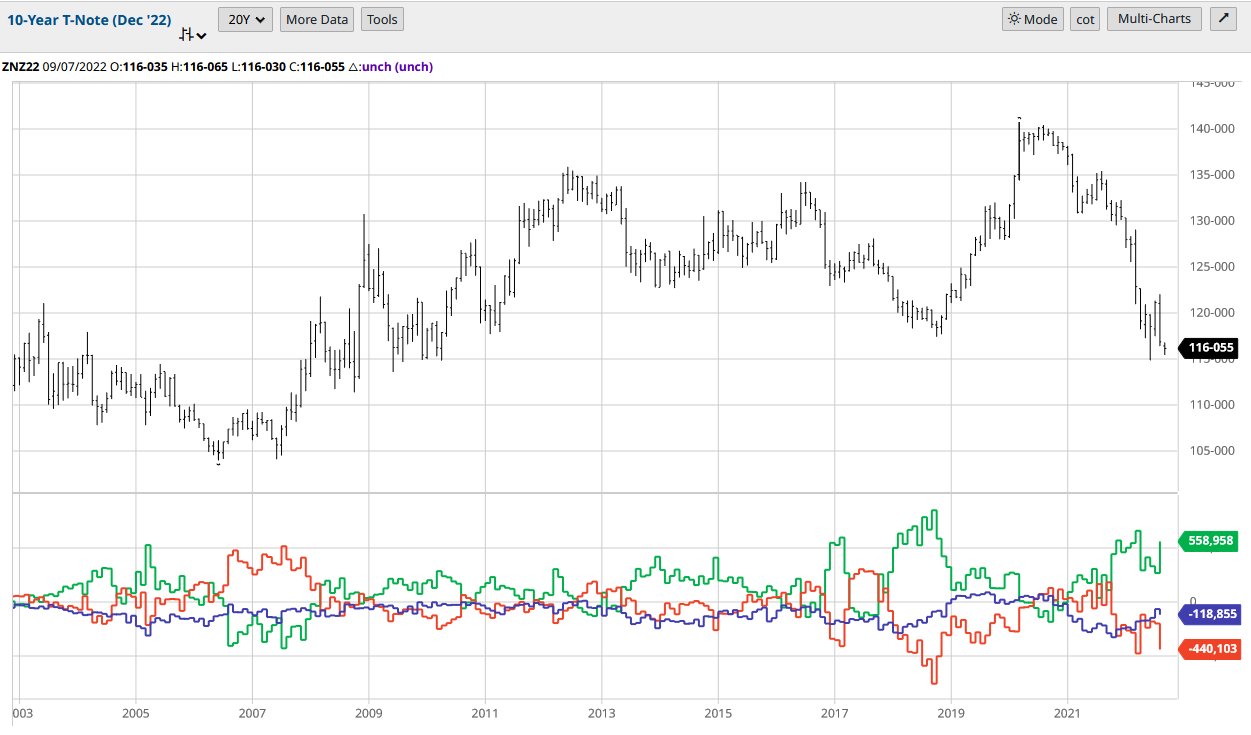

While “Dumb Money” (Large Traders – Red line at bottom of chart) are the most short 10yr Treasuries since the 2018 lows (lows in price, highs in yields), “Smart Money” (Commercials – Green line at bottom of chart) are the most aggressively long 10yr Treasuries since the 2018 lows (in price, highs in yields):

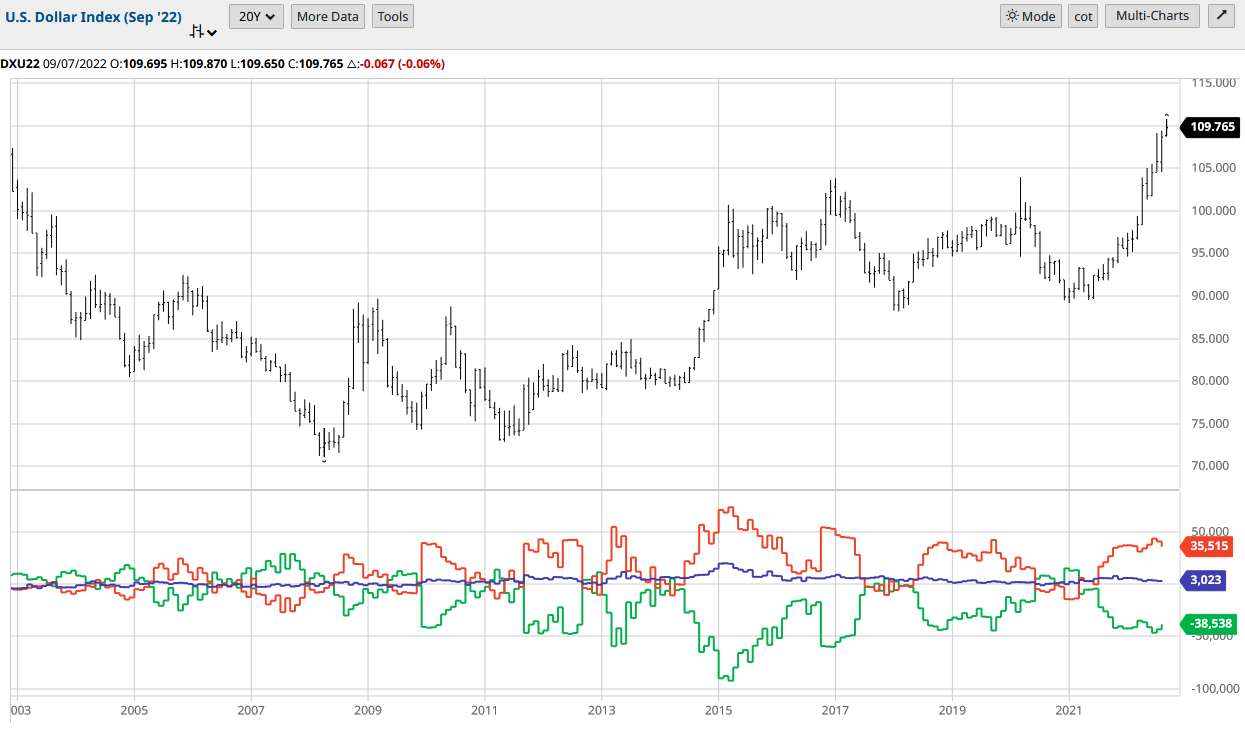

And finally, while “Dumb Money” (Large Traders – Red line at bottom of chart) are the most long US Dollar since the 2017 and 2020 highs (in price), “Smart Money” (Commercials – Green line at bottom of chart) are the most aggressively short US Dollar since the 2017 and 2020 highs (in price):

What side of the trade do you want to be on going into Sept 13 and Sept 21?

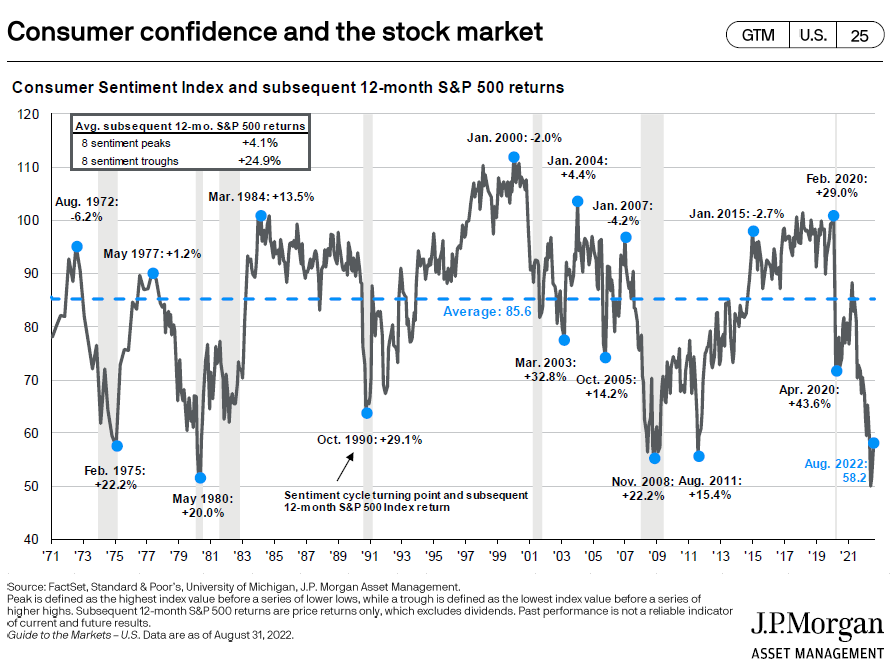

Consumer sentiment has bottomed – in line with previous major inflection points (bottoms) in previous bear markets:

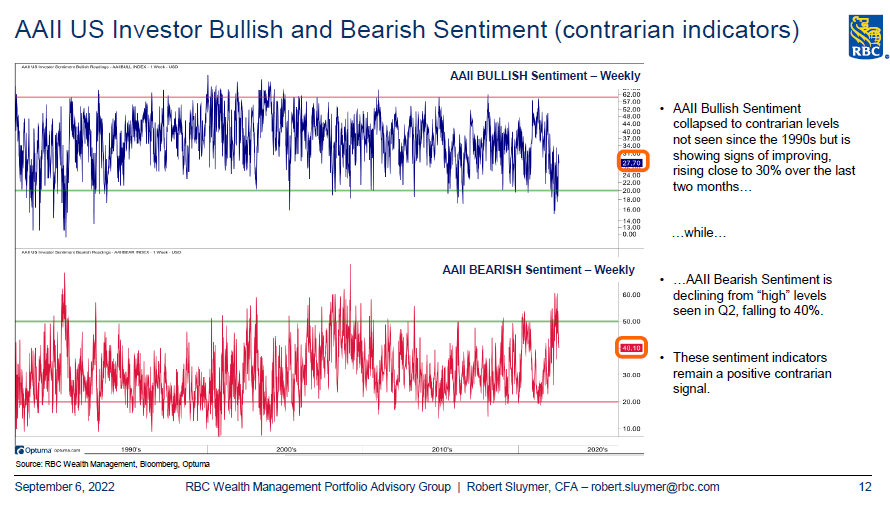

Retail Sentiment is completely flushed:

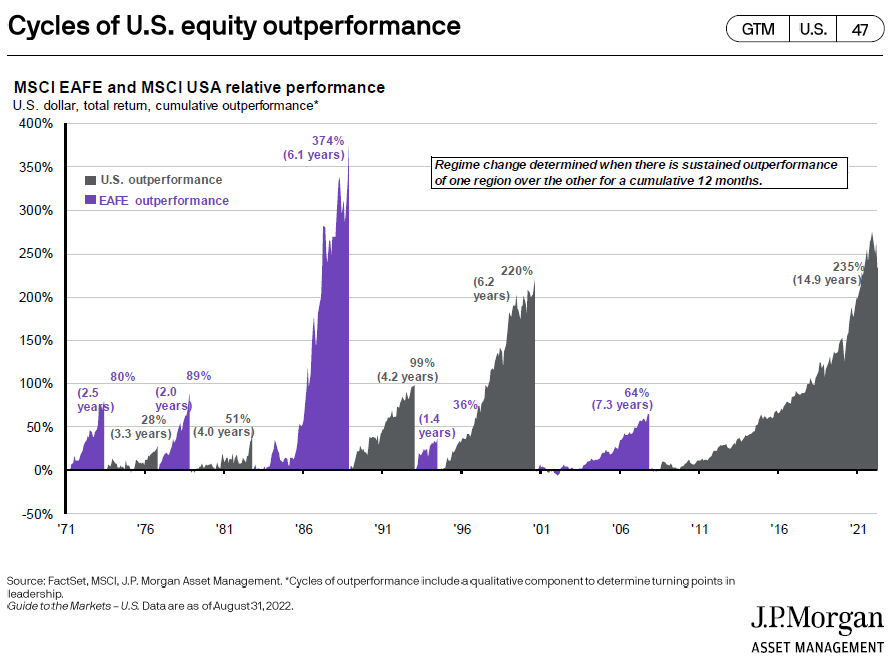

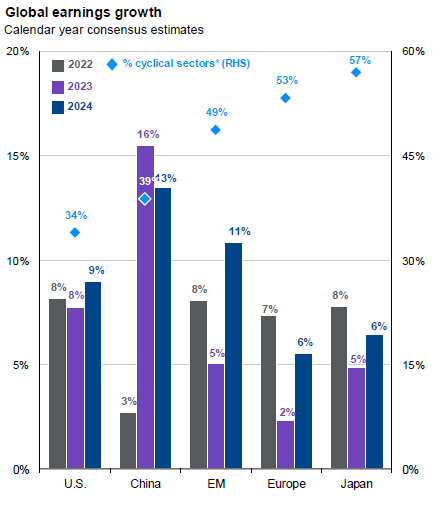

We’ve repeatedly talked about what will happen to the USD (weaker) and Emerging Market Equities (stronger) when the Fed pivots (hikes at a slower pace). Here’s a look at cycles of US vs. Non-US performance over time – followed by earnings expectations by country for next year:

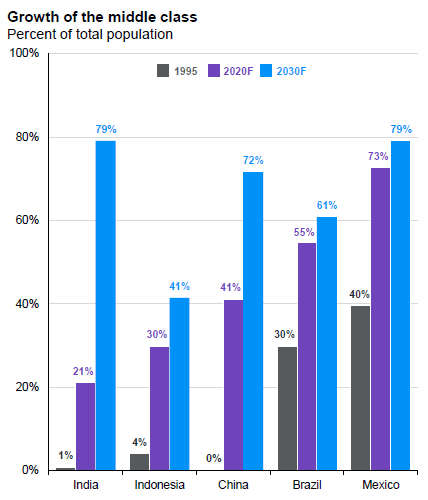

For those of you doubting the long China thesis, know that these trends are too strong for even the government to screw it up (no matter how hard they try with Zero Covid policies). They are working full time to destroy their own prosperity but will fail miserably based on demographics in the next 3-5 years (and the fact that like 1918-1920 the virus eventually dies on its own). We covered this theme extensively two weeks ago.

While China is well positioned for the next 3-5 years, the US is also well positioned with the Millennial population beginning housing and family formation:

Last but not least, don’t forget about Biotech:

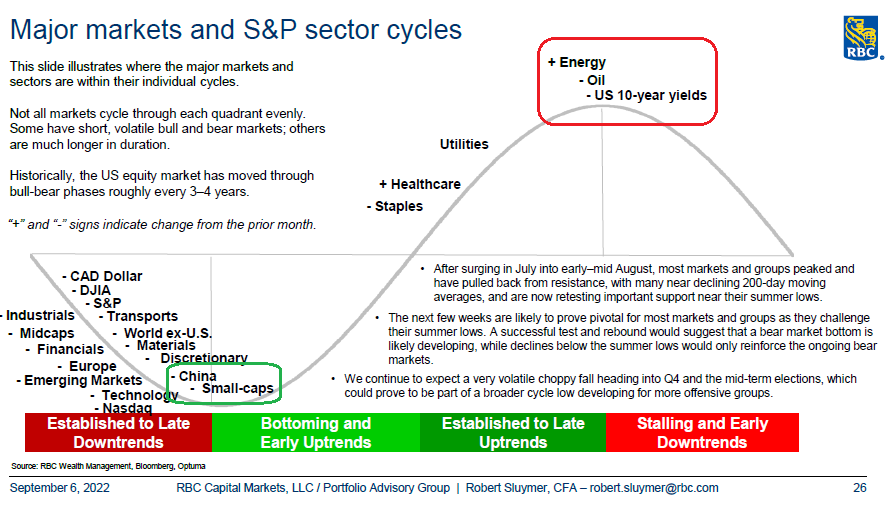

Now onto the shorter term view for the General Market:

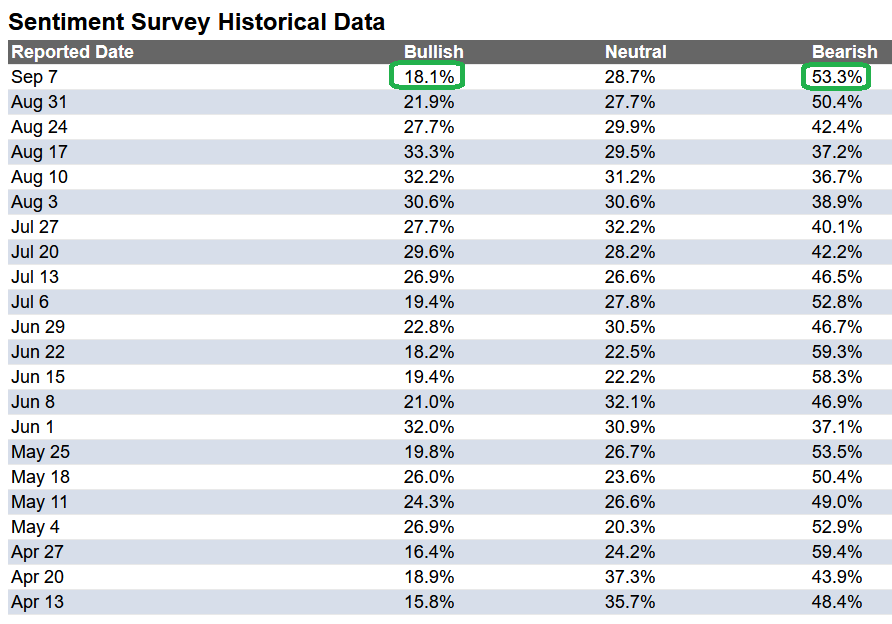

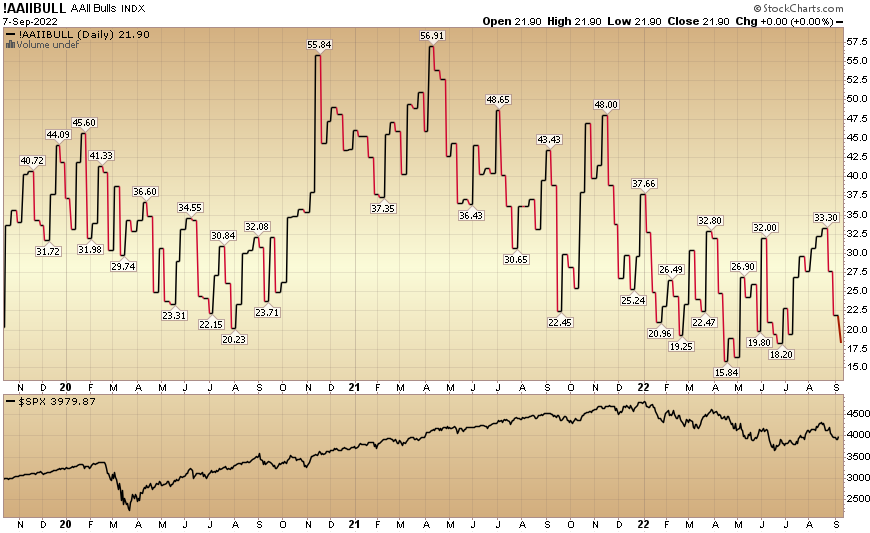

In this last week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) dropped to 18.1% from 21.9% the previous week. Bearish Percent rose to 53.3% from 50.4%. Retail investors’ fear is at June low levels again.

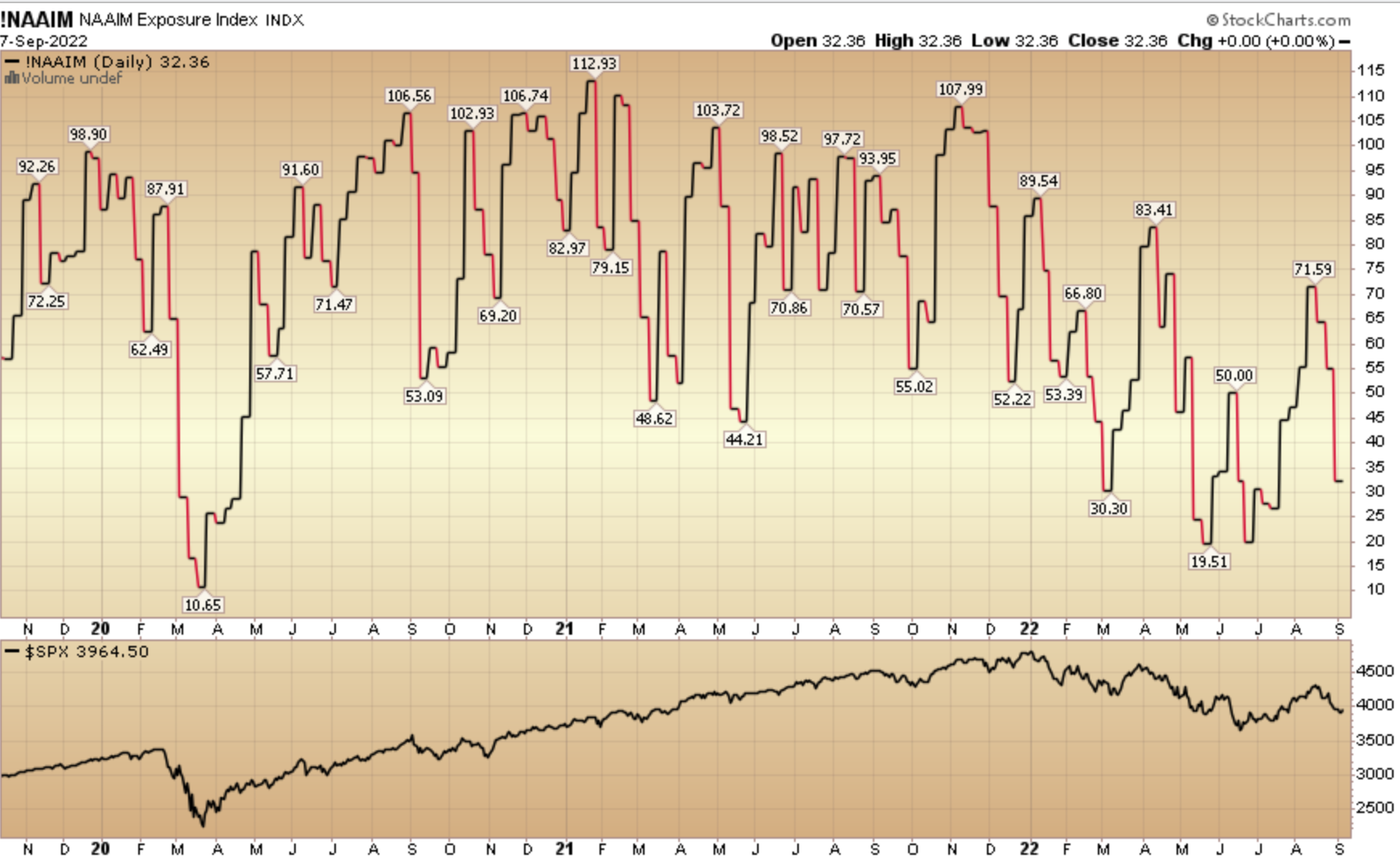

And finally, the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) dropped to 32.36% this week from 54.86% equity exposure last week. Any good news and managers will be forced to chase up into year-end:

More By This Author:

3 Investing Themes For The Next 3 Years

“Wrong Side Of The Wave” Stock Market (And Sentiment Results)

A “Sealing Systems” Stock Market (And Sentiment Results)