The ETF Portfolio Strategist - Saturday, June 26

Risk Assets Recover

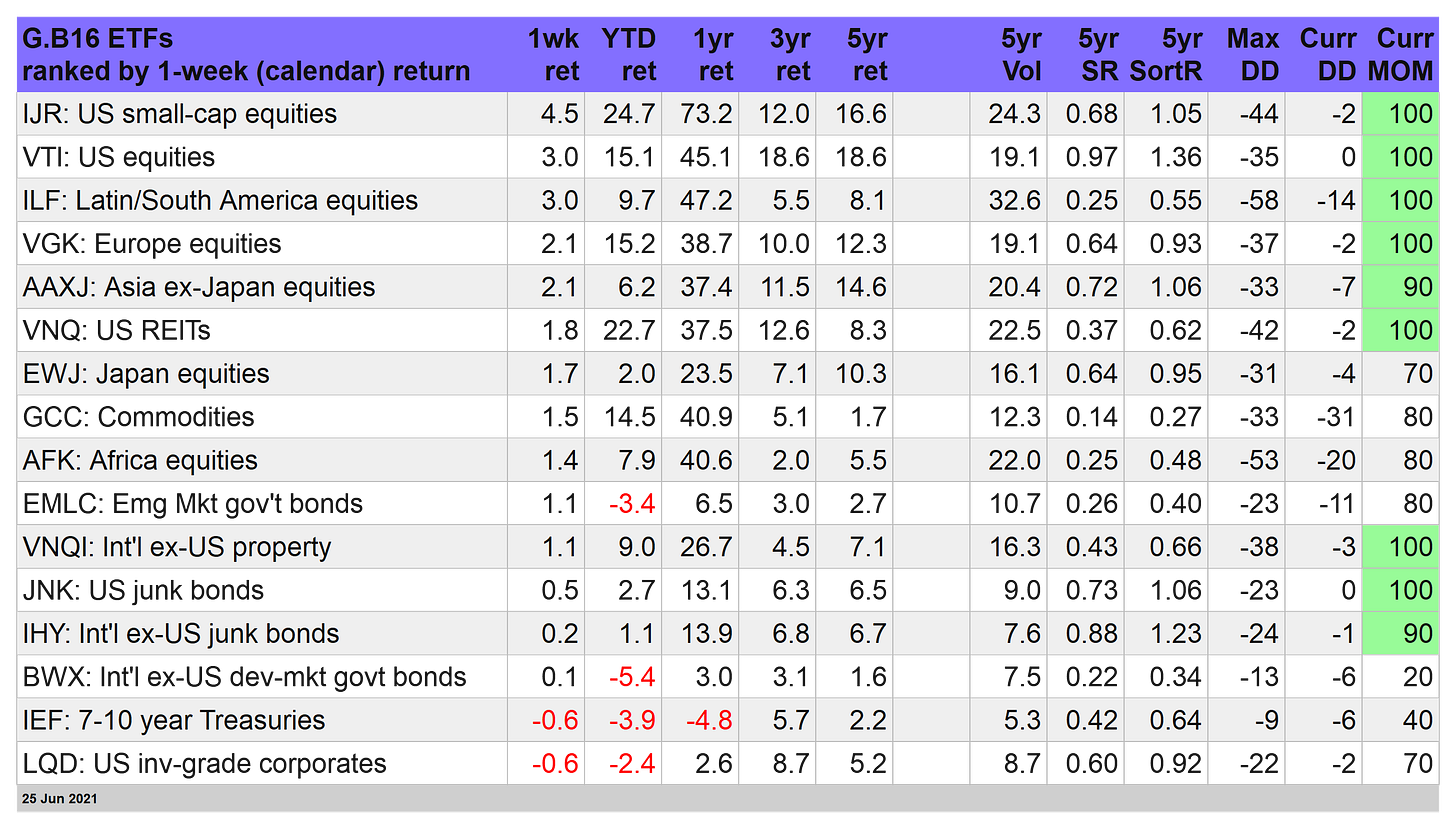

The sound you may have heard was beta going “pop.” Following the previous week’s widespread losses, global markets rebounded. With the exception of US bonds, all of our ETF proxies in our 16-fund opportunity set snapped back by the close of trading on Friday, June 25.

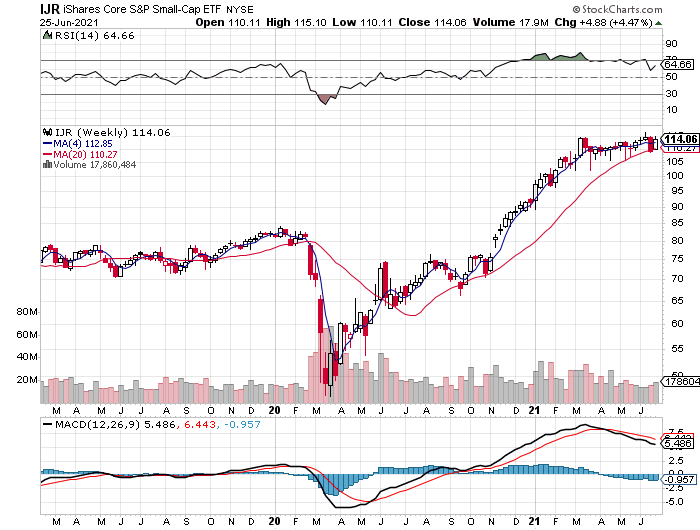

Leading the revival were US small-cap stocks. The iShares Core S&P Small-Cap ETF (IJR) jumped 4.5%. The gain recovered most of the previous week’s loss, but the longer-term view suggests the fund is flat-lining, albeit near the top of its trading range for this year.

The question for IJR – and perhaps most risk assets: What’s the catalyst for the second half of 2021 to propel prices higher? Arguably the economic recovery is fully priced in to most risk assets. If so, that’s a hard act to follow. Or is infrastructure spending up to the task?

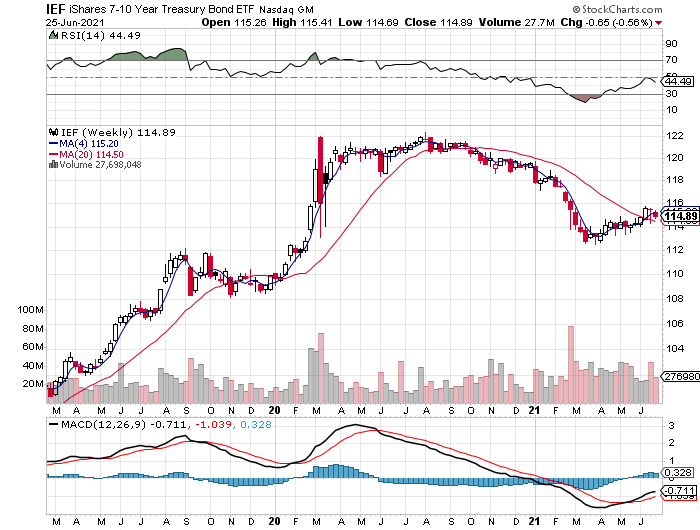

The only losers for the week were our usual suspects: Treasuries (IEF) and US investment-grade corporates (LQD). Each fund gave up 0.6% on the week, although a modest upside trend still appears to be intact.

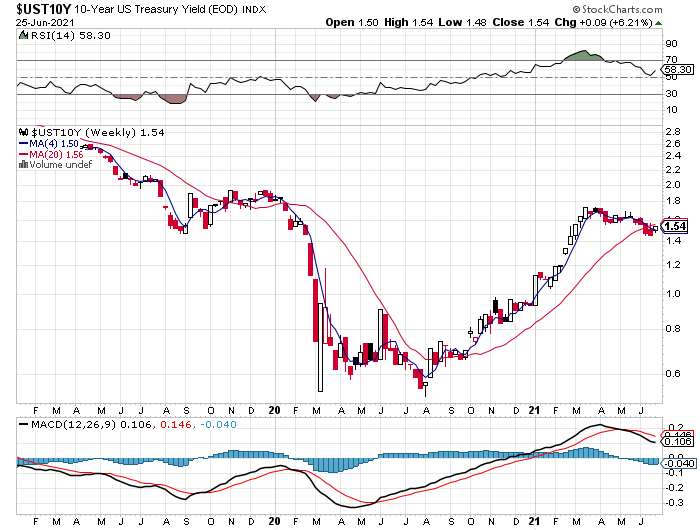

The key question for bonds (and beyond) is still: Is inflation transitory? The answer’s as mysterious as ever, and will remain so for months until the data graces us with new numbers on the economic front.

Otherwise, it’s not obvious that the benchmark 10-year Treasury yield is reversing from its slide of late. The benchmark rate rose to 1.54% at this week’s close — the first weekly increase in five weeks, but it’s still tough to argue that anything’s changed.

For year-to-date results, most of our opportunity set continues to post gains, led by US small-caps (IJR) and US real estate investment trusts (VNQ). The only losers so far this year: foreign government bonds (EMLC and BWX), along with US fixed income (IEF and LQD).

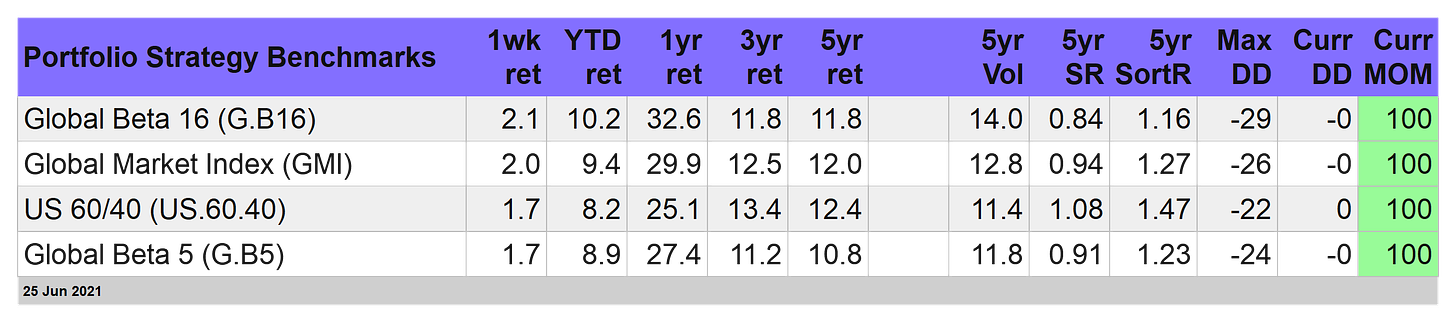

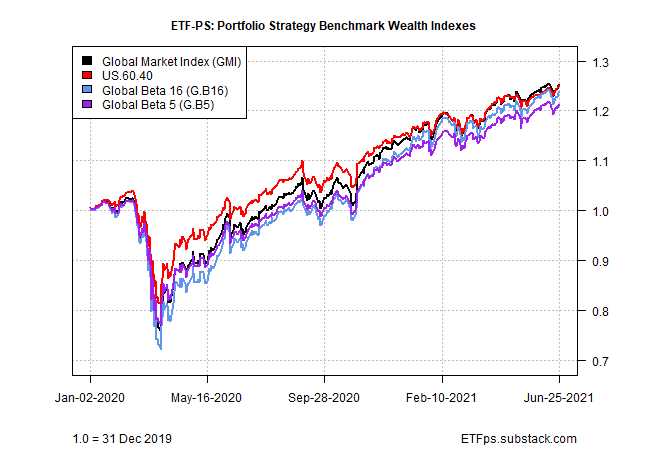

Strategy Benchmarks Pop

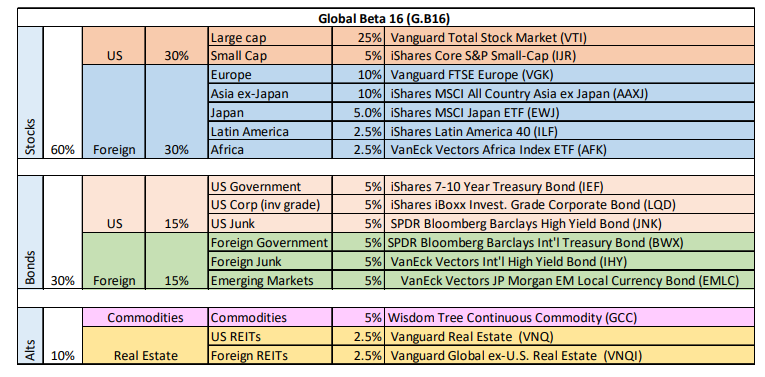

With most corners of global markets higher this week, it’s no surprise that our strategy benchmarks revived. Leading the bounce was Global Beta 16 (G.B16), which rallied a strong 2.1%.

The latest gain strengthened the across-the-board increases for year-to-date results. Here, too, G.B16 is comfortably in the lead still.

The main event for next week: Will the US infrastructure package survive? The odds were looking up on Thursday, when news broke that the White House and a bipartisan group of Senators cut a deal on moving the legislation forward. The implication: more stimulus for the economy is coming, which markets cheered.

But an update, via Politico: “The five GOP senators who cut a deal with moderate Democrats and the president are frustrated that Biden explicitly tied his signature on a bipartisan infrastructure bill to a separate Democrats-only measure, according to three Republican aides familiar with the dynamics.”

Is it back to the drawing board? Probably — isn’t it always these days? Cue up a relevant Yogi Berra quote: "It ain’t over till it’s over."