The ETF Portfolio Strategist: Risk Bites Back

It had to end eventually. Or is this just one more pause in an ongoing bull market? If only we knew.

What is clear is the S&P 500 Index took a beating in the final two trading days of this week, although it managed to claw back some of the losses in the final hours of trading. By Friday’s close (Sept. 4), this benchmark was down 4.5% from Wednesday’s record high and off 2.3% for the week—the first weekly decline for the S&P since mid-July.

All in all, not too bad when you consider that US stocks have been rising furiously for months. The question is whether something’s finally snapped? While we ponder the possibilities, let’s check in with our risk-management systems and how our proprietary portfolios are holding up in the wake of the latest run of market volatility.

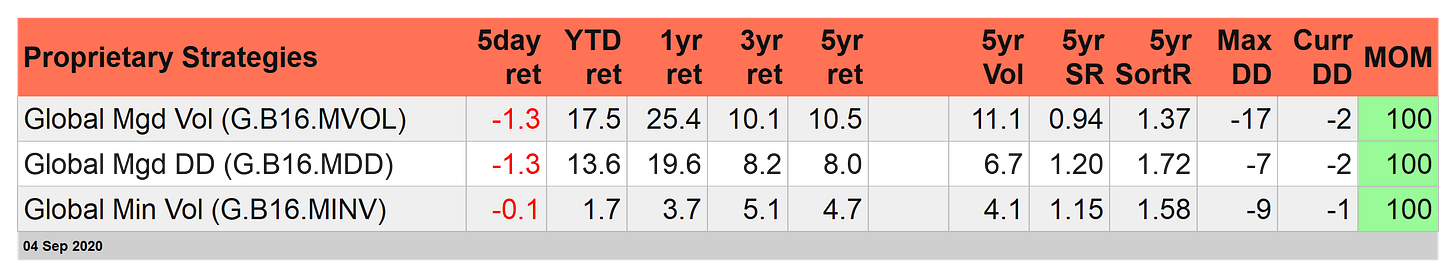

Not surprisingly, all three of our in-house strategies took a hit this week. Global Managed Volatility (G.B16.MVOL) and Global Managed Drawdown (G.B16.MDD) shed 1.3% for the five trading days through Friday’s close (Sept. 4). Global Minimum Volatility (G.B16.MINV) was off a relatively light 0.1%. (All three portfolio use the same 16-ETF opportunity set that spans global stocks, bonds, real estate and commodities. For details on the funds, strategy rules, and risk and return metrics in the tables below, see this summary.)

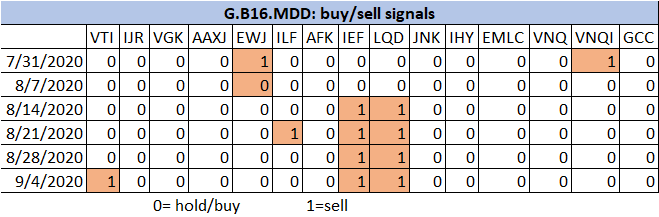

When this week’s trading dust settled, another fund holding switched to a risk-off position for Global Managed Drawdown (G.B16.MDD), which uses drawdown as a risk metric for determining if a fund bucket should be risk-on or risk-off. The new sell is the broad US equity ETF: Vanguard Total US Stock Market (VTI). At next week’s open, VTI will be unceremoniously dumped and the proceeds shifted to iShares Short Treasury Bond (SHV), a cash proxy. When the trade clears, G.B16.MDD will have three of its 16 funds in a risk-off posture.

By contrast, Global Managed Volatility (G.B16.MVOL) continues to reflect risk-on for all 16 funds (the same fund set as G.B16.MDD). Although market vol has picked in recent sessions generally, it’s not yet increased to a level that triggers a risk-off trade for G.B16.MDD’s holdings.

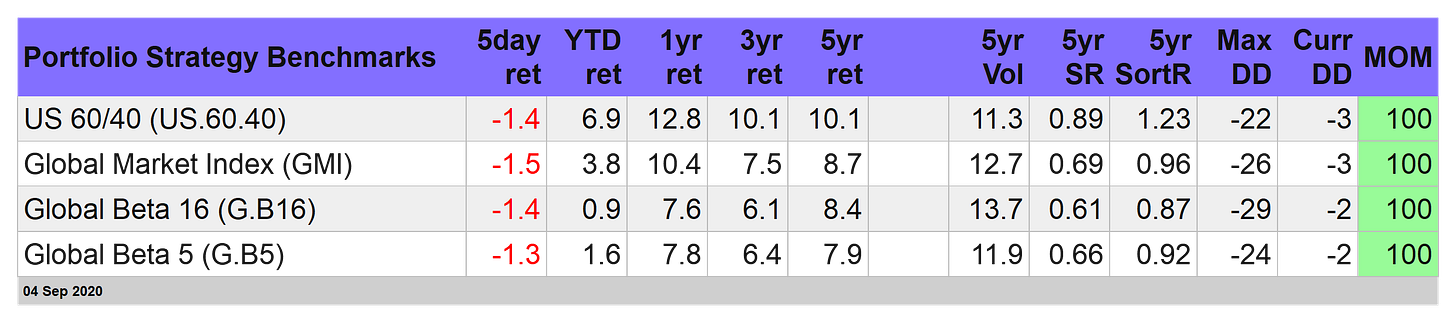

Meanwhile, our passive portfolio benchmarks slumped this week, ranging from a 1.3% loss in Global Beta 5 (G.B5) – a globally diversified stock/bond/real estate/commodity portfolio via five ETFs – to a slightly deeper 1.5% slide in the Global Market Index, an unmanaged benchmark that holds all the major asset classes (except cash) in market-value weights via 14 ETFs.

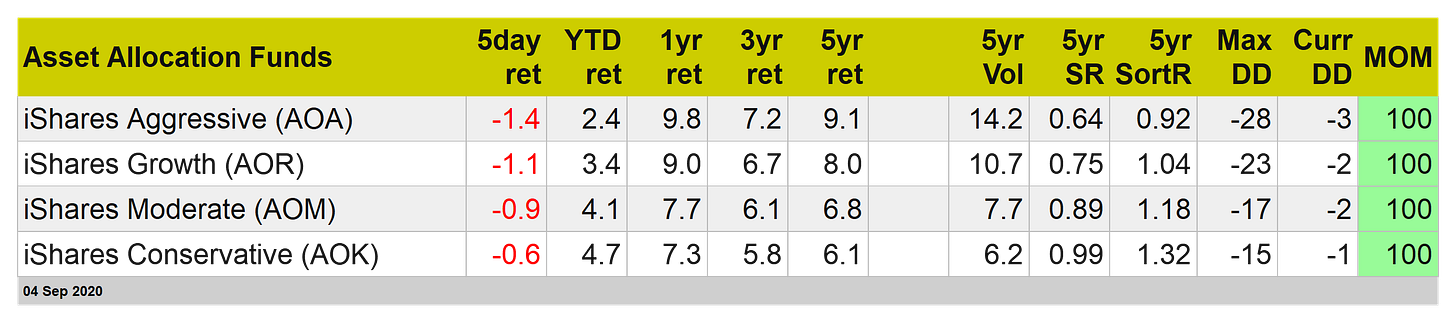

For additional perspective on a portfolio basis, a set of BlackRock asset allocation funds in various risk flavors posted losses this week ranging from -0.6% to -1.4%.

With a long holiday weekend now in progress in the US, the crowd has time to consider what lies ahead. After an extraordinary summer bull run, the approaching onset of autumn provides an excuse to reassess just how much optimism is warranted when considering the outlook for the economy and the markets.

Perhaps it’s just coincidence, but Federal Reserve Chair Jerome Powell wants you to know that he’s not planning to raise interest rates soon. Friday’s employment report for August was “a good one,” he told NPR. But apparently the nation’s top Fed head is expecting the economic recovery to slow and remain patchy (if not worse) for some time, or so one might surmise after reflecting on his latest remarks.

"We think that the economy's going to need low interest rates, which support economic activity, for an extended period of time," he advised. "It will be measured in years."

Whether such dovish talk can still work its old magic and support risk assets is open for debate at barbecues across America this Labor Day weekend. Meantime, here at The ETF Portfolio Strategist we’re sticking with burgers, hot dogs and our risk-managed strategies on the assumption that the latter will remain among the more appealing options in the investment toolkit if things turn ugly.

Disclosure: None.