The Danger Is Deflation, Not Inflation

Fundamentals

There is a lot of talk about the Fed possibly raising interest rates, three, four or six times. Everyone has an opinion. Yesterday, Chairman Powell said interest rates would remain unchanged until the Fed finishes tapering, and then will only raise them a quarter-point, subject to the conditions of the market. It's always subject to conditions of the market.

Since last June, Powell has been talking about the acceleration in prices of commodities, assets, and other areas. Since then we have seen a major correction in most markets. Recently, the Nasdaq, stocks and the mini-S&P have had a correction. There's a lot of fear in the market with the expectation that interest rates are going to pop this economic bubble of artificially inflated assets. If you take into account the amount of stimulus, it has put the purchasing power of the US dollar in jeopardy. Its value has declined as the Fed has created more and more stimulus. Is it time to take away the free money?

The pandemic over the past couple of years has had major effects. We have one of the fastest increases in homelessness in decades. Every major city in the US has more homeless than before the pandemic.

The pandemic has accelerated the demise of the Western economic system and the US dollar as the world’s reserve currency. It's being challenged because of the tremendous debt, $30 trillion, that it's carrying. The tail end of the debt is set to explode if interest rates do rise aggressively.

The danger is inflation; is it lasting or temporary? Are going to go back to the levels that the Fed has set as a target of 2 to 2.5 percent on the 10-Year Note? In the face of the Fed talking about raising rates, the 10-Year Note is at 1.80. The 30-Year is at 2.08, down a few basis points. The bond market appears to be saying that we are not looking at runaway inflation. The yield curve seems to be suggesting that we may go into a slowdown–the opposite of what the hawkish Fed stance is suggesting.

US 10-year Bond Yield, investing.com

In 2018, the Fed raised interest rates a quarter-point and the markets collapsed and gold bottomed. The Fed was then forced to backtrack and had to begin to lower interest rates.

With the Producer Price Index is at about a 7 percent inflation rate, the real return on the 10-Year Note is negative. Even the 5-Year Note is in negative territory in relation to inflation.

“The Fed, therefore, is between a rock and a hard place,” Equity Management Academy CEO Patrick MontesDeOca said. “They cannot raise interest rates aggressively without collapsing the market.”

The gap between inflation and interest rates has to be narrowed, which is about a 4 percent negative yield against the US dollar.

It's tricky to remove the easy money when the bond market is indicating the possibility of a slowdown. As we move into the second and third quarter of this year, we're going to be watching to see how much the economy slows down. The IMF just forecast that the global economy will slow down this year. Omicron will continue to be a drag on the global economy.

Just as in 2018, it appears that if the Fed raises rates, the markets will respond and force the Fed to stop raising rates. Global debt is about 130 percent of GDP; such levels are unsustainable, let alone if rates increase. Even a quarter point would devastate the global economy.

Russia and other countries are beginning to talk loudly about eliminating using the US dollar as the reserve currency in trade with China. They want to start using the Yuan. There is an increasing consensus against the US dollar, which is imploding and causing a level of inflation that we have not seen in 40 years. In 1971, the debt was far less and the Fed could raise interest rates.

Discord Alert, VCPMI Trading Room

For the Fed, inflation will help make it easier to pay down debt with inflation depreciated dollars. Even though they talk hawkish about inflation, it is in their interest to allow some inflation to decrease the impact of the massive debt on the system.

Precious Metals

"Fred Hickey: Another 5 tons inflows into the GLD ETF today. That’s 37 tons in the last five business days. Evidence of U.S. institutional gold buying – which has been missing since 2020. This is the type of buying that drives gold bull markets…"

Relatively speaking, the cheapest assets on the board are gold and silver. GLD is beginning to see an inflow of capital. That's a really positive sign that money is starting to come into the metals sector. The metals sector has suffered with so much money going into Bitcoin in response to the collapsing US dollar. The currency is imploding, which is reflected in the values of food, commodities, and other essentials. Stocks rose first, since 2020, and then gold hit $2,089. GLD, the major gold ETF, at the time hit 194 In terms of a risk-reward ratio, silver and gold are the best assets out there to buy. We see substantial moves in a short period. For gold, look for reversions. $1,780 and $1,800 appear to be the new bottom and holding those levels should send the market back up. If we close below those levels, we may test $1,750, but if that is the case, this would be an incredible buying opportunity for gold and silver.

Featuring: Hecla Mining (NYSE: HL)

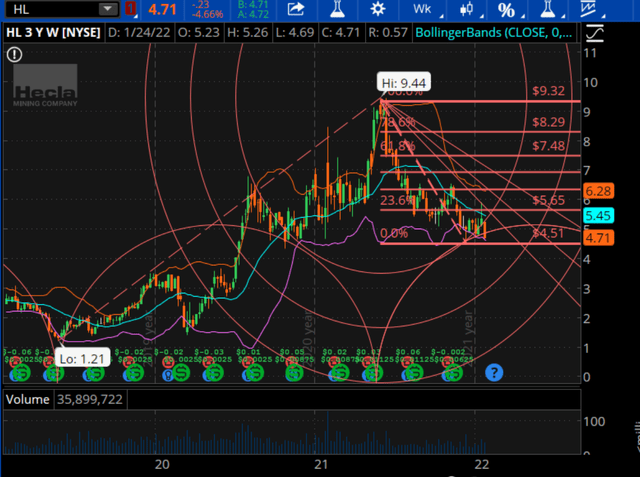

Hecla Mining Chart Technical Analysis, Think or Swim

Hecla Mining is a precious metals company that creates value for shareholders by discovering, acquiring, developing, producing, and marketing mineral resources at a profit.

In 2020, Hecla’s Greens Creek mine produced 10.5 million ounces of silver, and the San Sebastian mine produced 954,772 ounces of silver, at an average cash cost per ounce of $5.49. The Nevada operations produced 31,756 ounces of gold, and the Casa Berardi gold mine produced 121,493 ounces of gold in 2020, at an average cash cost per ounce of $1,131.

Forecasted earnings growth for Hecla Mining in 2022 is 58.3%. Over the last five years, Hecla Mining is profitable and is currently in good financial health. Hecla has a diluted EPS of 0.04, and a net income of $18.44 million.

We really like Hecla Mining, in which we are building a long position. Hecla offers an incredible opportunity to buy and hold the stock over the next year or two. It's the second-largest gold producer in the US and one of the oldest silver mining companies. It has the credibility of longevity and is offering an incredible value in terms of price and in terms of intrinsic value. We're at a 61.8 percent correction from the high in May-June. The stock has the potential to test the high of 9.44. It's an excellent silver asset to buy and hold. It has come down to a low of 4.50 on December 13. Since then, we made a high of 5.09 recently and appear to be building a base at these levels. Taking the Fibonacci retracement from the recent high to the recent low, the market yesterday completed a 23.6 percent retracement. The 32.8 percent target is 6.35, a 68.5 percent retracement is 7.48 and a 78.6 retracement target is 8.29. If we close above 8.29, we will challenge the highs of 9.44 with the Fibonacci extension of 12.30. It appears these targets will be met in the next 12 months.

“I strongly recommend accumulating physical gold and silver,” MontesDeOca said. “You should also have a percentage in Bitcoin. These markets are going to be the beneficiaries of a new reality in which interest rates, without any significant economic growth, cannot go up.”

To learn more about how the VC PMI works and receive weekly reports on the E-mini, gold, and silver, check us out on Ticker ...

more