The Credit Market Is Sending A Bearish Signal For Stocks

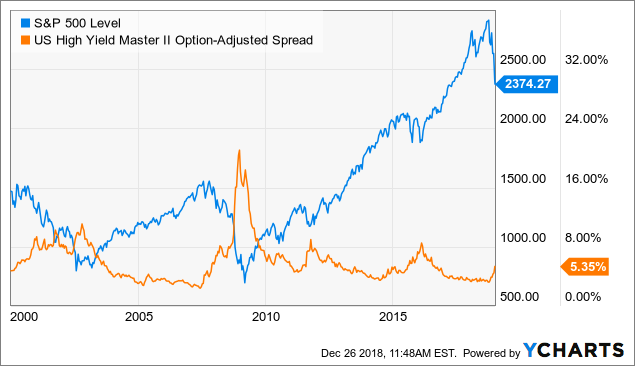

There is no way to know for certain how deep or long-lasting a market correction will be, but some indicators have a solid track record in terms of predictability over the long term. Credit spreads are particularly effective in that regard.

When the stock market falls and credit spreads remain stable, this is many times a short-term dip and ultimately a buying opportunity. On the other hand, if credit spreads are increasing as the stock market is falling, this can signal that the situation is far more serious and concerning.

For illustrative purposes, the chart shows the evolution of the S&P 500 and high-yield credit spreads since 1999.

^SPX data by YCharts

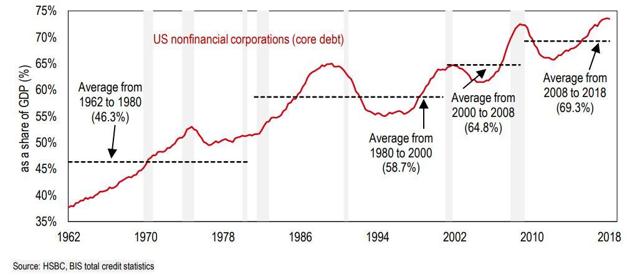

Watching the credit markets can be particularly important in the current scenario since corporate debt levels in the US is at new historical highs.

This generally tends to happen near the end of the expansionary economic cycle, and factors such as the trade war, slowing economic growth in China and Europe, falling liquidity from the Fed, and the political uncertainty coming from Washington are putting considerable pressure on financial markets.

If we see a sustained increase in credit spreads going forward, highly indebted corporations could be particularly vulnerable to all kinds of problems.

Source: HSBC via Marketwatch

Credit Spreads And Stocks By The Numbers

The following quantitative system is available in real time for members in The Data Driven Investor, and it's based on managing risk exposure in the stock market by watching the main trends in the credit market.

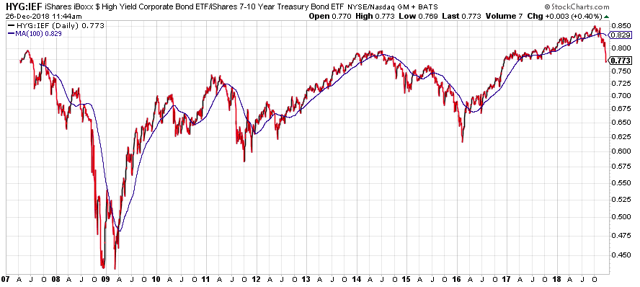

We start by creating a ratio that measures the relative performance of iShares iBoxx $ High Yield Corporate Bond (HYG) versus iShares 7-10 Year Treasury Bond ETF (IEF). When this ratio is rising, it means that high-yield bonds are outperforming Treasury bonds, so risk appetite is increasing and credit spreads are falling. Rising risk appetite in the bond markets is usually good for stocks too, and vice-versa.

The chart shows how the ratio has evolved since 1999, with the 100 days moving average of such ratio in blue.

Source: stockcharts.com

When the ratio is above the 100-day moving average, meaning that credit spreads are falling and risk appetite is rising in the credit markets, the system is invested in SPDR S&P 500 (SPY). Conversely, when the ratio is below the 100-day moving average, the system goes for safety, buying iShares 20+ Year Treasury Bond ETF (TLT).

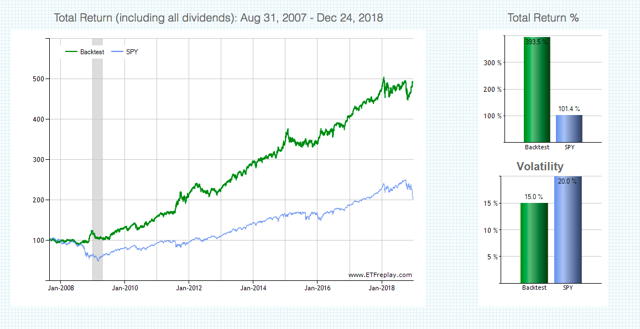

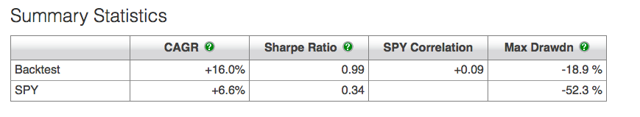

The system has substantially outperformed a buy-and-hold strategy in SPDR S&P 500 in terms of returns and downside risk. Since 2008, the system gained 408.6%, more than quadrupling the 101.1% produced by a buy-and-hold position in the same period. In annual terms, the quantitative system gained 16% versus 6.6% for SPDR S&P 500.

More importantly, the system has a much smaller drawdown than the buy-and-hold strategy. The quantitative system has a maximum drawdown of 18.9% versus 52.3% for the index-tracking ETF.

Source: ETFreplay.com

Source: ETFreplay.com

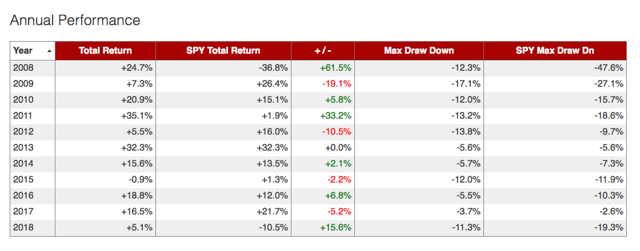

The table below shows the performance statistics for the system versus the SPDR S&P 500 in every year since 2008. In years such as 2008 and 2018, the system went for protection because risk appetite was falling in the credit markets, and this allowed the model to not only protect investor capital but even make a sizeable profit in a bear market for stocks.

Notably, the system only had a small loss of 0.9% in 2015, making money in 10 of the past 11 years.

In case you were wondering, the system sold stocks and purchased bonds in October of 2018, which was obviously a smart decision in retrospect.

No particular indicator can be perfect or infallible. We want to have multiple indicators, and then we weight the evidence from those indicators to make investment decisions based on hard data and statistical evidence as opposed to opinions and emotions.

Sometimes, it's relatively easy to reach a conclusion because most of the indicators are pointing in the same direction, and in other occasions, the evidence is more mixed and nuanced.

Importantly, systems such as this one are designed to avoid big drawdowns, which is arguably the most important priority when managing capital.

However, if markets go through sideways periods and shallow pullbacks, the system should be expected to provide false signals, meaning that the system goes for safety when it should instead remain long stocks in a small market adjustment.

That being acknowledged, having access to quantitative systems is remarkably valuable because many of the most expensive mistakes investors generally make are due to subjectivities and emotions interfering with rational decision-making.

The quantitative systems are not perfect, and they never will be, but they do a solid job at protecting your capital from devastating drawdowns, while also providing a valuable tool to analyze the market environment in a clear and objective way.

All asset classes are interconnected and price action in the bond market can tell us a lot about what is going on in the stock market too. As of the time of this writing, price behavior in the bond market is sending a bearish signal for stocks.

Disclosure: I am long SDS.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any ...

more