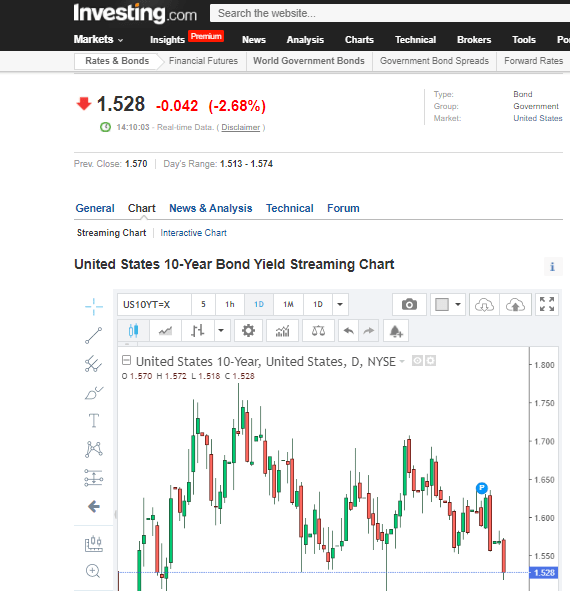

The 10-Year Note Gives Buy Signal For Gold And Silver

Fundamentals

Regardless of the inflationary rhetoric we hear, the 10-year note is down to 1.53. Pundits and experts are pontificating about interest rates, but if you look at the 10-year note, we are down 4 ticks. Interest rates are not going up on the short end of the market, which is bullish for gold. That is what the gold market is beginning to react to.

At least for the time being, the pressure on interest rates appears to be easing. It appears that inflation fears are a short-term aberration. We are seeing shortages in almost every sector of the economy. Food prices are also rising, globally. The key is how long it takes to replenish the supply chain and meet the pent-up demand as people move back into the economy.

The gold and silver prices continue to be below their mean. Almost everything else across the board are rising in value, yet gold and silver continue to languish. This anomaly is not going to last. The markets will adjust. They do not go when you want them to go, but they will go. Take advantage of the fact that we haven’t seen the major moves yet, which are on the horizon. This is an excellent opportunity to add to your gold and silver positions. Stay long and use this short-term volatility to trade the market and add to your long position. We are very close to a major move up in precious metals.

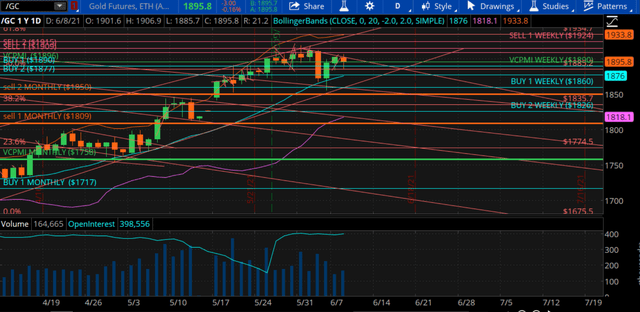

Gold

Courtesy: TDAmeritrade

Gold is in a fast market. We came down to $1892 and then reverted back up almost to $1909, which is the Variable Changing Price Momentum Indicator (VC PMI) Sell 1 level. Then it reverted back down to a harmonic buy trigger. This is a very strong signal. $1890 match on the daily and weekly, so expect reversion to occur from here. Buyers should come in at this level. If gold hits $1896, it will change the bearishness to an uptrend. Maintain your net long position. We have covered our short positions. It appears that the counter-swing correction has been completed. The correction did not last long, which is a very bullish sign.

It appears that the market has formed a flag. If the market breaks through that, then we are looking at $1953, which is the weekly target. The daily signal is up to $1915. $1924 is the first weekly target, which has been activated. The daily is activating targets of $1899 to $1915.

$1864 is the monthly VC PMI average. We are trading right at a 50% Fibonacci retracement from the recent high of $1675. The 61.8% retracement from this correction is $1952.90. Right above it, we are looking at $1961, which is the VC PMI monthly target. The AI is telling us that $1950/$1960 is going to be tested. I would lock in profits in that area. We have had two previous tests of the low and we may not go down again.

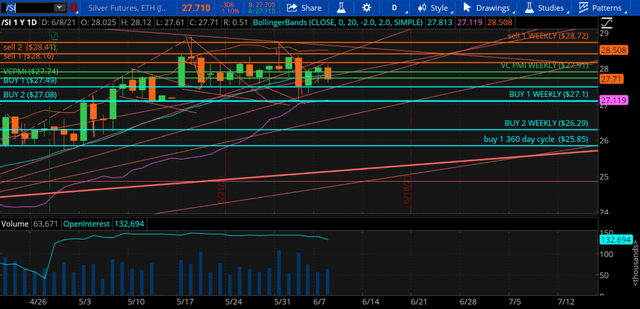

Silver

Courtesy: TDAmeritrade

Silver is doing pretty much the same move as gold. We are also in a fast market in silver. We are seeing a reversion from $27.74, which is the average price. If we run up to $27.91, we will be looking at a bullish price momentum with targets of $28.16 to $28.41. We are net long.

Virtual Currencies

There has been a great deal of talk about virtual currencies. The market has entered into a very volatile period, in response to comments by Elon Musk and other crypto gurus. There are a lot of people in these markets who should not be in such highly volatile markets. If you can’t handle the volatility, do not be in virtual currency markets. However, they are very exciting markets. We are trading these markets, but be careful. Do not over-leverage yourself. It seems that the volatility is going to increase even more.

Grayscale Bitcoin Trust (OTC: GBTC) is entering into the VC PMI Buy 2 level. 2737 is the Buy 2 weekly level, which means there is a high probability that the market will activate a bullish weekly signal.

Disclosure: I am/we are long GDX. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from SA). I have no business ...

more