Tesla & AI Comments Lift Stocks, But...

Equity futures point to a mixed market open later this morning with the S&P 500 and Nasdaq being led higher in part by the pre-market surge in Tesla (TSLA) shares. Better than expected September quarter earnings are one factor in the shares moving higher but so is the company’s outlook for the current quarter. Tesla shared that it expects to sell more vehicles in 2024 than the prior year, implying deliveries of at least 515,000 vehicles in the current quarter compared to 490,000 vehicles projected by Wall Street.

Confirmation of ongoing AI adoption offered by IBM (IBM) is also helping to lift tech stocks this morning. IBM shared that its book of AI business was more than $3 billion in the September quarter, a $1 billion-plus sequential improvement. This follows Apple’s (AAPL) release last night of a beta version of its upcoming iOS 18.2 that includes new Apple Intelligence features and anticipated ChatGPT integration. Very recent comments from Verizon (VZ) andAT&T (T) suggested we have yet to see the much-touted iPhone upgrade cycle for Apple’s latest models, but AT&T CEO John Stankey summed up what we’re likely to see pretty well in our opinion:

“We're still waiting, obviously, for the software release and whether or not that software release drives interest in the consumer base to accelerate that remains to be seen, I don't know. I've given you my point of view that says, I think some of these things are going to be a little bit more graceful ramp-up in consumer interest as opposed to a big bang. Software oftentimes tends to be that.”

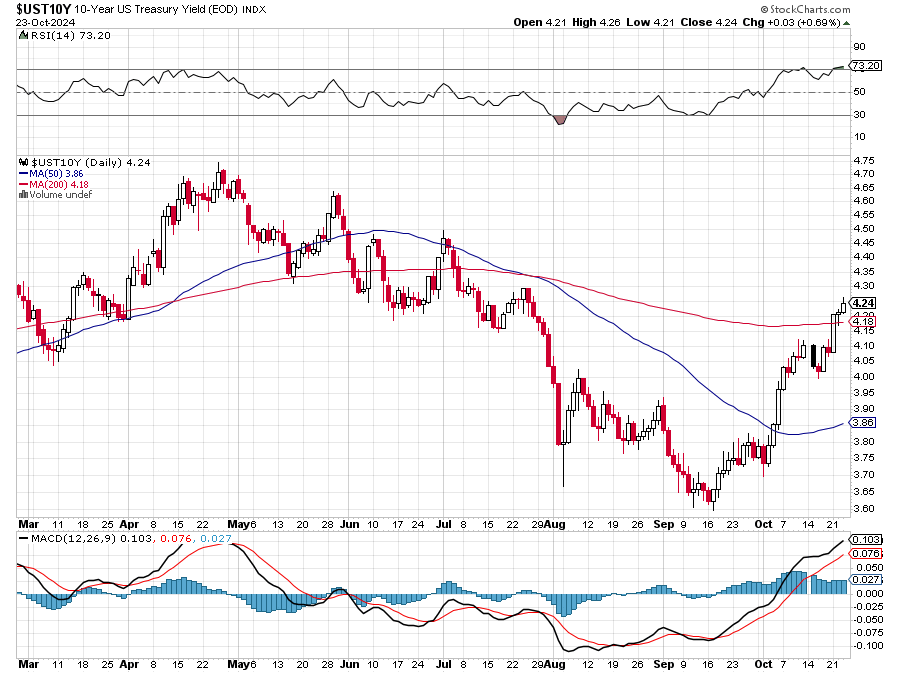

Getting back to this morning, while the market runs through quarterly results from a few dozen companies lurking in the background there are renewed questions over the pace of Fed rate cuts. We’ve discussed how recent updates to the Atlanta Fed’s GDPNow model point to the economy being more robust than many expected back in July and August. With hits Flash October PMI data at 9:45 AM ET this morning, S&P Global (SPGI) will bring the first hard look at the US economy in the current quarter. Should these initial figures show continued strength in the economy and job creation on solid footing, the odds of the market continuing to recalibrate rate cut expectations are likely. This week alone, we’ve already seen the number of expected rate cuts between now and the Fed’s June meeting soften to 4.5 from 5 exiting last week.

As you digest that S&P’s findings, we would suggest you guage the impact not only in the CME’s FedWatch Tool but also in the 10-year Treasury Yield and the dollar relative to other currencies. On its earnings call last night, IBM called out the recent strengthening in the dollar, indicating it will be a headwind to revenue growth.

More By This Author:

The US Economy - Good For Earnings But...The VIX, Treasuries, And Earnings

Stocks Look To Claw Back Recent Losses, But…

Disclosure: None.