Tailing 30Y Auction Prices At Lowest Yield In 3 Years

Following a mediocre 10Y auction, which tailed yet whose internals were far stronger than the smallish tail would indicate, moments ago the US Treasury sold $16 billion in 30Y paper, in an auction that was in many ways a carbon copy of yesterday's benchmark sale (in virtually every way besides the sharp negative rate in repo).

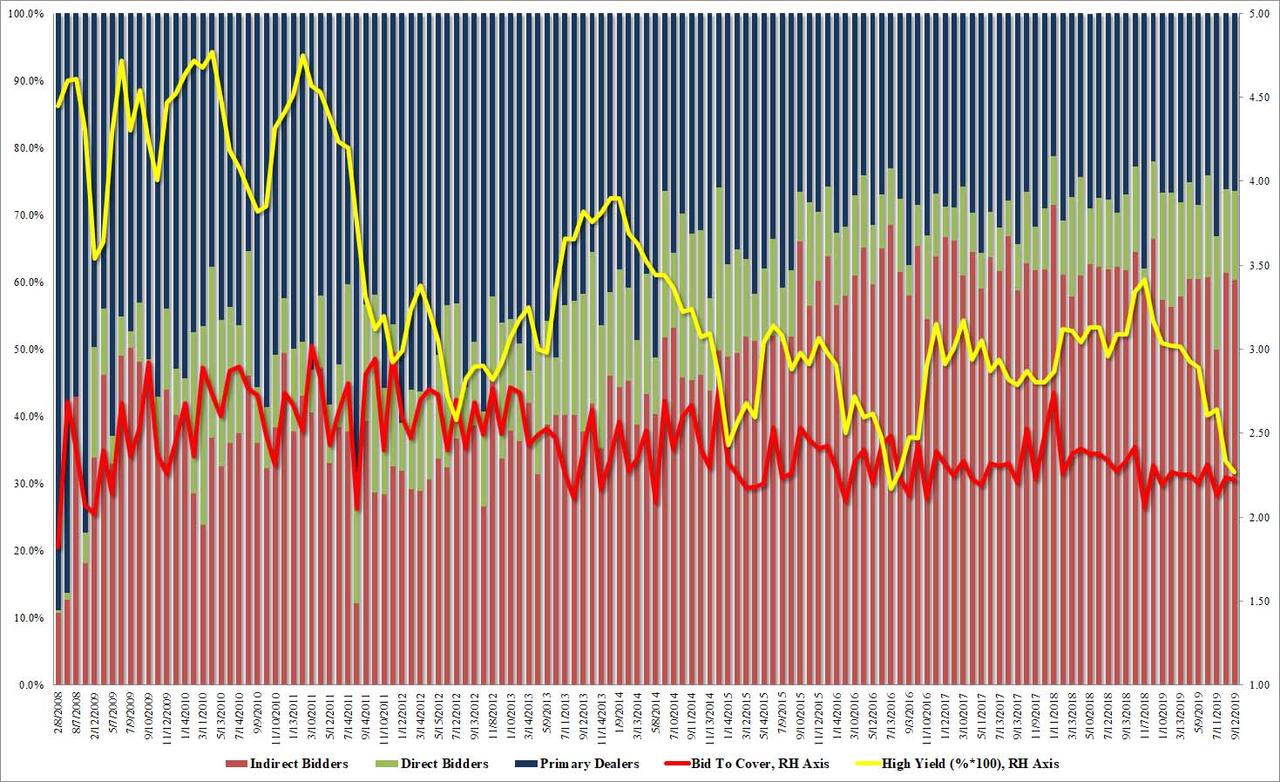

The 30Y paper sold at a yield of 2.270%, which while below August's 2.335% and the lowest since July 2016, tailed the When Issued 2.254% by 1.6bps; this was also the third consecutive ultra-long auction that has tailed and 2nd in the last seven.

However, just like yesterday, the tail masked the fact that the auction metrics were not terrible, with the bid to cover almost unchanged from August, and at 2.22% it was just below the six auction average of 2.23%. Meanwhile, for all fears of a foreigner boycott of US paper, the Indirect takedown was 60.3%, just below last month's 61.3%, and above the recent auction average of 58.5%. And with Directs taking down 13.3%, Dealers were left holding 26.4% of the final takedown.

Overall, a mediocre auction which however served to push the curve to session wides, with the 10Y knocking on 1.80%'s door at last check, as numerous funds are caught nursing a very painful VaR shock hangover.

(Click on image to enlarge)

Disclosure: Copyright ©2009-2018 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

moreComments

No Thumbs up yet!

No Thumbs up yet!