Stocks Surge For 4th Straight Week Amid U.S. Macro Meltdown

Stocks rallied for the 4th straight week - longest sin-streak since June - led by The Dow, and Small Caps surge today back into the green for the week...

(Click on image to enlarge)

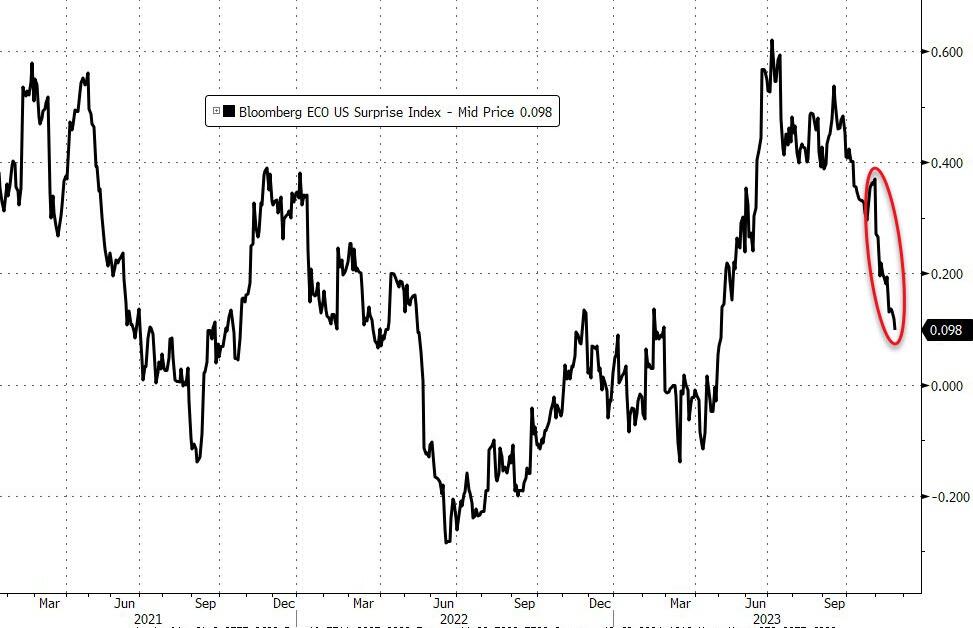

... as plunging US Macro data..

(Click on image to enlarge)

Source: Bloomberg

...supported the trend for rising expectations of rate-cuts...

(Click on image to enlarge)

Source: Bloomberg

...just ignore the implied recession needed to fulfill expectations for 100bps of cuts next year!

Meanwhile, financial conditions have done nothing but loosen since Powell mentioned the market doing The Fed's job of 'tightening'...

(Click on image to enlarge)

Source: Bloomberg

US equity majors are up 9-13% off the late October lows...

(Click on image to enlarge)

Source: Bloomberg

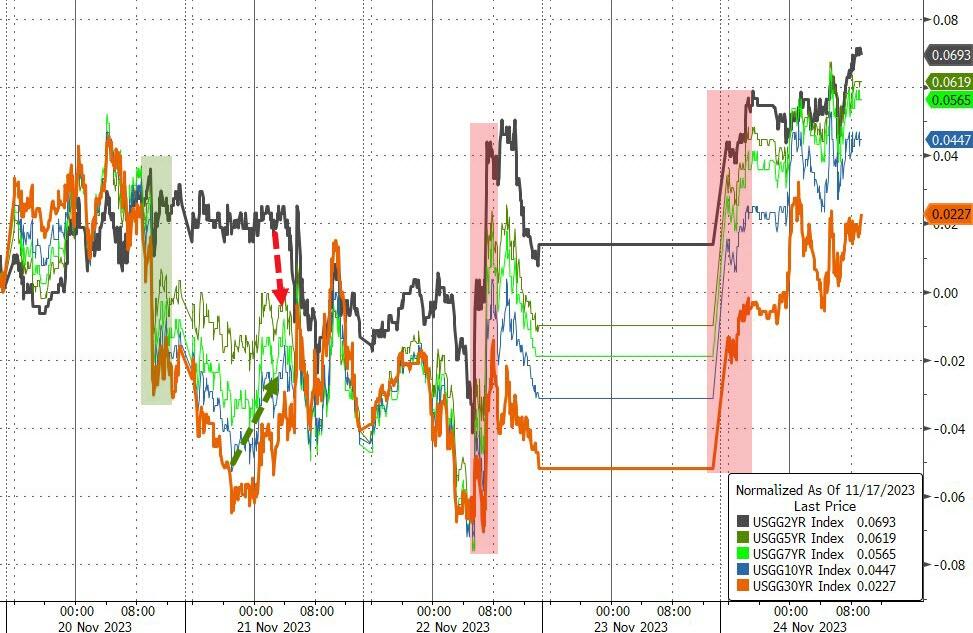

Treasury yields ended higher on the week (largely thanks to a 6-8bps jump in yields today) with the short-end underperforming on the week...

(Click on image to enlarge)

Source: Bloomberg

The dollar ended lower for the 3rd week of the last 4, at 3-month lows...

(Click on image to enlarge)

Source: Bloomberg

Ethereum outperformed Bitcoin on the week, rallying back above $2100...

(Click on image to enlarge)

Source: Bloomberg

Bitcoin broke out to a new cycle high, near $38,500...

(Click on image to enlarge)

Source: Bloomberg

Spot Gold prices jumped back above $2000 (silver outperformed on the week, up 2.5%)...

(Click on image to enlarge)

Source: Bloomberg

Oil prices ended the week very marginally higher (after 4 weeks down in a row), but with plenty of chop on the way...

(Click on image to enlarge)

Finally, with regard to the 'Santa Rally', Goldman Sachs notes that on a 10-year lookback, equities tend to struggle in December, particularly the Mag 7...

(Click on image to enlarge)

Source: Bloomberg

And with the S&P higher 15 of the last 18 sessions, on track to post its best month since July off 2022, bringing us back to multi-month highs in terms of prices, but in terms of valuation as well. Across eight different measures, the median absolute metric trades in its 89th percentile relative to history.

Do you feel lucky?

More By This Author:

US Manufacturing PMI Unexpectedly Slumps Into Contraction; Jobs & Prices Lower

New Study Finds That Costlier U.S. Cities Offer Better Middle And Lower Class Living Standards

These Are The Countries With The Highest Inflation Rates

Disclosure: None