Stocks Hit Fresh Records Despite Rising Rates. What Gives?

Image Source: Unsplash

The S&P 500 and Dow closed with record numbers on Wednesday. Leading the charge were technology stocks. Bank stocks also performed well. At the beginning of September, we wrote: "We are hard pressed to find what could possibly go wrong in September. So perhaps, the path of least resistance will continue to drive stock prices higher.” We wrote the same at the start of October. So far, so good, notes Ed Yardeni, editor of Yardeni QuickTakes.

However, be warned: tensions between Iran and Israel may increase even further. That could certainly unsettle the stock market and create another buying opportunity.

By the way, the stock market has been reaching new heights even as assets in money market mutual funds (MMMF) rose to a record $6.5 trillion during the Oct. 2 week. That's quite remarkable. Imagine the meltup in stock prices if the Fed continues to lower interest rates.

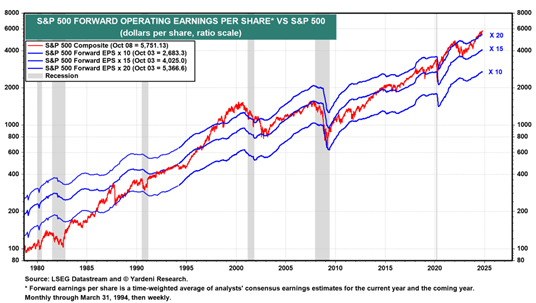

The S&P 500's forward earnings ratio has also been rising in record high territory since early September 2023. During the current bull market, the S&P 500 forward P/E has increased from 15.3 during the Oct. 12, 2022 week to 21.6 currently. That's not quite a record high, but it is getting closer to the 25.5 reached in 1999.

The stock market rally continues to broaden as more stocks start to participate. The percentage of S&P 500 companies with positive year-over-year price changes is at approximately 85%.

The stock market has rallied even as the 10-year Treasury note yield rose from 3.62% on Sept. 16 to 4.07% on Wednesday. That surprised plenty of bond investors who expected the Fed's 50 bps cut in the federal funds rate (FFR) and very dovish forward guidance to push yields lower.

Indeed, stock prices rose despite relatively hawkish minutes from the Sept. 17-18 FOMC meeting. The minutes showed that more members than just Governor Michelle Bowman – the lone dissenter – favored a smaller 25 bps cut to the FFR last month. The 2-year Treasury yield rose to 4.03% as a result.

About the Author

Dr. Ed Yardeni is the president of Yardeni Research, Inc., a provider of global investment strategy and asset allocation analyses and recommendations. He previously served as chief investment strategist for Oak Associates, Prudential Equity Group, and Deutsche Bank's US equities division in New York City.

Dr. Yardeni taught at Columbia University's Graduate School of Business and was an economist with the Federal Reserve Bank of New York. He is frequently quoted in the financial press, including The Wall Street Journal, Financial Times, The New York Times, The Washington Post, and Barron's.

More By This Author:

RING: Digging Up Profits By Investing In Gold Mining SharesAmid Israel-Iran Fight, Where Will Oil Go Next?

UNH: A Solid Healthcare Play In A Rotational Market

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more