Stocks Dump, Bonds & Bullion Jump After Dismal Data

Image Source: Unsplash

Following the cataclysmic drop in new home sales, notably weak PMIs, and ugly Richmond Fed data, reality is starting to bite at the markets as 'real' economic data confirms the apparent collapse in ad-spend that Snap's warning signals. The reaction to all this was dramatic, to say the least.

Stocks pulled back all their gains from yesterday and then some, with the Nasdaq and small-caps at Friday's lows (before the late-day melt-up).

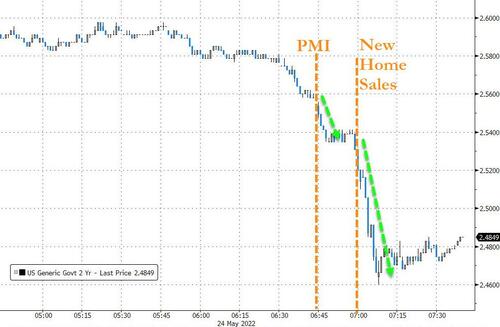

Bond yields are crashing hard, down around 13-15 bps across the curve, led by the short-end.

Short-end yields did start sliding earlier in the day (as stocks were weaker from Snap), but the initial leg down was on the weak PMI data. And then when New Home Sales crashed, yields tumbled.

Rate-hike expectations are sliding notably, and at the same time, subsequent rate-cut expectations are rising.

Gold is also extending gains.

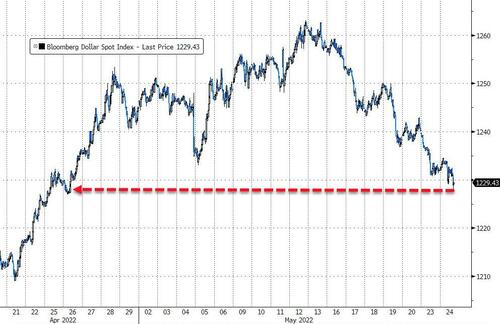

This is as dollar dumps to one-month lows.

Bad news just proves to be bad news for stocks.

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more