Stocks Drift Higher On Low Volume, Interest Rates Rise Surreptitiously, CPI Report Looms Friday Morning

Gundlach: CPI inflation could hit 7% or higher in next few months

— zerohedge (@zerohedge) December 7, 2021

Stocks drifted higher on low volume Wednesday. The S&P was up +0.31%, the Nasdaq up +0.64%, and the Russell rose by +0.80%. NYSE + NASDAQ Advancers to Decliners were 5,141 to 2,883 and volume of 8.8 billion was light relative to what we’ve seen of late.

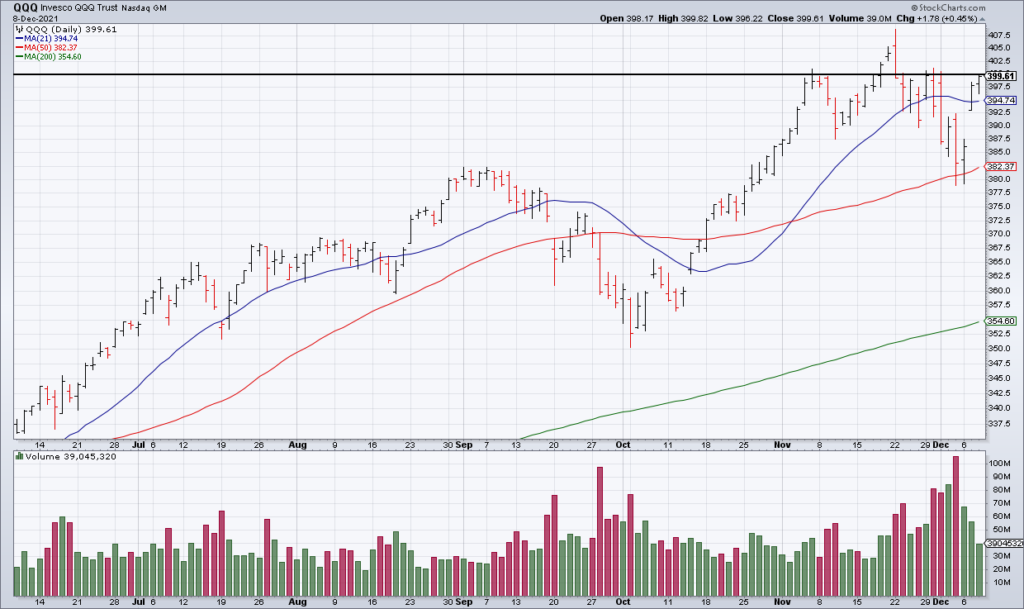

QQQ closed just below the key $400 level at $399.61 – on very light volume as you can see in the chart above. Thursday’s session seems likely to be a low volume snooze-fest ahead of the key November CPI Report on Friday morning.

While there’s not a lot to say about the stock market Wednesday, the bond market was another story. Bonds sold off hard with TLT down -1.73% on strong volume. In fact, it’s looking like TLT might have experienced a false breakout last week similar to the one in IWM – though neither are confirmed yet.

This is important because rising interest rates are a headwind for the expensive tech stocks that dominate the stock market. That’s because most of their earnings are in the future and higher rates mean those earnings have to be discounted at a higher rate as well, reducing their present value.

While the move in bonds this week has gotten little attention, the stock market will take notice soon if it continues. The November CPI Report Friday morning will be important for bonds, as well.