Stellar 7Y Auction Stops Through After Jump In Foreign Demand

After two mixed coupon auctions this week (a solid 2Y, a subpar 5Y) moments ago the Treasury concluded the week's final coupon auction when it sold $44 billion in 7Y paper in a well-received sale.

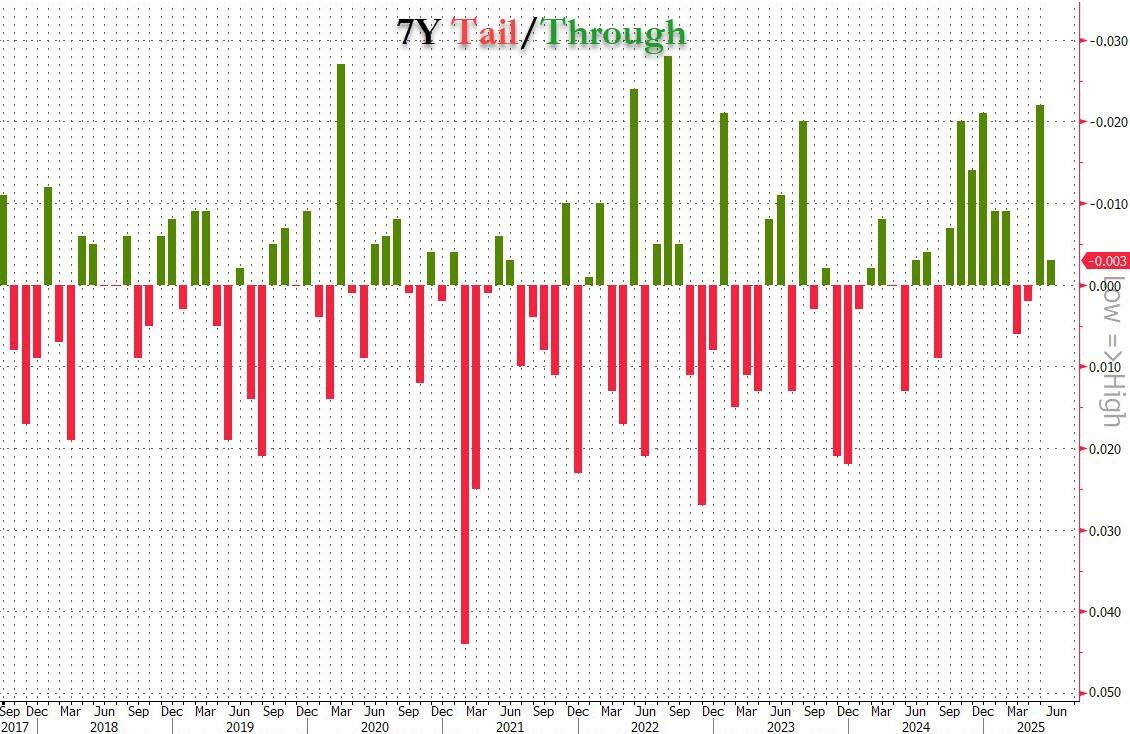

The auction stopped at a high yield of 4.022%, down from 4.194% in May and the lowest since last September. The auction also stopped 2bps thru the 4.024% When Issued, the second consecutive stop through in a row and 8th in the past 10 auctions.

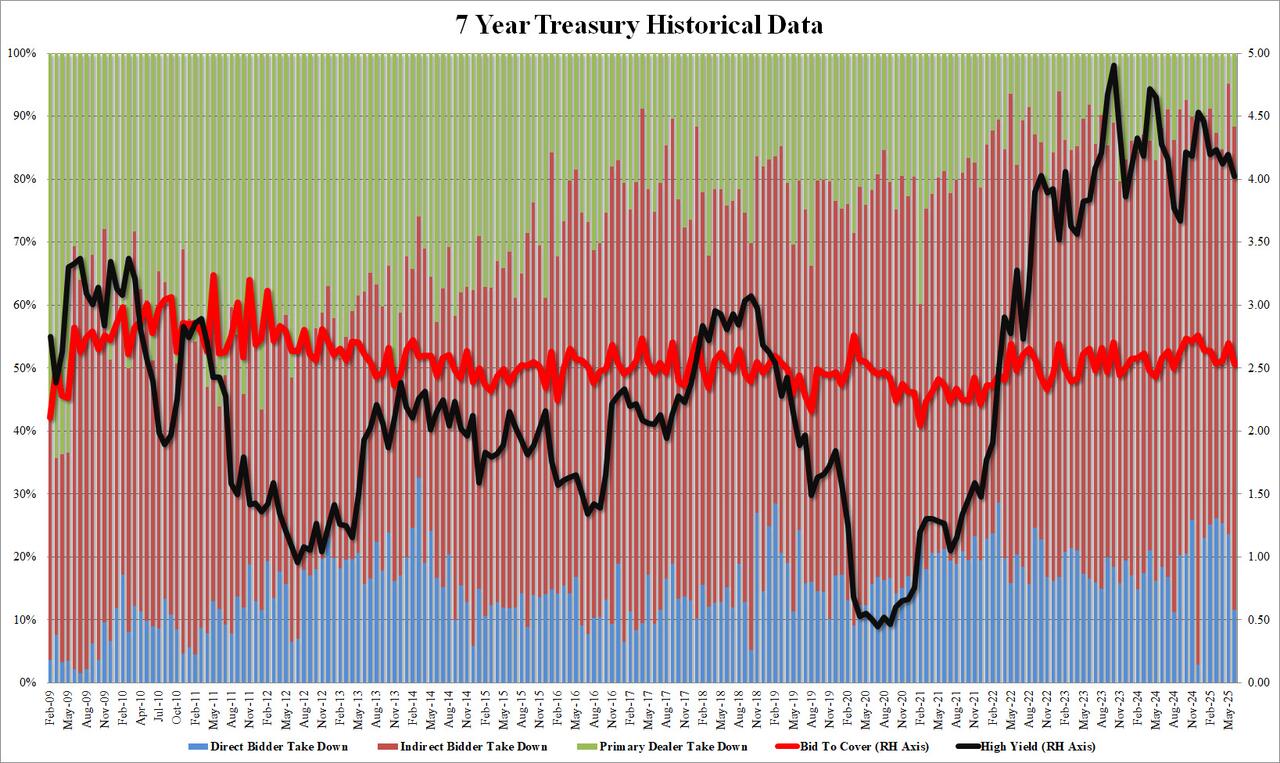

The bid to cover was ugly: it dropped from 2.695 to 2.531, the lowest since August 2024 and obviously well below the six-auction average of 2.637.

The internals were most solid, with Indirects rising to 76.7%, up from 71.5% in May and the highest since December. And with Directs taking just 11.62%, the lowest since December's record low 2.85%, Dealers were left with 11.6%, up from May's record low of 4.85%.

Overall, this was a solid auction, arguably the best of the week, and one which came with yields across the curve already near session lows so there was little movement: the 10Y was down at 4.257% after the auction broke for trading, barely changed from where it was earlier.

More By This Author:

Fed Moves To Relax Key Capital Rule For Big Banks To Support Treasury Markets

Labor Market Creaks... Continuing Jobless Claims Highest Since Nov 2021

Q1 GDP Revised Lower As Personal Spending Unexpectedly Prints Weakest Since Covid

Disclosure: Copyright ©2009-2025 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more