Stellar 3Y Auction Stops Through With Lowest Dealer Award On Record

If there were some concerns that the week's first coupon auction would be a disappointment due to today's risk-on sentiment and lack of concessions into the 1pm auction block, they were promptly blown away moments ago when the Treasury announced results from today's sale of $40BN in three year paper, which were nothing short of stellar.

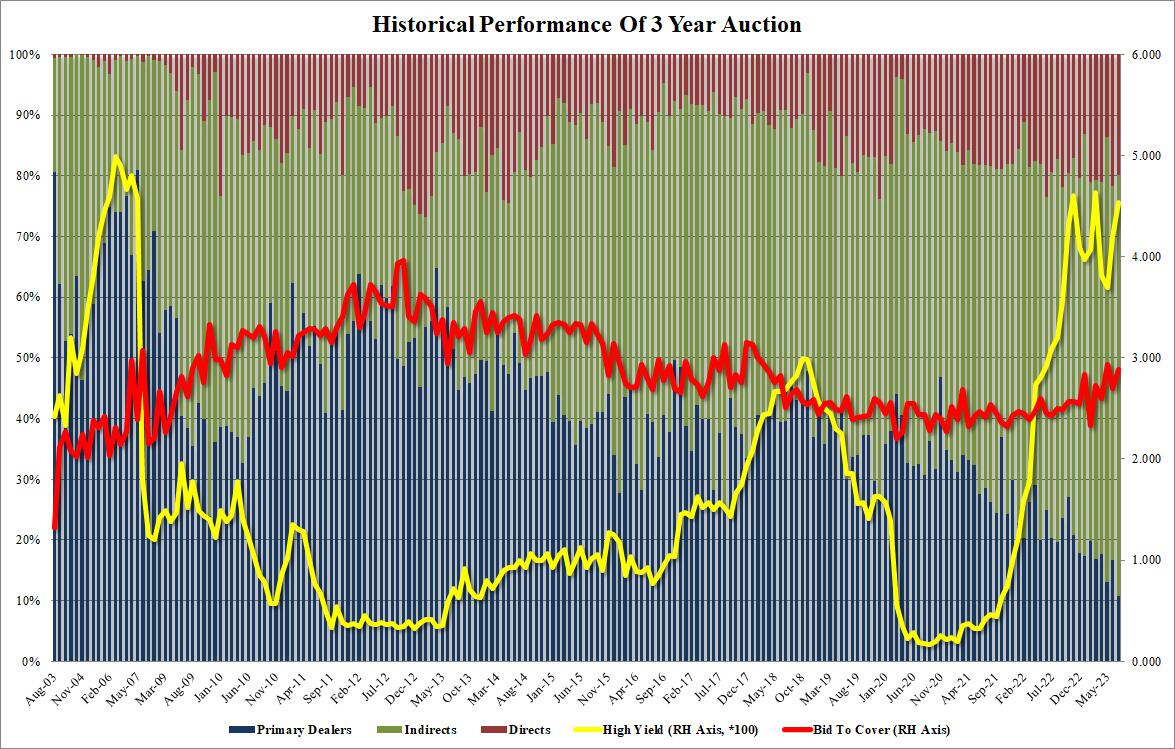

Stopping at a high yield of 4.534%, this was more than 30bps higher than last month's 4.202% and not far below the current cycle high of 4.641% reached in March (just before yields collapsed following the March banking crisis). The auction also stopped through the When Issued 4.536% by 0.2bps, the 4th stop through in the past five auctions (last month the auction tailed by 0.2bps).

The Bid to Cover jumped to 2.882 from 2.696, and was also above the 6-auction average of 2.686.

The internals were also solid, with Indirects awarded 69.4%, up from 61.5% in June, and not just well above the recent average of 64.5% but just shy of the all time high. And with Directs awarded 19.8%, below last month's 21.7% but above the 6-auction average of 18.6%, that left Dealers holding on to 10.8%, which was the lowest on record.

(Click on image to enlarge)

Overall, this was another stellar Treasury auction and positions the market nicely for tomorrow's benchmark sale of 10Y paper just as yields trade back below 4.0%.

(Click on image to enlarge)

More By This Author:

Used-Car Prices Tumble Most Since Start Of Pandemic, Record Drop For Month of JuneKey Events This Busy Week: 9 Fed Speakers, Q2 Earnings Season Begins And All Eyes On CPI

Ant Announces Unexpected Share Buyback At 75% Discount To Botched IPO