Stellar 3Y Auction Sees Lowest Directs On Record

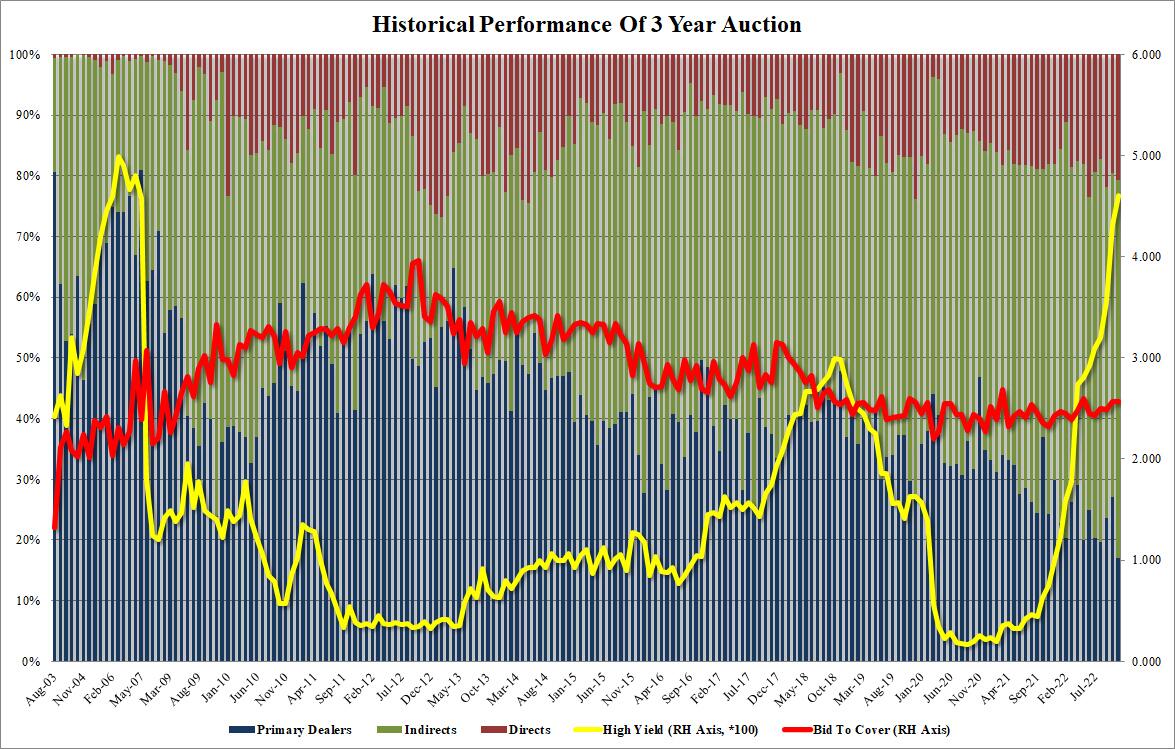

With stocks and gold soaring while the dollar and cryptos plunge in what appears to be an extremely chaotic day for most risk assets as midterms loom, moments ago the Treasury held its first refunding auction when it sold $40BN in 3Y paper at a high yield of 4.605%, the highest yield since Nov 2006 and well above last month's 4.318%. The auction stopped through the When Issued 4.617% by 1.2bps, the biggest stop through since at least 2016 (and the first non-tail since August).

The bid to cover of 2.568 was virtually unchanged from last month's 2.567 and came in modestly above the recent average of 2.506.

The internals were solid, with Indirects taking down 62.2%, up from 53.4% last month, and above the 57.5% recent average; and with Directs awarded only 17.0% or the lowest on record, meant Dealers were left holding 20.8%, up from 19.6% last month and roughly in line with the 19.9% recent average.

Overall, this was a remarkably solid 3Y auction despite the lack of concession with the 10Y sliding to session lows of 4.12% moments before the auction closed.

(Click on image to enlarge)

More By This Author:

Used-Car Prices Collapse The Most Since Lehman Meltdown

Futures Jump On China Reopening Rumors Ahead Of Key Jobs Report

A (Long Overdue) Great Rotation From Tech Into Energy

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more