Stellar 30 Auction Stops Through With Highest Bid To Cover In Two Years

After two disappointing, tailing auctions, moments ago the US Treasury sold $16 billion in 30-year bonds in an auction that was a blockbuster.

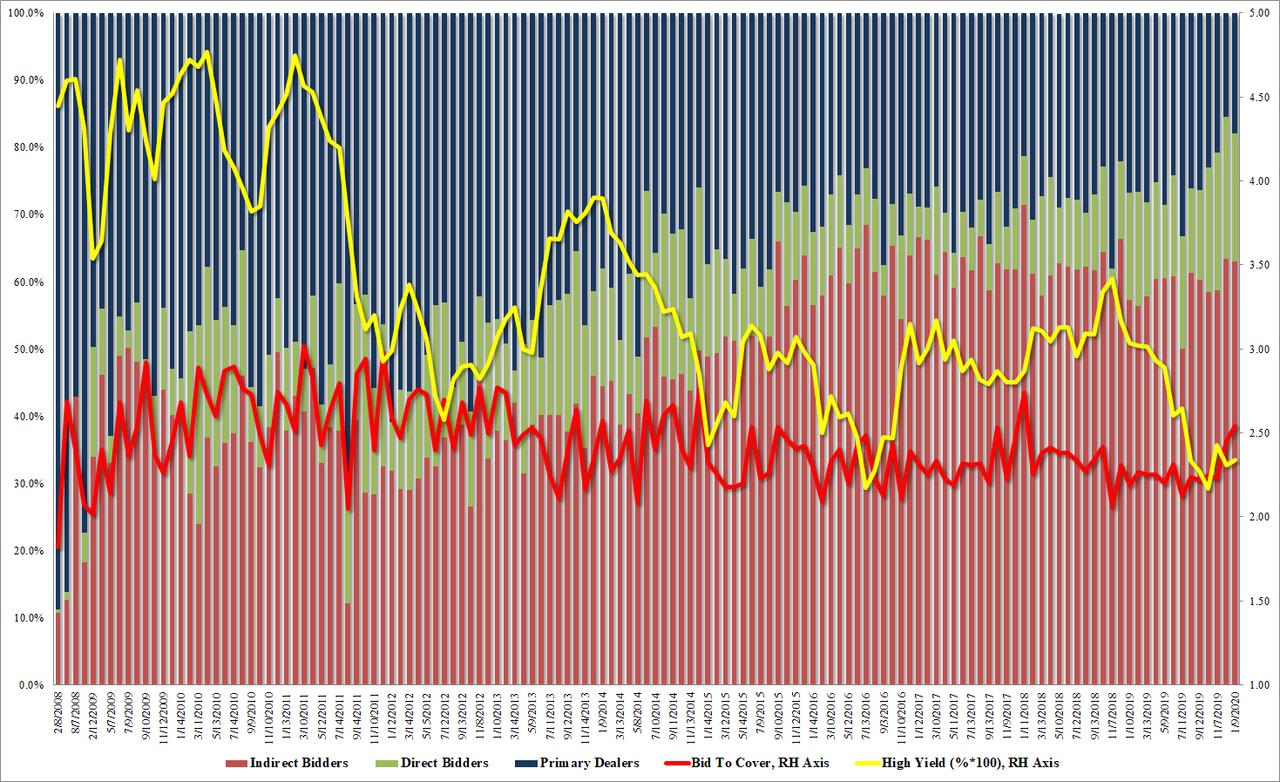

With both the 3Y and 10Y auctions earlier this week, and the first of the year and decade, tailing, traders were quite impressed when the 30Y auction stopped through the When Issued 2.358% by 1.7bps, pricing at a high yield of 2.341%, above December's 2.307% but below November's 2.43%. Curiously, this whopper of a result was actually rather tame considering just last month the stop through was 2.1bps (although following 5 tailing auction).

The internals were quite impressive as well, with the Bid to Cover surging to a 2-year high of 2.532, up from 2.455 in December, and the highest since January of 2018. Looking at the takedown, Indirects were allotted 63.0%, just shy of December's 63.4%, and the second-highest since 2018. And with Directs taking 17.9%, below last month's 21.1% but just above the six auction average of 17.1%, Dealers were left holding 19.1%, below the recent auction average of 24.1%.

(Click on image to enlarge)

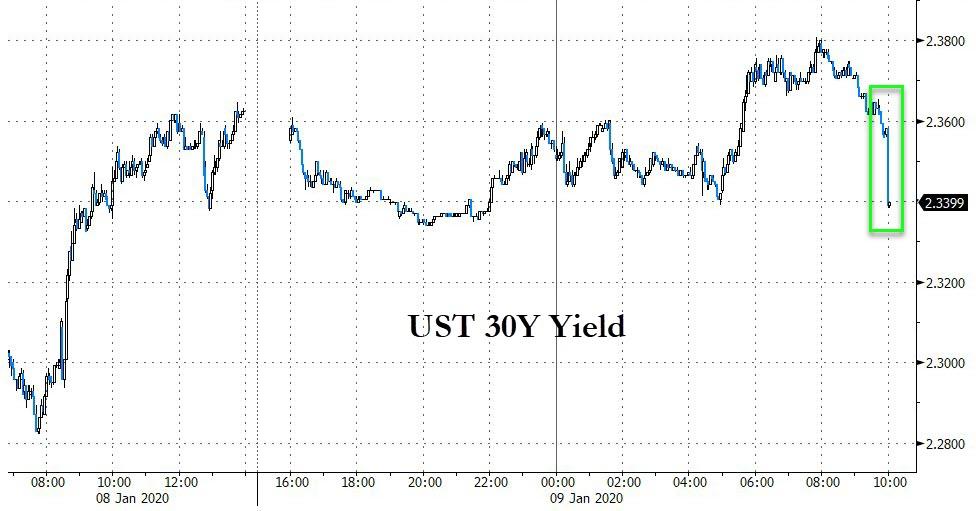

Overall, this was an impressively strong auction, and a polar opposite of yesterday's dismal 10Y, and which promptly sent the entire yield curve sharply lower.

(Click on image to enlarge)

Disclosure: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

moreComments

No Thumbs up yet!

No Thumbs up yet!